10:44 am

March 2, 2022

Yesterday the Douglas County Superior Court ruled that the capital gains tax is unconstitutional. According to the ruling, the tax is an income tax and it violates the state constitution’s uniformity requirement and 1% limit on property taxes.

The attorney general has already said he will appeal. If the state supreme court ultimately agrees that the tax is unconstitutional, what would that mean for the state budget?

Under ESSB 5096, the first $500 million in capital gains tax collections a year are dedicated to the education legacy trust account (ELTA). Any collections above that would go to the common school construction account. Additionally, ESSB 5096 allows the ELTA to be used for early learning and child care (in addition to other education programs). The enacted 2021–23 biennial budget assumes that the capital gains tax will increase revenues to funds subject to the outlook (NGFO) by a net of $415 million in 2021–23 and $840 million in 2023–25. According to the fiscal note for ESSB 5096, the estimated increase in revenues to the ELTA—part of the NGFO—was $500.0 million in 2021–23 and $1.028 billion in 2023–25. (There is also an offsetting business & occupation tax credit—hence the lower net estimate for the NGFO.)

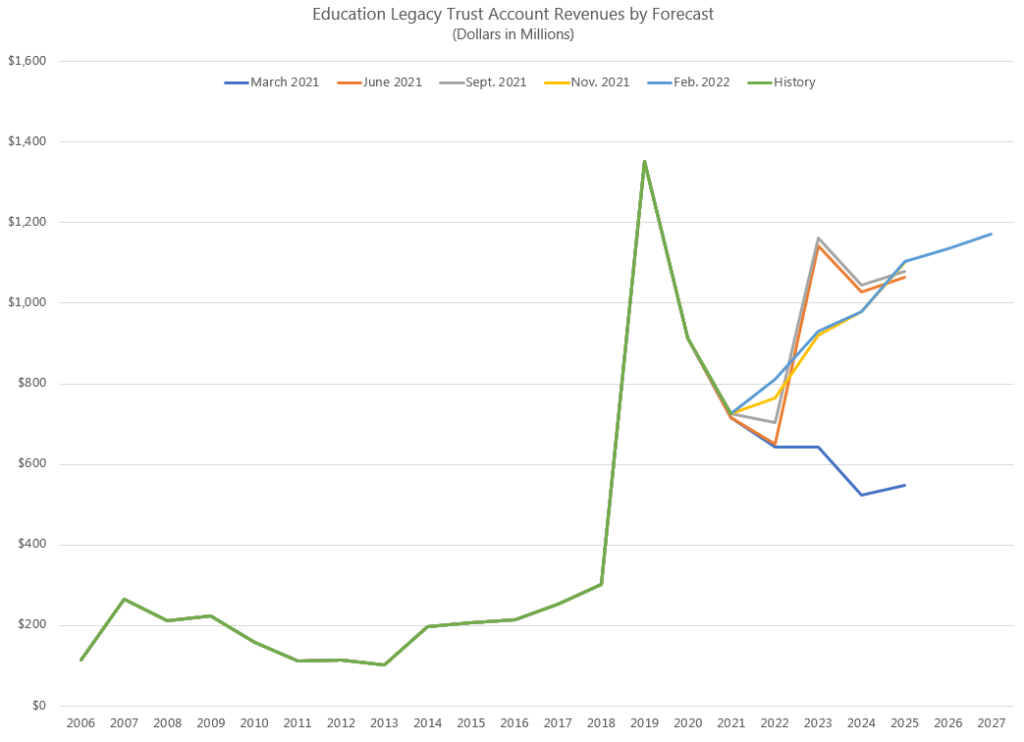

However, the Nov. 2021 revenue forecast noted that capital gains tax revenues are expected to come in lower than estimated in the fiscal note. In the forecast, the Economic and Revenue Forecast Council estimated that capital gains tax revenues to the ELTA would be $234 million in 2021–23 and $942 million in 2023–25—$353 million less over the outlook period that is assumed in the budget. The chart shows how the ELTA revenue forecasts have changed with the addition of the capital gains tax. (The June 2021 forecast was the first one after enactment of ESSB 5096 and FY 2023 is the first year capital gains tax revenues would be collected.)

So, if the capital gains tax is unconstitutional, the state would have roughly $1.2 billion less to work with over the outlook period. Remember, though, that with the Feb. 2022 forecast, NGFO revenues are $10.129 billion higher through the outlook period than Legislators expected last year. That figure does not include the capital gains tax revenues.

As legislators work on the 2022 supplemental operating budget, they could rework their spending plans to increase reserves so that state programs can be sustained should the supreme court agree that the capital gains tax is unconstitutional.