11:18 am

August 19, 2019

The Pew Charitable Trusts has a new paper about how states are forecasting revenues from marijuana taxes: “Forecasting revenue from a product that was illegal just a few years ago, and remains so under federal law and in most states, presents a unique challenge for state budget planning.”

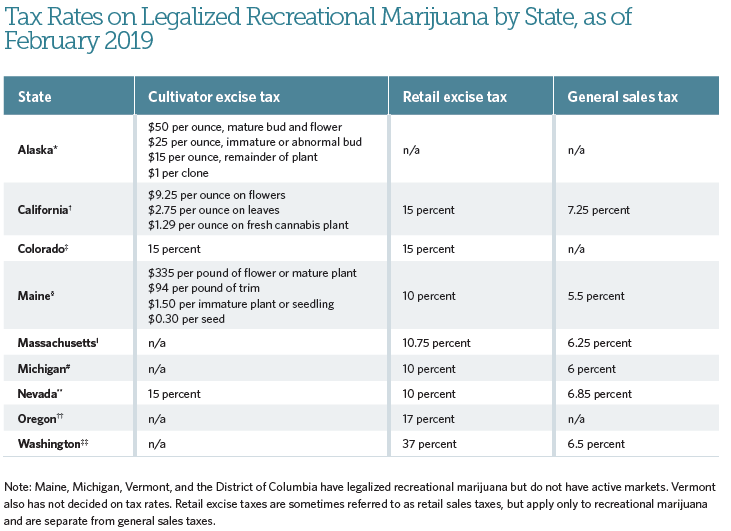

The table below (from the report) compares how states tax legal marijuana.

The paper goes over various challenges involved in forecasting marijuana tax revenues:

- What is the level of consumption? How will consumption change when the product becomes legal?

- Will consumers move from the black market to the legal market? When?

- How will marijuana prices change over time? How do prices affect demand in this market?

- Will cross-border sales have an impact?

- Will revenue growth slow over time? (The paper notes that Washington’s marijuana tax collections grew 277 percent from 2015 to 2016, 70 percent from 2016 to 2017, and 17 percent from 2017 to 2018.)

Pew sensibly notes, “Policymakers should be careful not to assume that revenue growth from such a new and volatile market will be sustainable.”

Further, “Given how unpredictable the marijuana market is, states should exercise caution in budget planning to ensure that the money strengthens, rather than weakens, their long-term fiscal position.”

Indeed, when revenues come in lower than forecasted, funds may not be available for planned programs and services. (But revenues that come in higher than forecasted can also present problems, as Opportunity Washington noted last month about Seattle’s sweetened beverage tax.)

In related news, Stateline has a story today about new state taxes on vaping products. Seventeen states now have specific taxes on e-cigarettes, including Washington. Washington’s tax was enacted this year (E2SHB 1873) and is estimated to bring in $19.1 million in revenues in 2019–21 and $35.1 million in 2021–23.

Categories: Budget , Categories , Tax Policy.