12:56 pm

October 19, 2021

State revenues from funds subject to the outlook (NGFO) are estimated to be substantially higher through the outlook period (2019–21, 2021–23, and 2023–25) than was expected when the 2021–23 budget was adopted this spring. The June revenue forecast added $3.675 billion in economic changes (not including tax changes the Legislature made) and the September revenue forecast added another $1.818 billion. On top of that, actual revenues have so far come in $152.7 million higher than forecasted. Revenues are up an estimated $5.646 billion in all.

Adjusted for inflation, revenues in 2019–21 were 40.9% higher than the pre-Great Recession peak. Revenues per capita have also increased: adjusted for inflation, per capita revenues in 2021 were 31.6% higher than the pre-Great Recession peak. From around 1990 through the Great Recession, per capita revenues (adjusted for inflation) hovered around the $2,500 level. From 2012 to 2021, per capita revenues grew by 45.9%. In 2021, per capita revenues were $3,652.

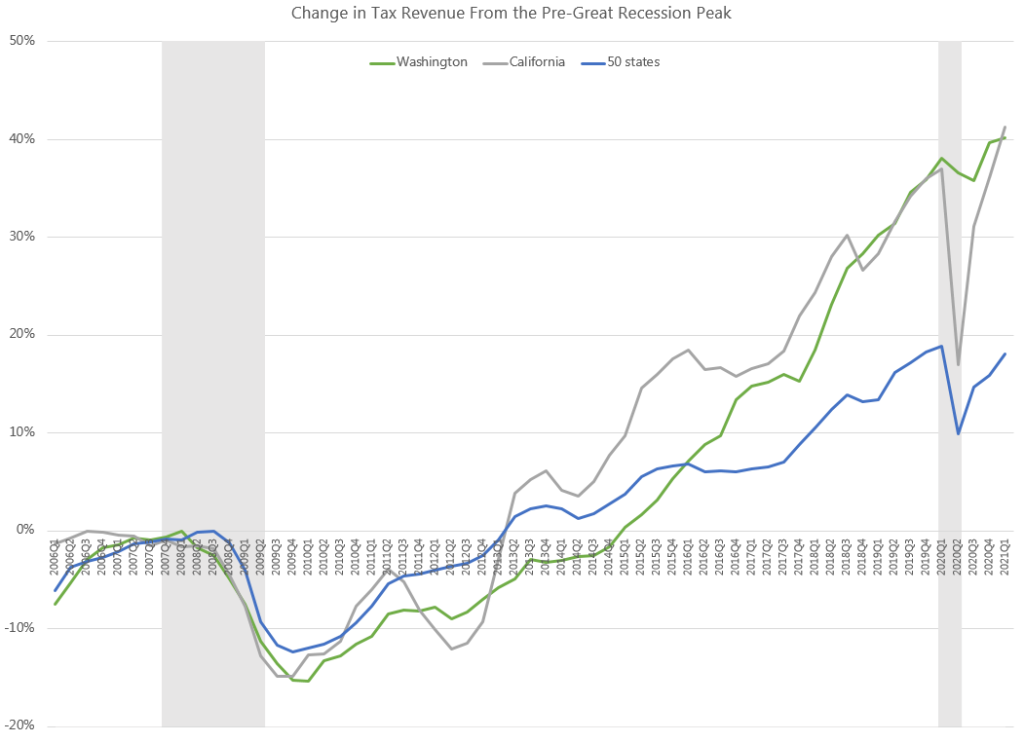

Meanwhile, according to Pew, Washington has the nation’s second-highest tax revenue growth from the pre-Great Recession peak through the first quarter of 2021. Tax revenue over this period grew by 40.2% in Washington, by 41.3% in California (the nation’s highest growth), and by 18.1% for the 50-state total.

By historical standards and compared to other states, Washington has a remarkably productive tax system. If the capital gains tax is repealed by the courts or by voters, there would not be a budget shortfall (given the current forecast). Additionally, the revenue forecast doesn’t reflect all the resources available. For example, there’s $1.273 billion in one-time general federal relief money the state still needs to appropriate and there’s $1 billion stowed in a shadow reserve account.

Washington’s Tax Structure Work Group is considering major reforms to the state’s fundamental tax structure. Lawmakers should consider whether those changes could kill the proverbial golden goose.

Categories: Budget , Economy , Tax Policy.