4:31 pm

April 22, 2021

Emily and I have written previously about the Senate’s progressive capital gains tax bill ESSB 5096 (here, here, here and here), which the Senate passed on March 6.

On Friday (April 16) the House Finance Committee took up the bill in executive session, adopted a striking amendment, and passed the amended bill. Yesterday (April 21) the House passed the House Finance Committee version.

The House version retains the 7 percent rate of the Senate bill; it clarifies the exemption for real estate; and it modifies the $250,000 standard deduction for individual and joint returns so that married couples or registered domestic partners that file separate returns are allowed a total deduction of $250,000 across their two returns, rather than $250,000 on each return. The amendment directs all funds from the capital gains tax to the education legacy trust account (ELTA). (The Senate version directs the first $350 million each fiscal year to the ELTA, the next $100 million to the General Fund-State (GFS) and the remainder to a newly created Taxpayer Fairness Account.)

The ELTA’s current revenue sources are the estate tax and interest earnings on the balance in the account. Monies in the account may be used only for support of the common schools, for expanding access to higher education through funding for new enrollments and financial aid, for other educational improvement efforts and (temporarily) for support of early learning programs. The House bill makes permanent the use of ELTA monies for support of early learning programs. It also makes child care an allowed use.

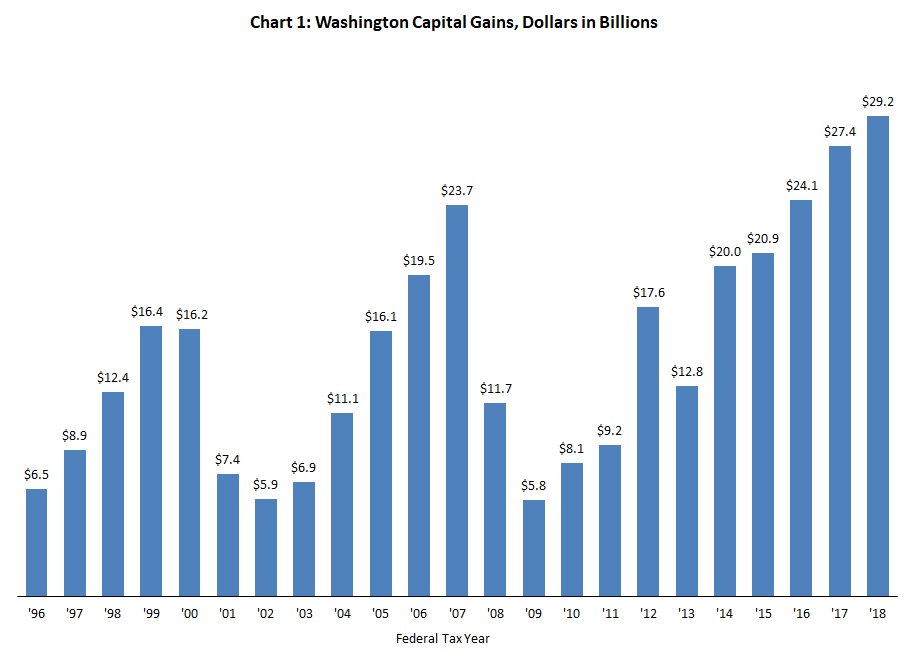

Capital gains are extremely volatile. Chart 1 shows the total amount of capital gains on Washington state federal tax returns for the tax years 1997 to 2018.

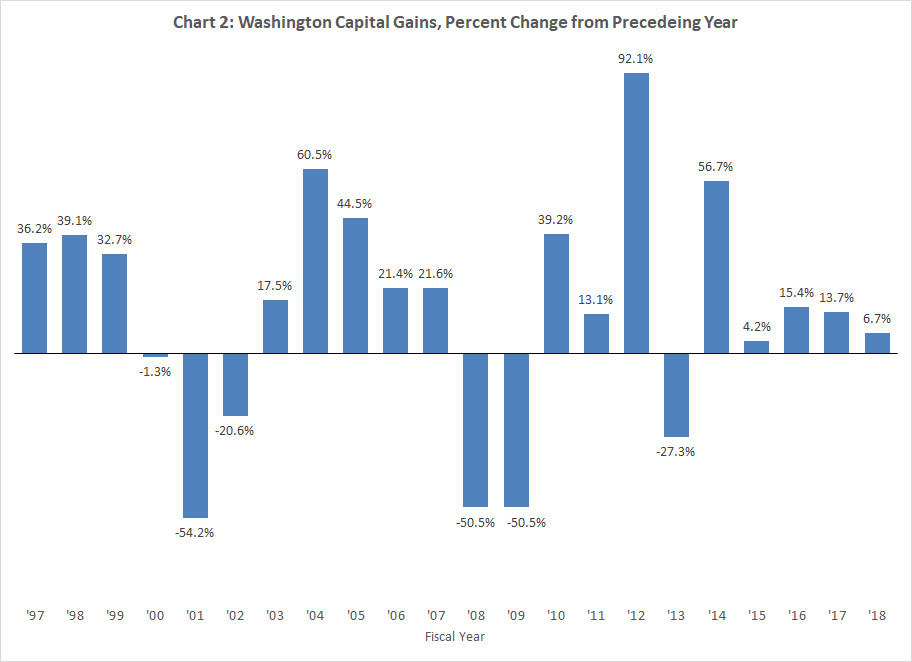

Chart 2 shows the year-to-year percent change in capital gains. Over the period, the average of the absolute value of these percentage changes is 33%. In only three cases was the change less than 10 percent, while in six cases the change exceeded 50%.

The California Legislative Auditor calculates that over the period from 1990 to 2014, capital gains income reported on California tax returns was 10 times more volatile than wage and salary income (here). Moreover, the Legislative Auditor finds that the progressive structure of California’s income tax magnifies volatility (here).

In response to this volatility, California voters in 2014 approved a constitutional amendment requiring capital gains revenues in excess of 8% of overall general fund revenues to be deposited in that state’s Budget Stabilization Fund, which is analogous to Washington’s Budget Stabilization Account (BSA).

Washington’s constitution requires that one percent of general state revenues be transferred the BSA at the end of each fiscal year and, in addition, that three-quarters of extraordinary revenue growth be transferred to the BSA at the end of each biennium. Extraordinary revenue growth is defined as the “amount by which the growth in general state revenues for that fiscal biennium exceeds by one-third the average biennial percentage growth in general state revenues over the prior five fiscal biennia.

Because of the restrictions placed on the use of monies in the ELTA, revenues from the capital gains tax will not be considered to be general state revenues and will not feed into the calculation of the amounts transferred to the BSA. This is unfortunate, particularly with respect to the calculation of extraordinary revenue growth given the extreme volatility of capital gains.

The simplest fix to this problem would be to direct capital gains revenues to the GFS rather than to the ELTA. If this option is unattractive to legislators, an alternative would be to require by statute that three-quarters of capital gains tax revenue in excess of 3 percent of GFS revenue be transferred to the BSA at the end of each fiscal year.

The texts of the capital gains bills and their fiscal notes are available here.

Categories: Categories , Tax Policy.