2:04 pm

January 24, 2023

Washington’s public pension plans are well funded. Overall, the funded ratio of all plans was 93% as of June 30, 2021 (the most recent data). All individual plans in Washington were over 90% funded, except for the Public Employees’ Retirement System (PERS) and Teachers’ Retirement System (TRS) plans 1 (which have been closed to new members since 1977). PERS plan 1 had a 71% funded ratio and TRS plan 1 had a 73% funded ratio. For these two plans, public employers have been paying an extra contribution toward the unfunded actuarial accrued liability (UAAL)—but the end is in sight.

In 2021, the Legislature opted to set aside $800 million from the general fund–state (GFS) to make an early payment for the TRS plan 1 UAAL on June 30, 2023. Gov. Inslee’s 2023 supplemental budget proposal would eliminate this extra payment (and the savings would help to balance his 2023–25 budget proposal).

This month the Office of the State Actuary (OSA) published a “Plans 1 Funding Policy Review.” It provides information on the current status of the plans and options for changing their funding policies. (Additionally, the Ways & Means Committee had a work session this week on state pension funding. The presentation from OSA provides very good background on pensions.)

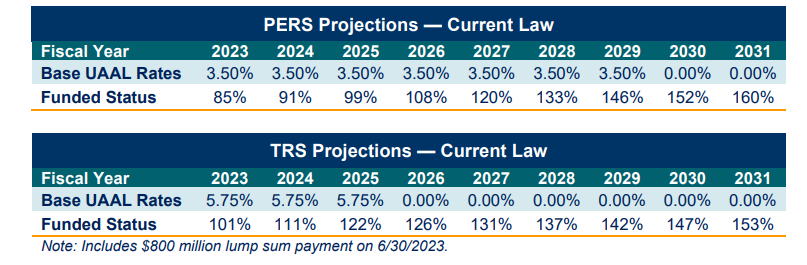

Under current law (including the $800 million payment), full funding is estimated to occur in FY 2026 for PERS 1 and FY 2023 for TRS 1. However, under the current two-year rate-setting process, the additional UAAL rates will continue through FY 2029 and 2025, respectively. OSA estimates that if the $800 million payment for TRS is not made, TRS plan 1 would be fully funded in FY 2025 and UAAL contributions would continue through FY 2027.

Importantly, estimates of funded status rely on assumptions about investment returns. Lower returns mean that higher contributions will be required to meet obligations. OSA assumes investment returns of 7.0%. (The Pension Funding Council has been gradually lowering the assumed long-term rate of investment return for pensions. The assumed rate was 7.5% for 2021–23 and the Pension Funding Council recommended in 2021 to reduce it to 7.0%.)

According to the Plans 1 Funding Policy Review,

OSA assessed the current Plans 1 funding policy as heavily weighted towards plan solvency with a smaller emphasis on affordability and budget stability. This weighting may have been necessary to bring the chronically underfunded Plans 1 to their current, projected status. However, it may no longer be necessary as the plans approach and ultimately reach full funding.

Several bills have been introduced this year that would make changes to the UAAL rates and provide cost-of-living adjustments (COLAs) to plan 1 retirees.

SB 5294 and HB 1201 were requested by the Office of Financial Management and have been heard by Senate Ways & Means and House Appropriations. They would repeal the PERS 1 UAAL minimum rate as of June 30, 2025 and the TRS 1 minimum rate as of Aug. 31, 2024 and set the UAAL contribution rates at 0%. Additionally, they would repeal the $800 million TRS 1 payment (consistent with the governor’s budget proposal). According to the fiscal note, the bills would reduce spending from funds subject to the outlook (NGFO) by $425.7 million in 2023-25 and by $371.6 million in 2025–27. (There would also be savings to local government employers.) For the fiscal note, OSA performed a stress test to look at what would happen in the short run if investment returns are low. OSA found, “a FY 2023 return of approximately 3.00 percent (or below) would result in a continuation of the UAAL for both plans.” As the tables below show, the bill would save state funds by not continuing to contribute extra dollars after the funded status of the plans reaches 100%.

SB 5350 and HB 1057 were requested by the Select Committee on Pension Policy (SCPP). SB 5350 has been heard by Ways & Means. The bills would provide a one-time 3% benefit increase (up to $110 a month) for PERS 1 and TRS 1 retirees in FY 2024. They would also require the SCPP to study a potential ongoing COLA for PERS 1 and TRS 1 retirees. (These retirees had an annual COLA from 1995–2011. They received one-time COLAs in 2018, 2020, and 2021.) The fiscal note estimates that the one-time COLA would increase NGFO appropriations by $41.6 million in 2023–25 and $48.6 million in 2025–27. (The costs would be amortized over 10 years; the full, 10-year cost would be $258.7 million.) OSA estimates that the policy would “immediately decrease the PERS 1 and TRS 1 funded ratios by 1 percent each.”

HB 1459 recognizes that the Pension Funding Council recommended a 7% investment return assumption, but notes that the state investment board has experienced historical growth of over 9%. Thus, it states that “lowering the investment rate of return was prudent, but the pension funding council’s recommendation does not need to be fully implemented at this time.” The bill would specify that the assumed rate of return would be 7.2% beginning July 1, 2023. The bill would provide an ongoing monthly benefit increase of up to $110 (based on the consumer price index) for PERS 1 and TRS 1 retirees. There is not yet a fiscal note, but the bill will be heard by Appropriations on Thursday.

Categories: Budget , Employment Policy.