9:02 am

January 22, 2020

Three bills have been introduced that would overhaul the workforce education investment surcharges.

The workforce education investment business and occupation (B&O) tax surcharges were adopted last year to supplement funding for higher education. (See this brief for more information.) Revenues to the new workforce education investment account (WEIA) are expected to be $380.0 million in 2019–21 and $393.1 million in 2021–23 under current law.

The Legislature also made appropriations from the WEIA in 2019: $374.7 million in 2019–21. These appropriations were estimated (in an April 27, 2019 Ways & Means Committee meeting document) to cost $557.0 million in 2021–23—well above the revenues that are expected in the account in that biennium. There is also a potential WEIA shortfall in the current biennium.

Additionally, the Department of Revenue (DOR) has warned the Legislature that the “[s]ignificant volume of ambiguity in the bill jeopardizes the Department’s ability to administer and taxpayer’s ability to comply.”

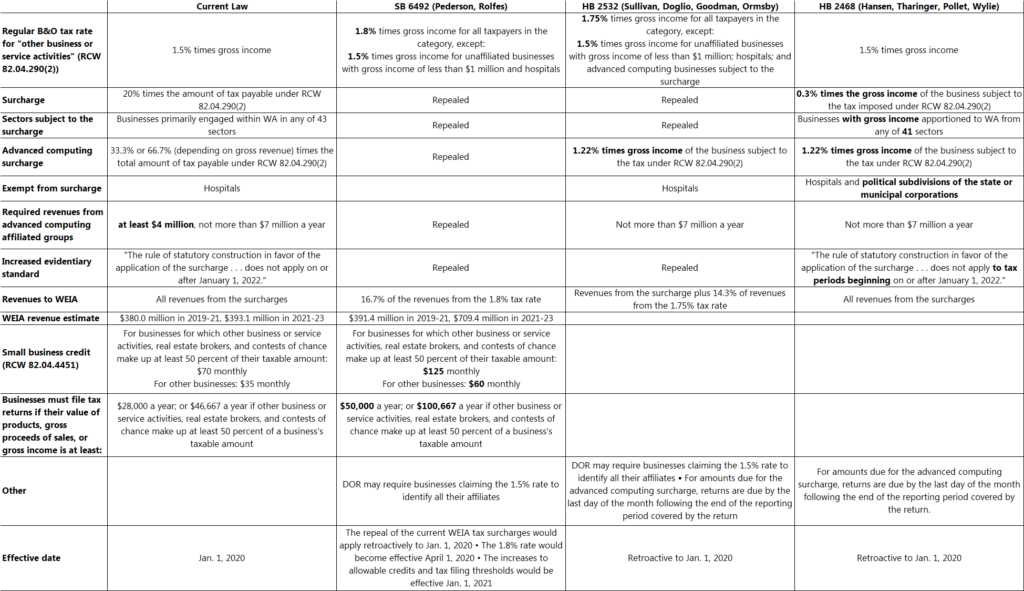

The three new bills (SB 6492, HB 2532, and HB 2468) attempt to address these issues. For example, SB 6492 would repeal the surcharges and apply a higher B&O rate across all sectors, exempting businesses with gross income less than $1 million. The table below compares the three bills to current law (click on the table for a larger version). I will update the table as more information about fiscal impacts is available.

In a partial fiscal note for SB 6492, DOR estimates that it would reduce general fund–state revenues by $16.3 million in 2019–21 and by $80.7 million in 2021–23. DOR estimates it would increase WEIA revenues by $11.4 million in 2019–21 and by $316.3 million in 2021–23. Thus, it estimates that, if SB 6492 is enacted, revenues to the WEIA would total $391.4 million in 2019–21 and $709.4 million in 2021–23.

DOR notes that at least 89,100 taxpayers are subject to the surcharges under current law. It estimates that 14,800 taxpayers would be subject to the 1.8 percent rate in SB 6492, of whom 4,400 are not subject to the current law surcharges. Under SB 6492, an additional 32,000 taxpayers would qualify for the (full or partial) small business tax credit.

In a Senate Ways & Means Committee meeting yesterday, Sen. Conway asked staff which sectors the 4,400 taxpayers (who would be newly affected by the WEIA surcharge) are in, as the 2019 bill attempted to restrict the surcharges to “professions that depend on higher education.” Sen. Pedersen noted that, given the exemption for businesses with less than $1 million in revenue,

the businesses that will be paying the additional B&O tax are businesses that, by their nature, rely on highly-educated professionals. There’s just no way, in the modern economy, that you can have more than $1 million in revenue and not need accountants, and not need lawyers, and not need other highly-trained professionals.