11:55 am

March 31, 2022

Today the Economic and Revenue Forecast Council (ERFC) held a budget outlook methodology meeting. The budget outlook workgroup wanted the ERFC’s guidance as to how to treat revenues from the capital gains tax in the upcoming official budget outlook (based on the 2022 supplemental).

The capital gains tax was adopted last year, and the first revenues are expected in fiscal year 2023. However, a Superior Court judge ruled the tax unconstitutional on March 1. Nevertheless, the supplemental budget passed by the Legislature (the details of which were announced on March 9) continued to assume that the capital gains tax will be collected.

The ERFC voted today to have the official outlook include the capital gains revenues. David Schumacher, director of the Office of Financial Management, said,

This money was assumed in the budget that was passed and is going to be signed here this afternoon. We don’t know what the Supreme Court may or may not do. We will have to react to this and the changing revenue forecast and lots of other variables between now and when we get to make another budget. So I don’t know that we should pick and choose which things to make changes now.

Rep. Orcutt requested that staff also produce an alternative outlook that excludes the capital gains tax revenues.

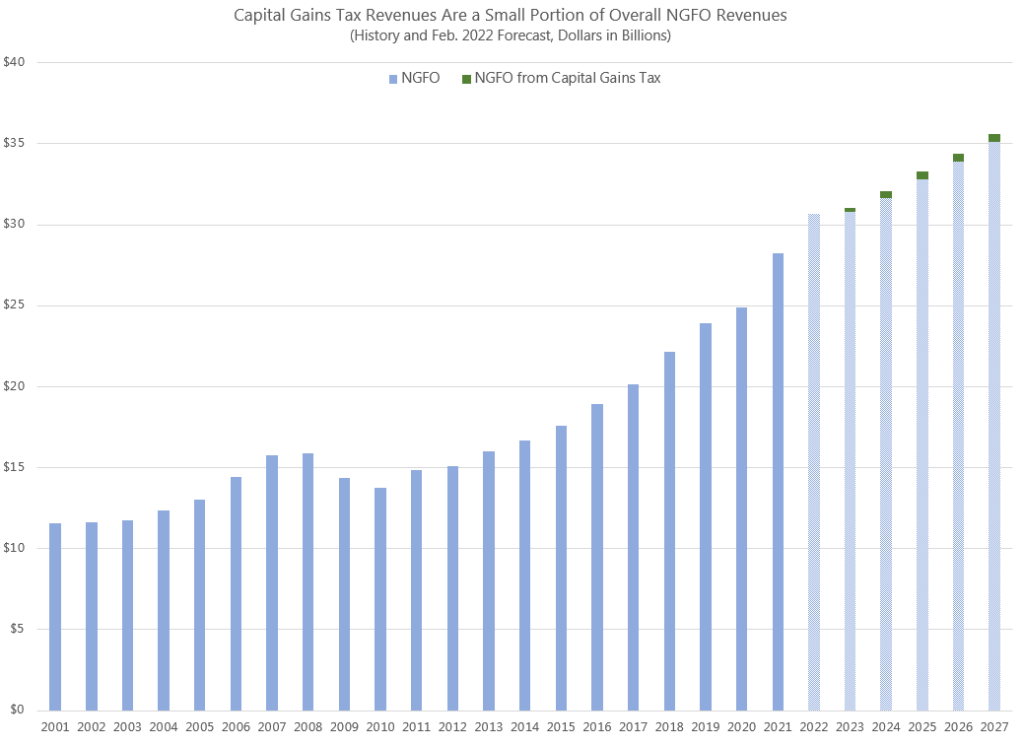

According to the ERFC, the Feb. 2022 revenue forecast includes NGFO revenues from the capital gains tax of $233.0 million in 2021–23 and $922.0 million in 2023–25. Given the high level of new spending in the supplemental and fairly low unrestricted NGFO ending balances, I estimate that the budget as passed by the Legislature would not balance in either biennium without the capital gains tax revenues. (This could change depending on what the governor vetoes from the budget.) However, as the chart shows, capital gains revenues are a very small portion of overall NGFO revenues.