10:01 am

June 27, 2019

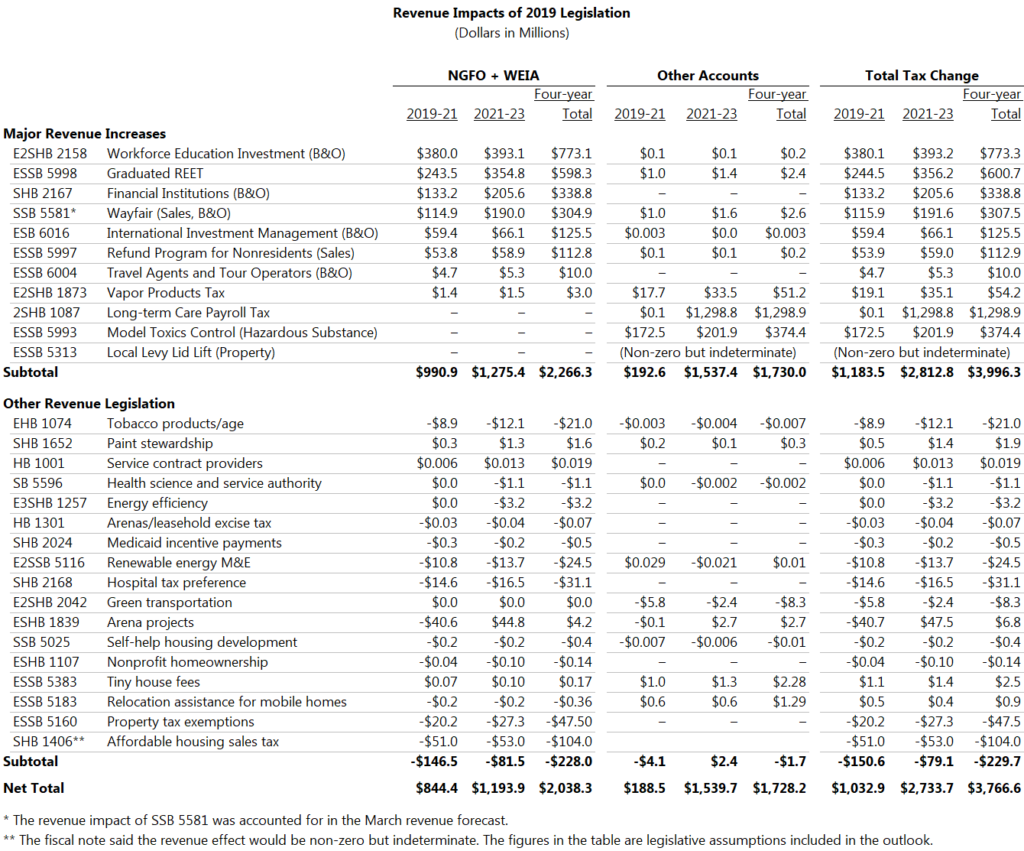

As Kriss noted earlier this week, the NGFO (funds subject to the outlook) revenue forecasts for 2019–21 and 2021–23 are up by $432.3 million and $677.5 million, respectively. The bulk of those increases ($329.8 million and $604.6 million) are due to legislative changes made during the 2019 session.

I’ve made a few updates to our running tally of tax increases from the session. It should be the final version, as it jibes with the revenue estimates included in the outlook and the June forecast (though our tally includes revenues to all funds, not just those subject to the outlook).

The net tax increase (going to all accounts) is $1.033 billion in 2019–21 and $2.734 billion in 2021–23. That does not include the impact of the increase to the local levy limit, which will mean higher property taxes for taxpayers in some school districts (depending on voter approval). The substantial increase in the second biennium is due to the beginning of premium collections for the new long-term care program.

Of all this, the net revenue increase to the general fund–state is just $295.0 million in 2019–21 and $531.6 million in 2021–23. Effectively, this means that most of the new tax revenues will not be subject to constitutionally-required transfers to the rainy day fund.

For more on the revenue legislation, see this report.