8:18 am

June 5, 2020

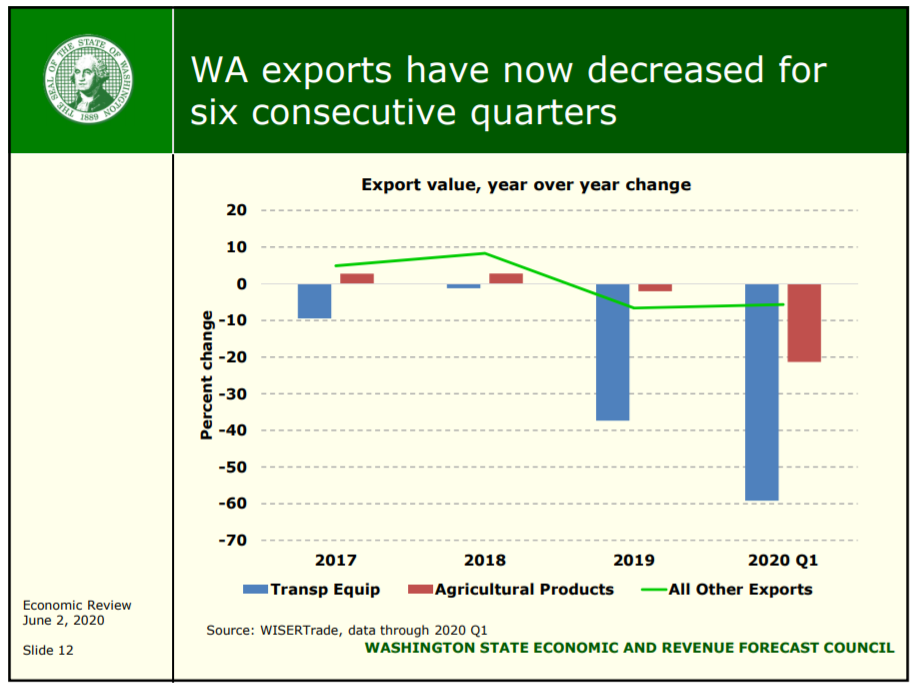

One of the negative indicators in this week’s economic forecast from the Economic and Revenue Forecast Council is exports:

Washington exports declined over the year for a sixth consecutive quarter. Year-over-year exports decreased 35.1% in the first quarter of 2020. The large decline was mostly because of transportation equipment exports (mostly Boeing planes) which fell 59.2% over the year. Boeing suspended deliveries of the 737 Max in March 2019. First quarter exports of agricultural products decreased 21.3% over the year and exports of all other commodities (mostly manufacturing) declined 5.7% over the year.

Yesterday, the U.S. Census Bureau and U.S. Bureau of Economic Analysis released U.S. international trade data for April. Total Washington exports declined by 23.8 percent over March and Washington imports declined by 11.8 percent over March. Year-over-year, March 2020 exports decreased 42.1 percent and imports decreased 5.2 percent. Year-over-year, April 2020 exports decreased 34.5 percent and imports decreased 16.2 percent. Exports from Washington have declined by more than those of the U.S. as a whole, but Washington imports have declined by less than those of the U.S.

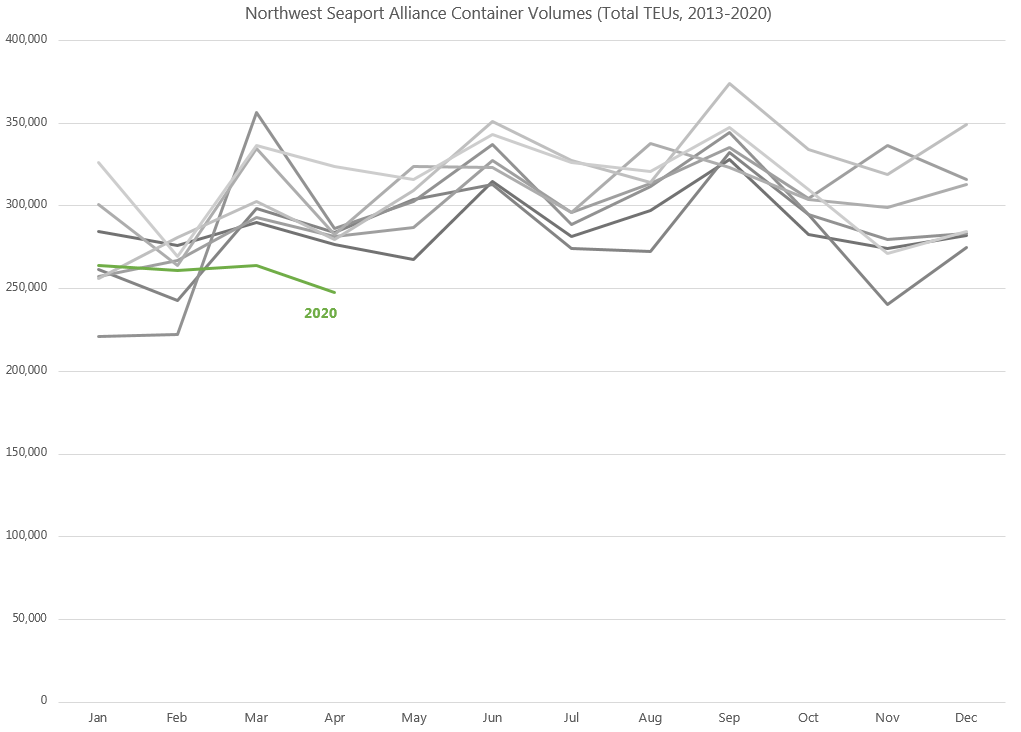

Meanwhile, the Northwest Seaport Alliance (NWSA, the marine cargo partnership of the ports of Seattle and Tacoma) reports that container volumes declined by 21.6 percent in March (compared to March 2019). There were 19 cancelled sailings in March (of 32 in the first quarter), “due to a combination of lingering trade dispute and the pandemic.”

In April, NWSA container volumes declined by 23.5 percent (compared to April 2019). There were seven more cancelled sailings. According to the NWSA, “The economic fallout from the COVID-19 pandemic continues to disrupt the global supply chain.”

NWSA has cargo data going back to 2013. Container volumes in March and April of this year are well below levels in the same months in any other year, as the chart below shows. Further, container volumes (in terms of twenty-foot equivalent units, or TEU) have been down, year over year, in each of the past eight months. Year-to-date volumes are down 17.5 percent over the same period last year.

These March and April declines in cargo are in line with what is happening at other U.S. ports. According to the American Association of Port Authorities, “Containerized cargo at U.S. ports is down approximately 20-25% from the same time periods in 2019.” Additionally, “Blank sailings, where ships cancel port calls, resulted in a revenue loss of roughly $300,000 per blank sailing at large U.S. ports.”

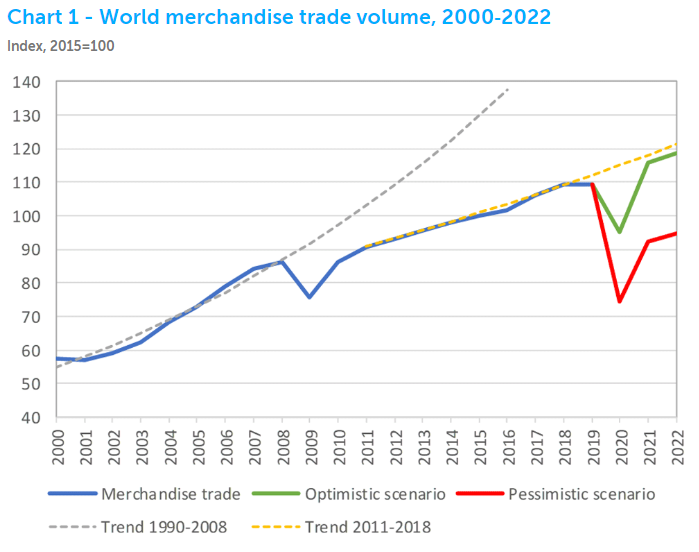

In April, the World Trade Organization (WTO) released a forecast for world trade. It estimates that world trade will fall by 13–32 percent in 2020. “WTO economists believe the decline will likely exceed the trade slump brought on by the global financial crisis of 2008‑09.”

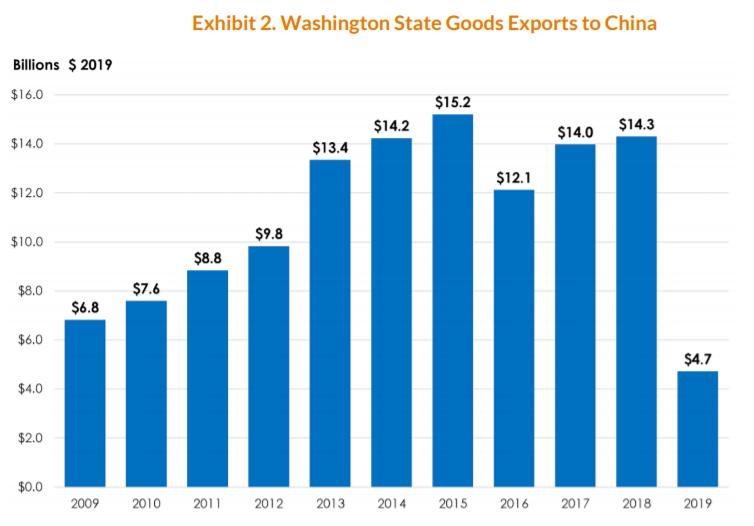

Finally, the Washington Council on International Trade (WCIT) released a report last month that offers a good overview of how ongoing trade conflicts and COVID-19 have impacted trade in our state. See, for example, the substantial decline in exports to China last year:

Tags: COVID-19 , COVID-19 & the economy