11:22 am

May 1, 2019

[UPDATE 6/27/2019: An updated version of the table is available here.]

In the March revenue forecast, the Economic and Revenue Forecast Council estimates that 2019–21 revenues in funds subject to the outlook (NGFO) will be $50.555 billion. The 2018 supplemental budget passed just last year was based on revenues of $44.990 billion.

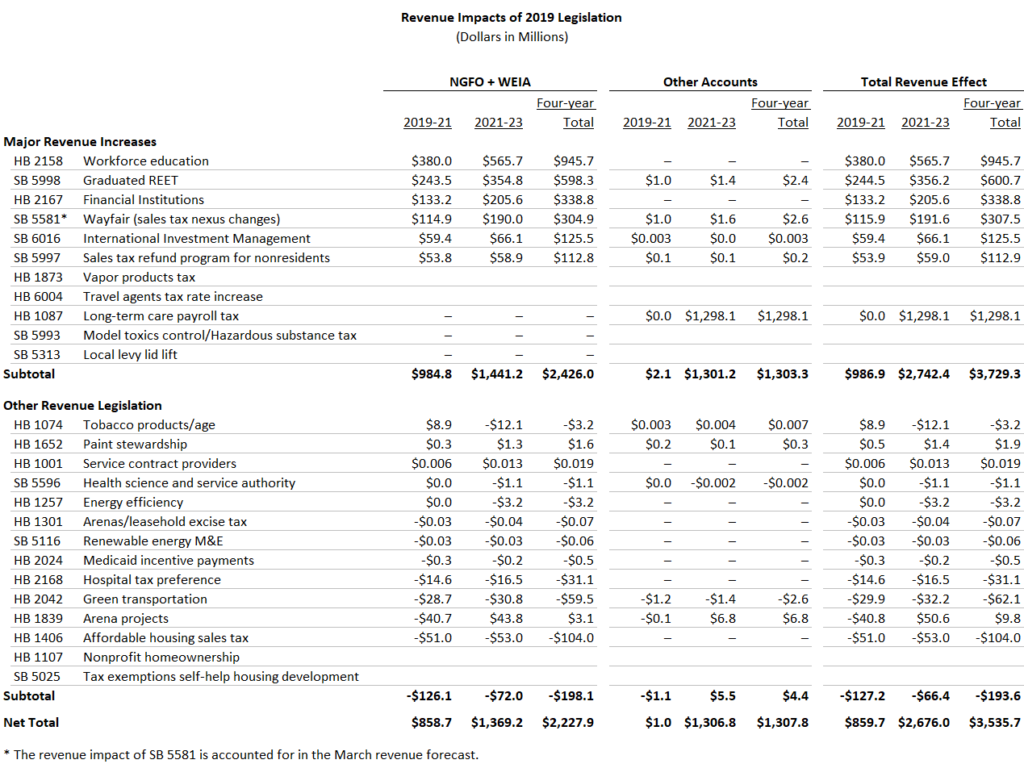

Despite the estimated revenue increase due to economic growth, the Legislature passed a number of bills this session that affect revenues, including several that significantly increase taxes. The table below tallies the effects of these bills. The numbers are based on the most recent publicly available information, but many of the estimates are not final. Also, I haven’t included estimates for some bills—in these cases, there is either no fiscal note or the available fiscal note is based on an early version of the bill (not the version that eventually passed).

Long story short, the numbers are not set in stone. I’ll update them as more information is available.

The table shows the impacts to the NGFO plus the new workforce education investment account (WEIA), as well as other accounts. As I noted yesterday, the WEIA is to fund higher education and career connected learning programs that would typically be funded through the NGFO, so I’ve combined them here.

Note that SB 5581 became law before the March revenue forecast, so those revenues are already included in the $50.555 billion expected for 2019–21.

The major revenue increase bills passed in 2019 increase total revenues (to NGFO, WEIA, and other accounts) by at least $986.9 million in 2019–21 and $2.742 billion in 2021–23. Of that, $984.8 million in 2019–21 and $1.441 billion in 2021–23 go to the NGFO + WEIA. Other legislation reduces total revenues by at least $127.2 million in 2019–21 and $66.4 million in 2021–23.