1:55 pm

January 6, 2021

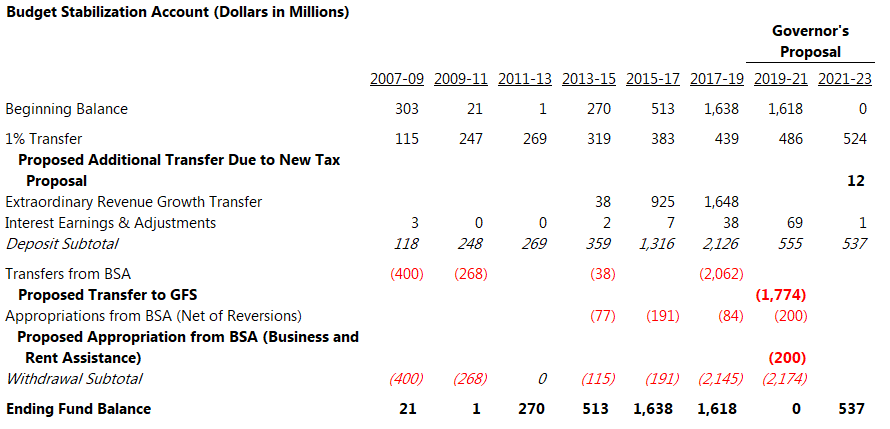

The governor’s proposed 2021 supplemental operating budget would drain the budget stabilization account (BSA, or the rainy day fund), as I noted last month.

Based on the November revenue forecast, the Economic and Revenue Forecast Council estimated that the BSA’s ending balance in 2019–21 would be $1.943 billion—the highest it has ever been. That figure includes the withdrawal of $200 million that the Legislature enacted in March for coronavirus response (EHB 2965).

Gov. Inslee’s 2021 supplemental would appropriate another $200 million from the BSA: $100 million for business grants and $100 million for rent assistance. Additionally, the proposed supplemental would transfer $1.774 billion from the BSA to the general fund–state (GFS). These proposals would reduce the BSA balance to zero for 2019–21.

(Normally, withdrawals from the BSA require a three-fifths vote of the Legislature. But, the constitution provides that when employment growth is estimated to be less than 1%, a simple majority only is needed to make withdrawals. According to the November revenue forecast, employment growth is expected to decline by 1.9% in FY 2021, so a simple majority would suffice in this case.)

According to the budget highlights document from the governor’s office, the new revenues he proposes for 2021–23 (including a capital gains tax) would “help the state maintain its healthy reserves.” And, Austin Jenkins reported, “Inslee’s budget calls for spending the ‘rainy day’ fund first and then replenishing it with the proceeds of the capital gains tax when that money starts to kick in.”

There’s nothing explicit in the budget bills tying capital gains revenue to the BSA (perhaps there will be something in the policy bill that would enact the capital gains tax). However, the constitution requires that 1% of general state revenues be deposited in the BSA each year. Thus, because the governor is proposing new revenues, the 1% transfer would be higher than it would have been otherwise, by about $12 million in the 2021–23 biennium.

Under the governor’s proposal, the BSA ending balance in 2021–23 would be $537 million. It’s possible that it could be higher. As I wrote in November, the governor used about $122 million from the state’s share of the federal Coronavirus Relief Fund to replace allocations that had previously been made from the March BSA appropriation. EHB 2965 specifies that if those funds aren’t used by July 1, they must be transferred back to the BSA. The governor’s proposal does not assume that the funds are returned, so anything that is returned would be on top of the $537 million.

Tags: 2019-21 , 2021-23