8:59 am

January 27, 2022

At a Ways & Means (W&M) Committee work session on Jan. 18, the Employment Security Department (ESD) provided an update on the paid family and medical leave program. According to the update, “ESD is currently concerned about the fund’s solvency.” They expect the account to have a cash deficit in March or April. (As I’ve noted, the premium rate for the program was increased to 0.6% for 2022, but the increased premiums aren’t due until April.)

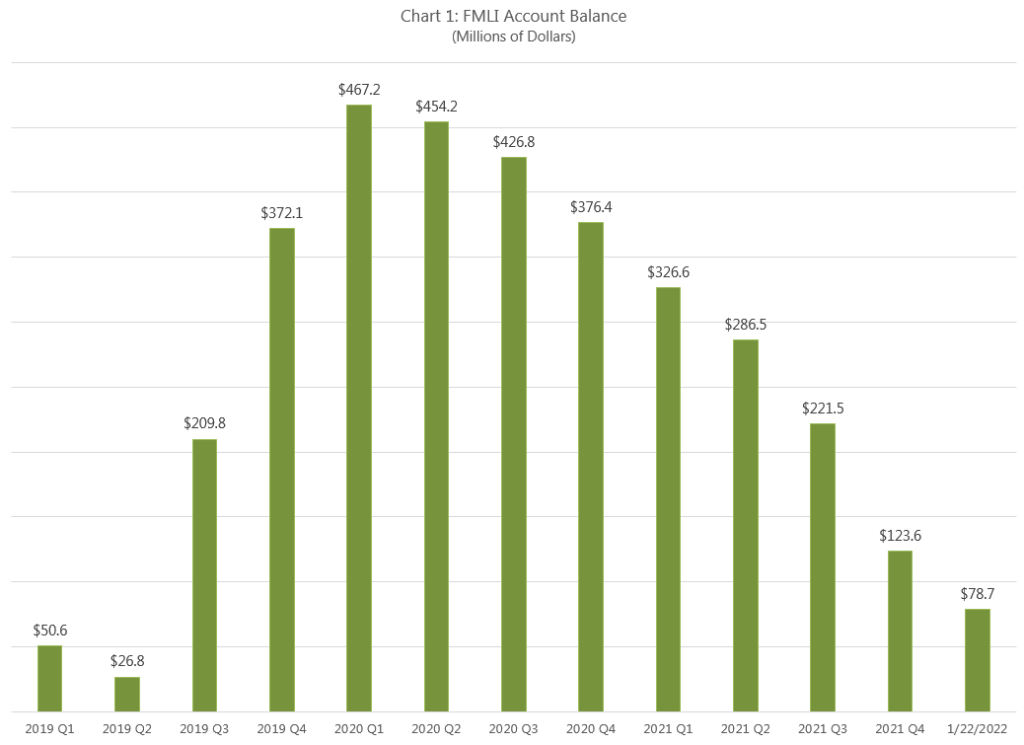

ESD held a special meeting of the Paid Family & Medical Leave (PFML) Advisory Committee yesterday to discuss the state of the trust fund (the family and medical leave insurance account). According to ESD’s presentation, the account’s balance as of Jan. 22 was just $78.7 million. (That’s about four weeks of benefits, but note that premiums due for the fourth quarter of 2021 are still coming in.) Chart 1 shows how the account has been drawn down. Benefits paid have exceeded premiums collected since the third quarter of 2020, and the gap has widened (see Chart 2).

The current 0.6% premium rate is the highest regular rate allowed under the statute (RCW 50A.10.030). For the first two years of collections, the premium rate was set at 0.4% of covered wages. Beginning in CY 2021, the premium is based on the FMLI account balance ratio as of Sept. 30 of the previous year. (The balance ratio is the account balance divided by total covered wages.) If the account balance ratio is less than 0.05%, a solvency surcharge must be assessed, on top of the regular rate.

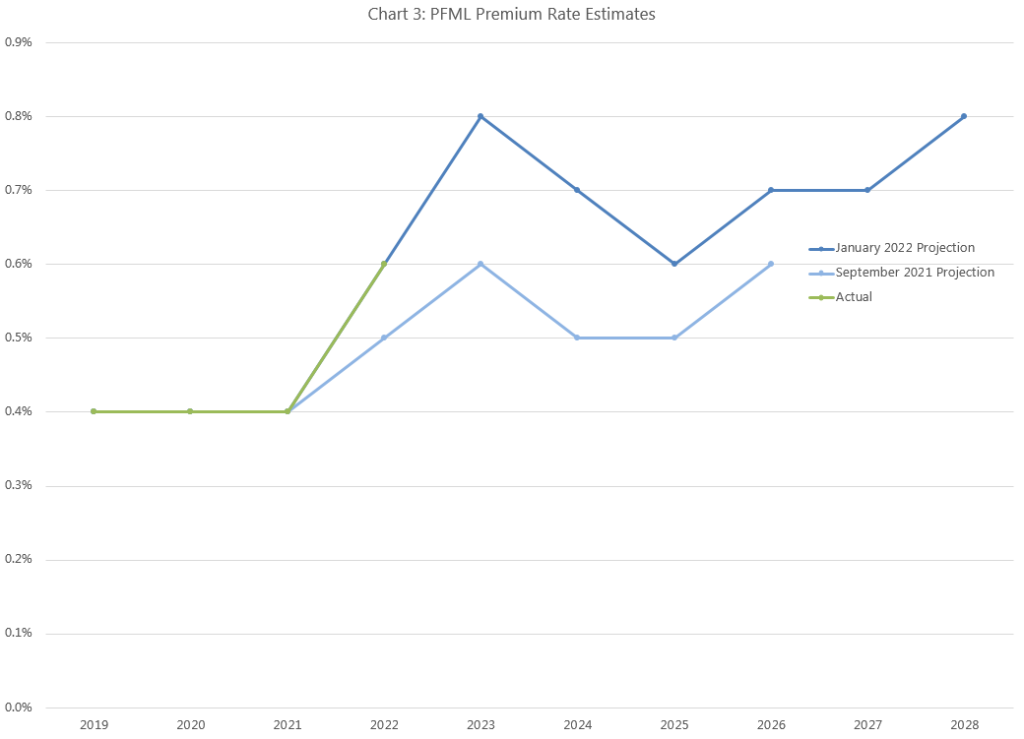

ESD is now estimating that if there is no change in funding, the regular rate would remain at 0.6% through 2028, and solvency surcharges would be needed in each year but 2025. In 2023, the total premium rate would be 0.8%. (See Chart 3.)

Gov. Inslee’s budget proposal would appropriate $82.0 million from the general fund–state, if needed to keep the family and medical leave insurance (FMLI) account from being in deficit. At the W&M meeting, ESD noted that November payments were about $90 million and December payments were a bit less than that. ESD said that a three-month reserve would be ideal over the long run, but that for now, the one-month reserve included in Gov. Inslee’s budget would be sufficient. However, at the Jan. 26 meeting, ESD said that, at this point, they don’t know if the $82 million would be enough.

Additionally, at the W&M meeting, ESD said that as they were developing the rate increase for 2022, they realized that it was “difficult to project the fund balance very far out into the future.” They expect to have an actuary hired in March who would help with projections and provide “some options for potentially changing the rate structure.” (Gov. Inslee’s budget proposal includes $100,000 from the FMLI account for an actuary “to conduct a market analysis of the Paid Family and Medical Leave program and to perform five enrollment and fund solvency projections annually.”)

In developing the PFML program, the state relied on microsimulation models. This work indicated that a 0.4% premium rate would cover program costs in a given year, but there doesn’t appear to have been an actuarial analysis looking at whether the adopted rate structure would be sufficient over the long run.

ESD suggested at the Jan. 26 meeting that the current rate structure is a concern because the rate calculation is based on the account balance as of Sept. 30, with no allowance for a specific level of reserves. As advisory committee members noted yesterday, the reason premiums were collected for a year before benefits were payable was to build up some months’ worth of benefit payments. Additionally, the rate calculation was done purposely so that account funds would automatically help to keep rates as low as possible, while maintaining solvency.

The PFML program was enacted in 2017. (A previous version was enacted in 2007 but never funded.) Premiums were first assessed beginning Jan. 1, 2019, and benefits were first payable beginning Jan. 1, 2020. As the two years of benefit payments have coincided with the pandemic, it is difficult to say whether the current financial status is indicative of a problem with the underlying rate structure, or whether the trust balance will improve when the pandemic is over.

According to ESD staff at the Jan. 26 meeting, they’ve compared the program’s actual experience to pre-pandemic estimates of wages and benefits, and they don’t see much evidence that the pandemic is a major factor here. They estimate that premium collections have come in about the same as was expected (although many people lost their jobs, the wages of those who remained employed increased). Additionally, although the growth in benefits shows some correlation with COVID hospitalizations, the growth is also following pre-implementation expectations.

Here’s a timeline of information on the account balance and premium rate:

Oct. 2020: ESD determined that the premium for CY 2021 would remain at 0.4% (see slide 7 here).

Dec. 2020: ESD’s 2020 annual report on the program noted, “Because of the higher-than-anticipated first-year program usage, the trust fund balance is lower than originally projected for September 2020. Since the premium rate for 2021 will stay the same, there will be less ability to absorb unexpected costs in the coming year than original projections anticipated.”

Sept. 16, 2021: ESD estimated that the premium rate would need to be 0.5% in 2022 and 0.6% in 2023. They said there was “No immediate concern for fund solvency.”

Oct. 2021: ESD announced that the premium for 2022 would increase to 0.6%, with no solvency surcharge (see slide 7 here).

Dec. 2021: The program’s 2021 annual report noted that claims have so far come in higher than expected before the program was implemented:

Categories: Budget , Employment Policy , Tax Policy.As benefits payments were higher than expected in 2020 and continue to trend upward, while the pandemic affected statewide employment and thus assessed premiums, the fund balance has trended consistently downward. The premium rate for 2022 . . . will mean premiums collected will increase starting in April 2022. However, since benefits payments are also expected to increase, despite the increased premium rate we expect the fund balance at the end of each quarter to continue be under a level equivalent to a quarter’s worth of benefits payments.