11:48 am

April 23, 2021

Yesterday Kriss wrote about the version of the capital gains tax bill that the House passed this week. The intent section of the bill states,

The legislature finds that it is the paramount duty of the state to amply provide every child in the state with an education, creating the opportunity for the child to succeed in school and thrive in life. The legislature further finds that high quality early learning and child care is critical to a child’s success in school and life, as it supports the development of the child’s social-emotional, physical, cognitive, and language skills. Therefore, the legislature will invest in the ongoing support of K-12 education and early learning and child care by dedicating revenues from this act to the education legacy trust account.

The legislature intends to levy a seven percent tax on the privilege of voluntarily selling or exchanging stocks, bonds, and other capital assets where the profit is in excess of $250,000 annually to fund K-12 education, early learning, and child care, and advance our paramount duty to amply provide an education to every child in the state.

(Emphasis added.) Early learning and child care may be “critical to a child’s success in school and life,” but they are not currently part of the state’s definition of basic education. Thus, they are not part of the state’s paramount duty under the state constitution (Article IX, Section 1), according to the state Supreme Court (in the McCleary decision on school funding and previous court cases).

But even if early learning and child care were part of basic education, the state would not need to impose a capital gains tax to fund them. Indeed, in a 2017 order in the McCleary case, the Court noted,

The State does not dispute, indeed it concedes, that there is enough money in the state’s Near General Fund to fully pay for the program of basic education, including salaries. Nor does it dispute that sufficient revenue will be collected to provide full funding. Whether that is achieved by September 1, 2018, is wholly within the legislature’s discretion in making taxing and spending decisions. The court has been clear and consistent that while the constitution empowers the legislature alone to write the budget, in doing so it must meet its “paramount” obligation first.

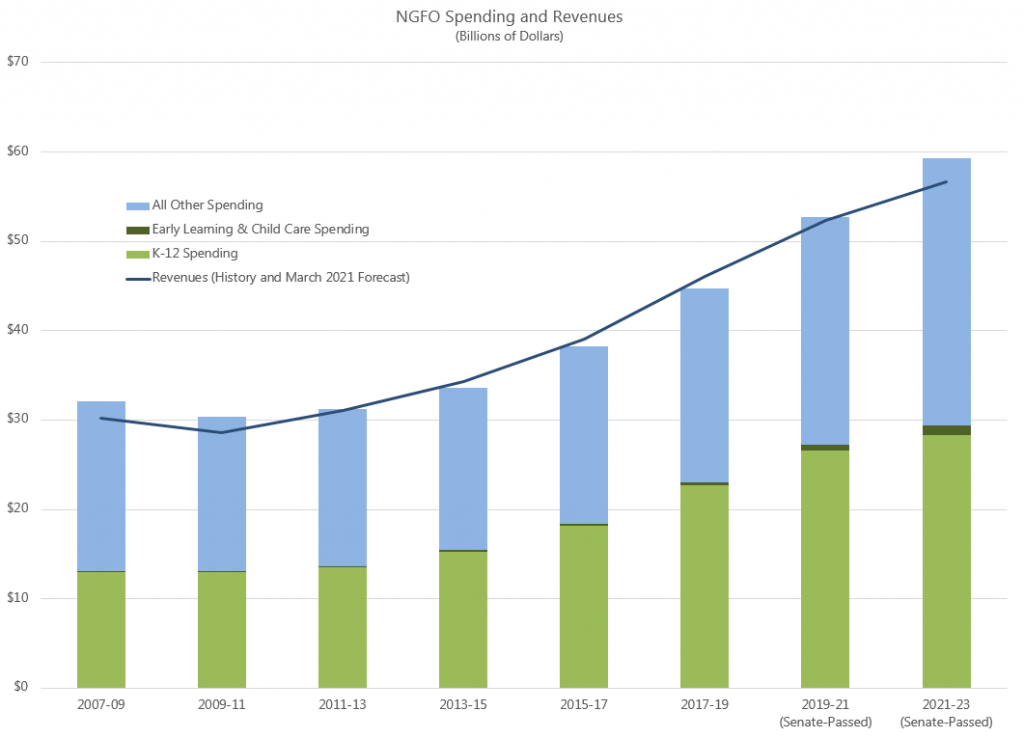

State funding for K–12 makes up about half of the budget (in terms of funds subject to the outlook). Even if state revenues declined, there would be more than enough to fund basic education. But revenues have grown each biennium since the Great Recession, and that growth is expected to continue. A new tax is not needed to fund the state’s paramount duty, as the Supreme Court stated. Early learning and child care could also be funded within current revenues, if the Legislature so chooses.

The chart shows the state’s spending and revenue data over time, for funds subject to the outlook (NGFO). For 2019–21 and 2021–23 I’ve used numbers from the Senate-passed operating budget (they are higher than those in the House-passed budget). In 2021–23, I also included the non-NGFO funding for the Fair Start for Kids Act. (As we wrote in our policy brief on the budgets, the budgets would mainly use federal relief funds for this child care bill, but they will need to use state funds in the future.)