2:05 pm

July 14, 2023

As Kriss wrote last month, the June revenue forecast for funds subject to the outlook (NGFO) is up over the outlook period (2021–23, 2023–25, and 2025–27) compared to the March forecast. Additionally, NGFO revenues are expected to grow by 2.4% in 2023–25 and by 6.8% in 2025–27. (However, adjusted for inflation, revenues are expected to decline by 3.9% in 2023–25.)

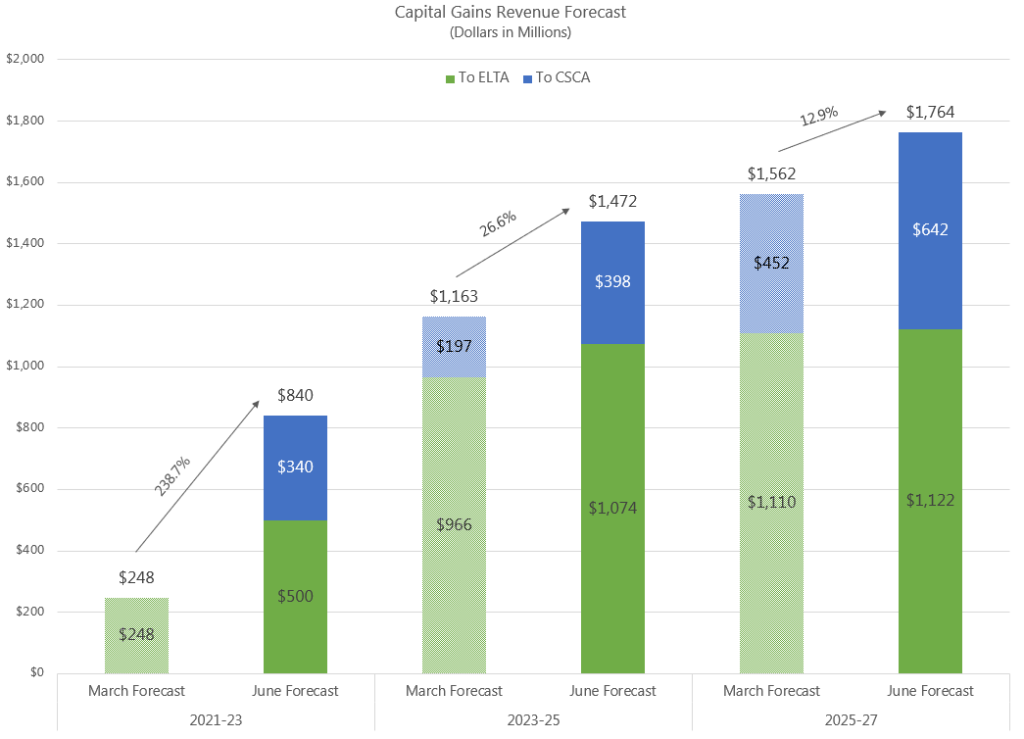

Of the $814 million increase to the NGFO forecast in June (compared to March) for the outlook period, $374 million (46%) is due to increases in forecasted capital gains revenues (net of a credit against the business and occupation tax). But this understates the forecasted increase to capital gains revenues because not all capital gains revenues are included in the NGFO. The first $500 million in annual capital gains revenues goes to the education legacy trust account (ELTA) and anything over that goes to the common school construction account (CSCA). The ELTA is a fund subject to the outlook but the CSCA is not.

The June forecast increased the estimate of capital gains revenues to the CSCA by $731 million over the outlook period. The chart below compares the March and June capital gains revenue forecasts by biennium. Although the state has collected $849.2 million from the capital gains tax for FY 2023, some amount of that will likely be refunded to taxpayers who requested extensions. Consequently, the June forecast estimates that revenues will total $840 million in 2023. The forecast also increases the capital gains revenue estimates for 2023–25 and 2025–27, with most of the increase going to the CSCA.