1:09 pm

July 9, 2020

The Economic and Revenue Forecast Council (ERFC) has posted an unofficial budget outlook that reflects the June revenue forecast. The outlook was prepared by the Office of Program Research and has not been officially adopted by the ERFC. (Budget outlooks are officially adopted in January and within 30 days of enactment of an operating budget.)

The outlook estimates that the unrestricted ending balance of the funds subject to the outlook (including the workforce education investment account) will be negative $3.403 billion at the end of 2019–21 and negative $8.465 billion at the end of 2021–23. Even if the Legislature drains the rainy day fund this biennium, the state would still be negative $1.487 billion at the end of 2019–21.

As I noted earlier this week, Gov. Inslee has already cut some spending. The outlook includes the effect of Gov. Inslee’s operating budget vetoes, but it does not reflect savings from the hiring freeze and furloughs. It’s not known how much the hiring freeze will save, but the furloughs are expected to save between $55 million and $91 million (depending on whether agencies not under the governor’s authority follow suit).

Additionally, the outlook does not include the additional costs expected due to the June caseload forecast. According to a preliminary estimate from the Office of Financial Management (OFM), the caseload forecast could increase spending needs by $161 million for 2019–21.

Medicaid caseloads are a major part of the increase. The state received $262 million from the federal government in FY 2020 due to the enhanced federal Medicaid match in one of the COVID-19 relief bills. OFM estimates that the enhanced match will mean that Washington will receive an additional $131 million from the federal government each quarter. (The higher match expires “on the last day of the calendar quarter in which the last day of” the public health emergency occurs, as determined by the Secretary of Health and Human Services.) These additional federal funds for Medicaid free up state funds to use elsewhere.

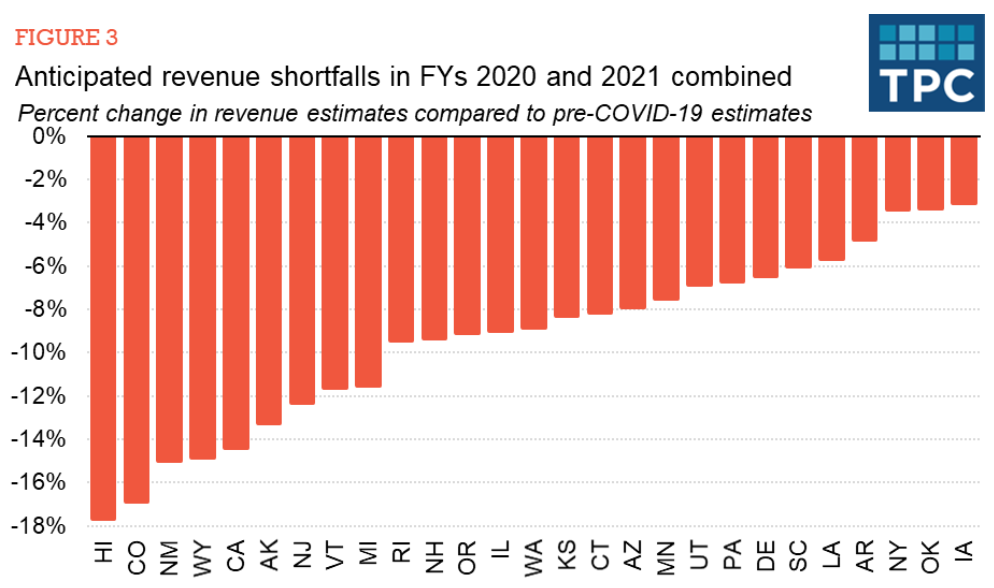

Meanwhile, Lucy Dadayan of the Tax Policy Center (TPC) reports that 27 states have revised their revenue forecasts so far. Based on those downward revisions, Dadayan estimates, “total tax revenue shortfalls for all 50 states will be roughly $75 billion in fiscal year 2020 and $125 billion in fiscal year 2021.” The chart below (from the TPC) shows the revenue reductions of the states that have revised their forecasts, as a percent of pre-COVID-19 forecasts. Washington’s revenue decline is the 14th largest.

Tags: covid , other federal action on COVID-19