10:12 am

March 20, 2023

As part of the 2021–23 biennial budget, the Legislature appropriated $800.0 million from the general fund–state (GFS) to make an extra payment toward the unfunded actuarial accrued liability (UAAL) of the Teachers’ Retirement System (TRS) Plan 1. The payment is scheduled for June 30, 2023. In 2021, the Legislature had also transferred the balance of the rainy day fund ($1.8 billion) to the GFS. The $800 million for TRS 1 is effectively one-time money from that transfer. As such, from a budget sustainability perspective, using the money for a one-time extra pension payment was appropriate (if it wasn’t going to remain in the rainy day fund).

However, Gov. Inslee’s 2023 supplemental budget proposal would repeal this extra payment and instead use the $800 million to help balance his 2023–25 budget proposal. (That is, it would be used for ongoing spending purposes.)

This year, the Office of Financial Management requested SB 5294, which would end the current UAAL minimum rates for TRS Plan 1 as of Aug. 31, 2024 and the Public Employees’ Retirement System (PERS) Plan 1 as of June 30, 2025 and then set the UAAL contribution rates at 0% (see this post for background). SB 5294, as introduced, would also repeal the $800 million extra TRS 1 payment.

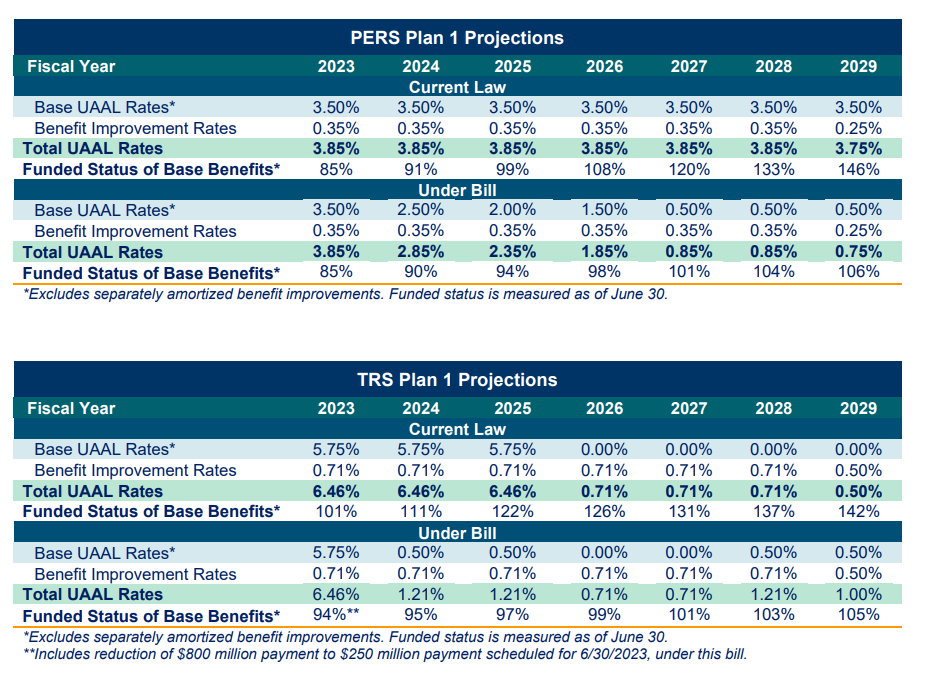

The Senate unanimously passed ESSB 5294 in February, and the bill is scheduled for executive session in the House Appropriations Committee on Thursday. As passed by the Senate, the bill would end the current minimum contribution rates for PERS 1 and TRS 1 a year earlier than originally proposed, and the minimums would be stepped down rather than going to 0% immediately. Going forward, minimum rates would thereafter be 0.5% whenever the value of assets in PERS/TRS is less than 100% of the actuarial accrued liability.

Additionally, as passed by the Senate, the bill would not repeal the full $800 million extra payment for TRS 1. Instead, it would make an extra payment of $250.0 million. That means that $550 million of one-time money would be available for use in the operating budget.

According to the fiscal note, as passed by the Senate, ESSB 5294 would reduce spending from funds subject to the outlook (NGFO) by $888.3 million in 2023–25 and $266.3 million in 2025–27. (The four-year savings of $1.155 billion exceeds the original bill’s four-year savings of $797.3 million.)

Under current law, in 2029, the funded status of PERS 1 is expected to reach 146% and the funded status of TRS 1 is expected to reach 142%. By not maintaining unnecessarily high contribution rates after the plans are fully funded, the bill would save state funds while still keeping the funded status of the plans at about 100%. The funded status of both PERS 1 and TRS 1 would be about the same in both the original version of SB 5294 and the version passed by the Senate, but both plans would reach 100% funded status in 2027 under the Senate-passed version and in 2026 in the original version.