9:32 am

September 28, 2021

The $6.7 billion growth in the revenue forecast from the March to September includes $1.2 billion in legislative changes. These were the tax changes made by the Legislature earlier this year, including mainly the capital gains tax.

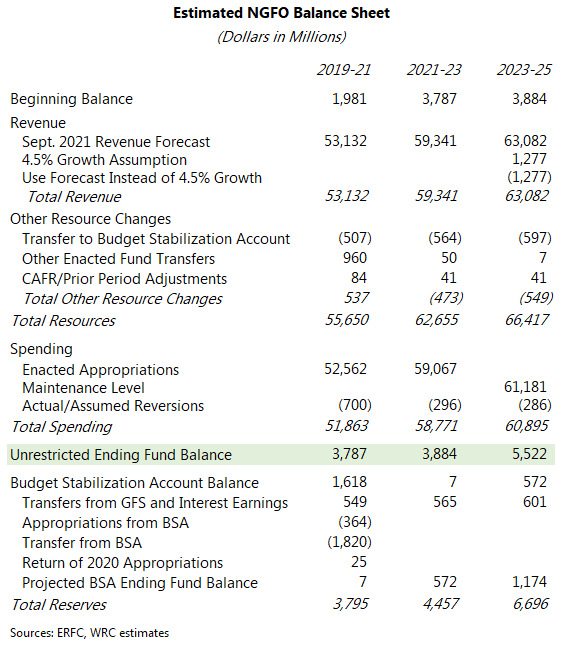

The 2021–23 operating budget, as enacted, balanced over four years. The unrestricted ending balance for funds subject to the outlook (NGFO) in 2023–25 was $83 million, according to the official budget outlook in June (which was based on the March revenue forecast). With the September revenue forecast, I estimate that the enacted budget now leaves an unrestricted NGFO ending balance of about $5.5 billion in 2023–25. Total reserves, including the budget stabilization account (BSA, or the rainy day fund), are about $6.7 billion.

The unrestricted NGFO ending balance could have been even higher under the rules established for the four-year balanced budget requirement. By statute, the second biennium must balance using either the official revenue forecast or assuming annual revenue growth of 4.5%. Even with the increased revenues in the September forecast, revenues are expected to grow by less than 4.5% annually in 2023–25, so the outlook could assume more revenues in 2023–25 than are expected in the forecast. But earlier this year the Legislature chose to use the revenue forecast instead of assuming 4.5% growth. They did that to limit themselves so they would “not get trapped into overspending.” My estimate of the updated unrestricted ending balance also uses the forecast instead of assuming 4.5% growth.

As we noted in June, the state did not have a budget shortfall to address this year—the March 2021 revenue forecast was essentially back to the pre-pandemic forecast. Even so, the Legislature enacted a capital gains tax and increased spending. With the new appropriations, NGFO spending increased by 17.6% in 2019–21 and by 12.4% in 2021–23. (Including appropriations of federal relief dollars, spending increased by 35.2% in 2019–21 and by 10.8% in 2021–23.) Additionally, the Legislature needlessly drained the BSA and transferred its $1.820 billion to the general fund–state and a new shadow reserve account. Enacting new taxes and draining the rainy day fund were unnecessary when the budget was adopted and are substantially less necessary now.

To summarize:

- The state has $5.5 billion in revenues over the outlook period that were not expected when the current budget was enacted.

- There is another $1.0 billion from the BSA that the Legislature transferred to the “Washington rescue plan transition account”—a shadow reserve account that is not included in the outlook and is off the balance sheet.

- The state still has $1.273 billion to appropriate from its share of the federal Coronavirus State Fiscal Recovery Fund. (This money must be used generally in response to the pandemic, but it is very flexible.)