1:40 pm

March 9, 2022

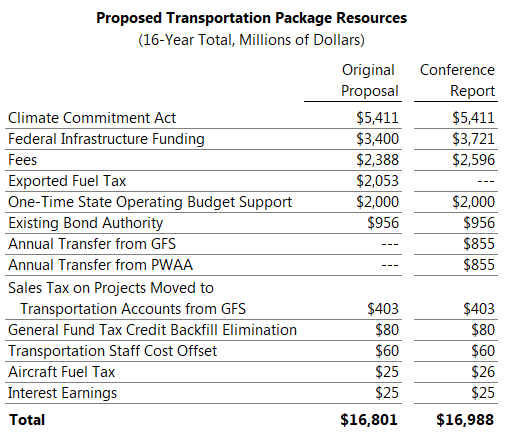

The transportation package that was proposed in February would have increased transportation revenues by $16.801 billion over 16 years. That included $2.053 billion in revenues from a new tax on exported fuel. The exported fuel tax provision was later stripped by the House.

The conference report for the transportation budget would increase revenues by $16.988 billion over 16 years. To partially make up the lost exported fuel tax revenue, the conference report for the transportation budget would transfer $57 million a year (FY 2024 through 2038) from the public works assistance account (PWAA) to the move ahead WA account and another $57 million a year (FY 2024 through 2038) from the general fund–state (GFS) to the move ahead WA flexible account. Together, these transfers would total $1.710 billion through 2038.

In the current four-year outlook for the operating budget, this GFS transfer would reduce operating budget revenues by $114 million in 2023–25. The transportation proposal also includes annual transfers from the GFS of $31 million in sales taxes on transportation projects ($403 million through 2038), but they would begin in FY 2026—outside the outlook window.

Compared to the original package, the conference report would also increase revenues from the federal infrastructure bill by $321 million and fee revenues by $208 million. (The main fee change would be to the stolen vehicle check fee. It is currently $15; the original package would have increased it to $50. The conference report would increase it to $50 through FY 2026, then to $75 thereafter.)

Tags: 2022supp