3:53 pm

June 18, 2020

Yesterday the Caseload Forecast Council presented the June caseload forecast. The forecast includes caseloads for education; corrections; public assistance; children’s services; medical assistance; and aging, long term, and early support. Not surprisingly, the forecasts for many of the areas have changed significantly since February.

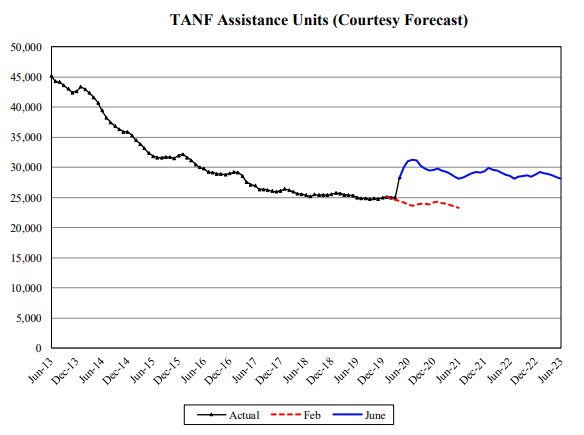

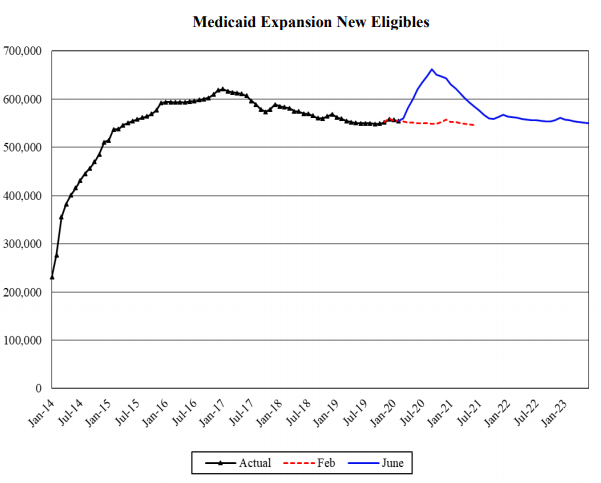

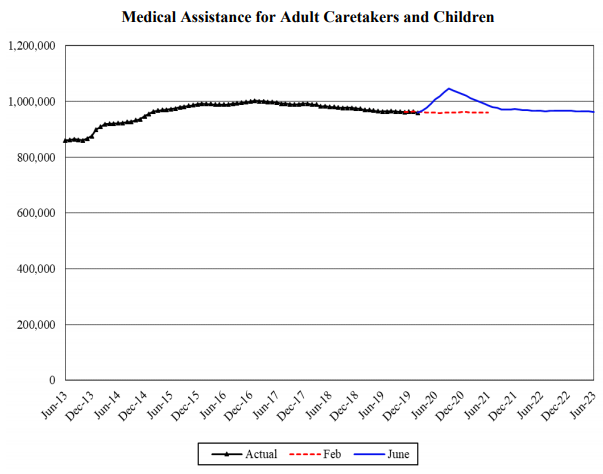

Among the caseloads whose forecasts for 2020 and 2021 have increased the most since February are Temporary Assistance for Needy Families (TANF), Medicaid Expansion New Eligibles, and Medicaid Adult Caretakers and Children. (The charts are from the forecast.)

- TANF caseloads are now expected to increase by 2.8 percent in 2020 and by 13.5 percent in 2021. The actual caseload for April 2020 was 15.8 percent above the February forecast for that month.

- Medicaid caseloads for those who are newly eligible under the Affordable Care Act’s expansion (i.e., adults under 138 percent of the federal poverty level) are now expected to increase by 1.0 percent in 2020 and 11.0 percent in 2021. (The federal government funds 90 percent of the costs for this population; other populations are typically funded half by the state.)

- Medicaid caseloads for adult caretakers and children are now expected to decline by 0.2 percent in 2020 and increase by 4.9 percent in 2021. (The higher federal match under one of the COVID-19 relief bills will apply to this group.)

Other forecasts have decreased since February, including for special education, the Washington College Grant Program, and Corrections.

There is not a cost estimate associated with the caseload forecast, but it will feed into the maintenance level (the cost of continuing current services) for the next budget.

Speaking of which, the Office of Financial Management (OFM) has issued instructions for agencies as they begin to develop their budget requests for 2021–23. OFM Director David Schumacher writes that the savings options drill that agencies recently went through “will serve as a starting point as we work on the 2021–23 budget.”

Additionally, agencies are asked to re-base their budgets for programs “not protected from reduction by either state constitutional provisions or federal law” to below the maintenance level and identify ways to reduce spending by 15 percent of maintenance level. According to the full instructions document, the protected programs are debt service, basic education, LEOFF and judicial pension system contributions, and mandatory Medicaid. (In a recent policy brief, we wrote about the “protected” versus discretionary parts of the state budget. There are varying degrees of “protected.”)

Categories: Budget , Economy.Tags: COVID-19 , COVID-19 & the economy , other federal action on COVID-19