12:07 pm

February 22, 2023

SJR 8201, which was approved Feb. 16 by the Senate Ways & Means Committee, would amend the state constitution to establish a public works revolving trust account. (Ways & Means also approved the implementing legislation, SSB 5303.)

Under the proposed constitutional amendment, when local governments repay their public works loans, the funds would be deposited in the new trust account instead of the public works assistance account (PWAA). The constitutional amendment would specify that funds in the public works revolving trust account could only be used “to provide loans and grants to local governments for public works projects.”

If SJR 8201 is passed by the Legislature, it would be on the Nov. 2023 ballot for voter approval.

Fundamentally, the purpose of this proposal is to prevent the Legislature from using funds meant for the public works assistance program for other purposes.

The PWAA has historically received revenues from the real estate excise tax (REET), the solid waste collection tax, and the public utilities tax (PUT), in addition to loan repayments. The Legislature appropriates funds from the PWAA to the state Public Works Board, which makes low-interest loans to local governments for public works projects. The loans are then repaid to the PWAA. Chart 1 shows the history of appropriations for the program, including Gov. Inslee’s proposal for 2023–25.

Currently, the PWAA “shall be used to make loans and grants and to give financial guarantees to local governments for public works projects” (RCW 43.155.050). But the Legislature regularly amends the statute to allow the PWAA to be used for other purposes, including to help close general budget gaps.

Since the Great Recession, from 2009–11 through 2021–23, the Legislature has transferred $1.295 billion from the PWAA to the general fund–state (GFS) and the education legacy trust account (ELTA). (Over $160 million more was transferred to other accounts, mainly to the drinking water assistance account and the water pollution control revolving account.) 2021–23 is the first biennium since the Great Recession in which no transfers have been made from the PWAA to the GFS or the ELTA. However, the 2022 transportation budget requires the transfer of $57 million a year (FY 2024 through 2038) from the PWAA to the move ahead WA account.

If SJR 8201 is approved, future transfers like these—which were made possible by loan repayment revenues—would be curtailed. However, the Legislature would still be able to stop appropriating PWAA funds to the Public Works Board in the first place and it would still be able to direct current tax sources to other accounts.

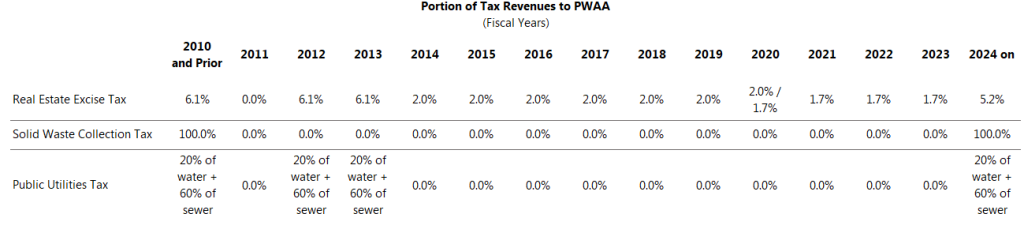

As Chart 2 shows, tax revenues to the PWAA exceeded loan repayment revenues prior to the Great Recession, but loan repayments have greatly exceeded tax revenues since then. The reduced impact of tax revenues is due to statutory redirections of the REET, solid waste collection tax, and PUT.

These statutory redirections have diverted more funds to the GFS and ELTA than the regular transfers have. In response to the Great Recession, the Legislature redirected revenues from the three taxes to the GFS for FY 2011. It restored the REET and PUT collections for FY 2012 and 2013 to the PWAA, but since then all or a portion of the revenues from the three taxes that previously were dedicated to the PWAA have gone to the GFS and ELTA instead. These redirections are meant to be temporary, but the Legislature has already extended them multiple times. Under current law, the taxes are supposed to largely revert to the PWAA beginning in FY 2024. (See the table.)

According to historical data and the state’s November 2022 revenue forecast, tax revenues to the PWAA are estimated to total $1.120 billion from 2009–11 through 2025–27. I estimate that if the Legislature had not diverted any of the PWAA’s tax revenues—if the PWAA’s share of the taxes had remained the same as in FY 2010—the PWAA would have received $2.561 billion in taxes over the period. That’s $1.441 billion that would have gone to the PWAA but instead was directed to other accounts. (See Chart 3.)

SJR 8201 would not prevent the Legislature from redirecting taxes again in the future. Indeed, it may be advisable to do so if the Legislature determines that the amount held in the constitutionally-protected trust account has grown to a level that is deemed sufficient for the public works program.