2:58 pm

February 16, 2024

The Feb. 2024 transportation revenue forecast estimates that transportation revenues (including, e.g., revenues from motor vehicle fuel taxes; licenses, permits, and fees; ferries; and tolls) will be $6.990 billion in 2023–25. That’s an increase of 0.01% compared to the Nov. 2023 forecast and a decrease of 0.79% compared to the March 2023 forecast (on which the current transportation budget was based).

For the budget period through 2027–29, the current forecast is effectively unchanged from Nov. 2023 and it is 0.22% higher than in March 2023. The state will not find a solution to transportation project cost overruns from growth in current revenues.

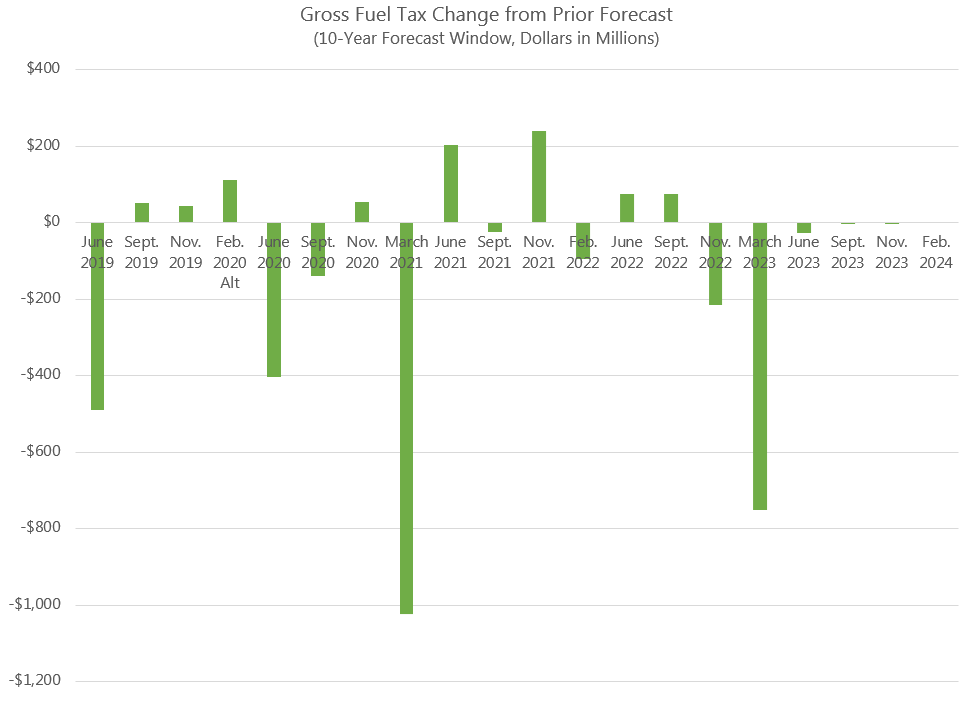

The largest component of the transportation revenue forecast is the gross fuel tax, but the forecast has only made extremely minimal changes to the gross fuel tax forecast since June 2023, which is very unusual.

While it’s possible that the June gross fuel tax revenue forecast just happened to be perfect, it seems more likely that the Department of Transportation is just not making changes to the forecast since it lost its forecaster last year. If this is the case, it is an unfortunate—but understandable—consequence of the upcoming transfer of responsibility for the forecast to the Economic and Revenue Forecast Council.

The ERFC will have full responsibility for the transportation revenue forecast beginning with the Sept. 2024 forecast. In advance of the move, the state is working with a Western Washington University economist on transportation revenue modeling. Given this and the lack of meaningful changes to the fuel tax forecast since June, the Sept. 2024 revenue forecast could be quite different from the June 2024 forecast.

Categories: Budget , Transportation.