8:19 am

June 18, 2020

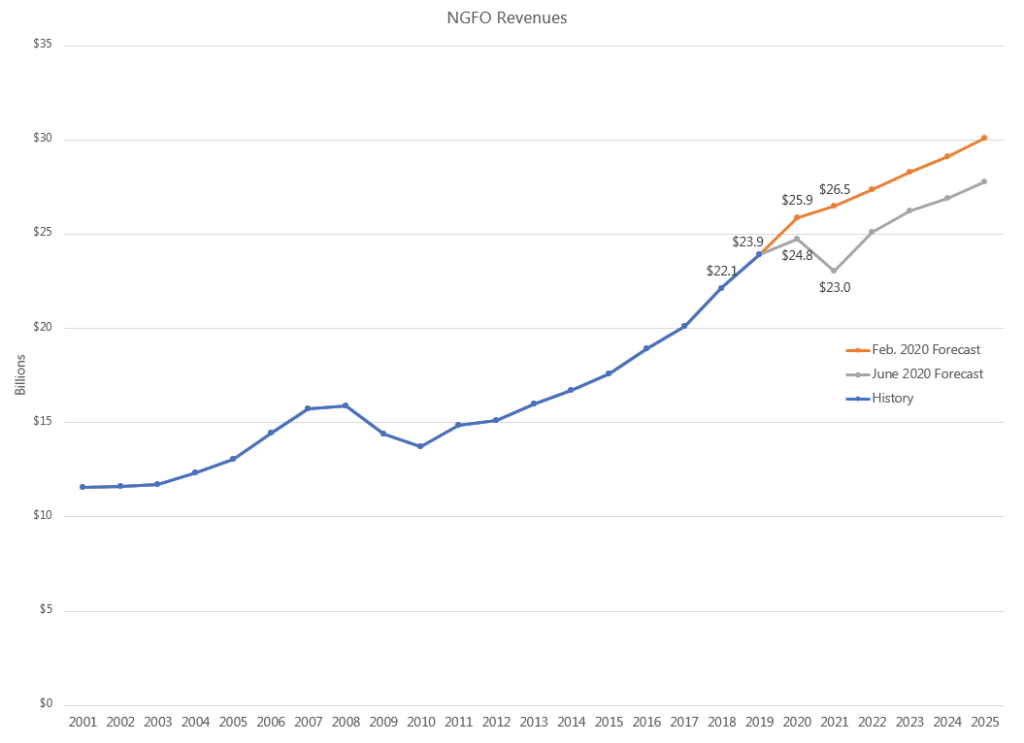

As Kriss noted yesterday, the June revenue forecast reduced estimated revenues by $4.539 billion for 2019–21 and $4.343 billion for 2021–23 (funds subject to the outlook, or NGFO). With the new forecast, revenues are expected to be lower than previously estimated in each year beginning with 2020. (And 2021 revenues are now expected to drop below the 2019 level.) The June revenue forecast for 2019–21 is 8.7 percent lower than the February forecast (on which the 2020 supplemental was based), but 2019–21 revenues are still expected to be 3.7 percent higher than 2017–19 revenues.

There is not a publicly available budget outlook that accounts for these reductions over four years. However, the revenue forecast does include an updated balance sheet for the current biennium. With the estimated revenue reduction, the unrestricted NGFO ending balance for 2019–21 is negative $3.372 billion. If the rainy day fund is drained, total reserves would still be negative $1.410 billion. (The April outlook had estimated that the 2019–21 unrestricted ending balance would be $1.292 billion, with another $1.979 billion in the rainy day fund.)

Also yesterday, Gov. Inslee announced some new measures to cut state costs: canceling the 3 percent salary increases for some employees and requiring furloughs.

Under the collective bargaining agreements adopted for 2019–21, state employees generally received a 3 percent salary increase for FY 2020 and will receive another 3 percent increase effective July 1. The Legislature extended those raises to non-represented employees in the 2019–21 budget. Now, agencies under the governor’s authority will cancel the 2021 raises for “agency directors, Exempt Management Service and Washington Management Service employees, and all other exempt employees who earn more than $53,000 annually.” About 5,600 state employees will be affected.

(There is a process to renegotiate the raises for union-represented employees, if “a significant revenue shortfall occurs resulting in reduced appropriations, as declared by proclamation of the governor or by resolution of the legislature.” But those conditions have not yet been met.)

Additionally, more than 40,000 state employees will have to take one furlough day a week through July 25 (five days). The first furlough day has to come by June 28 (i.e., in FY 2020). And, “After July, employees will be required to take one furlough day per month” through November (four days).

The governor can order furloughs even for represented employees, as the CBAs include provisions for them. For example, here’s the relevant section in one of the general government CBAs: “The Employer may temporarily layoff an employee for up to thirty (30) calendar days due to an unanticipated loss of funding, revenue shortfall, lack of work, shortage of material or equipment, or other unexpected or unusual reasons.” (During the Great Recession, the Legislature passed SB 6503 in 2010—the bill closed state agencies for 10 days.)

According to the governor, the cancellation of the wage increase and the furloughs are expected to save about $55 million. Further, “The governor urged other agencies not under his authority — including higher education institutions, the Legislature, courts and separately elected officials — to adopt similar measures. If they do, the state would save another estimated $91 million.”

(The state is expected to have 120,339 FTE employees in 2021. Of those, about half are under the governor’s authority.)

Finally, note this from the announcement: “The governor is directing agencies to seek an approved plan under the SharedWork program with Employment Security Department to provide some financial support for furloughed employees.” (Under the program, employees can collect partial unemployment insurance benefits when their hours are reduced.)

For more on the Great Recession budgets see these posts:

- Looking back at state budgeting in the Great Recession, part 1: Revenue losses

- Looking back at state budgeting in the Great Recession, part 2: How the governor and Legislature responded

- Looking back at state budgeting in the Great Recession, part 3: New Resources

- Looking back at state budgeting in the Great Recession, part 4: Overview of spending cuts

- Looking back at state budgeting in the Great Recession, part 5: Detailing the policy cuts

- Looking back at state budgeting in the Great Recession, part 6: Public employment