10:37 am

November 29, 2022

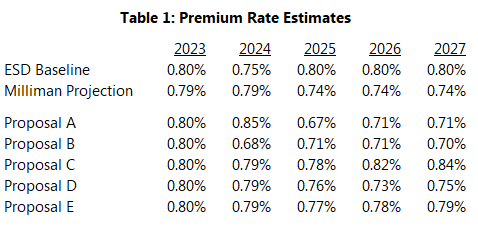

The Legislative Task Force on Paid Family and Medical Leave Insurance Premiums met last Tuesday to discuss five proposed recommendations for changes to the paid family and medical leave (PFML) premium rate structure. Premium rates would be above 0.6% in all scenarios through at least 2027.

Changes are necessary because the program has run deficits over several periods this year. We wrote in detail about the program’s financial troubles here. A few background points before I get to the task force proposals:

- The 2022 supplemental operating budget appropriated $350 million from the general fund–state to cover any deficit in the family and medical leave insurance (FMLI) account on June 30, 2023 (the end of the 2021–23 biennium). This is not a reserve account for the FMLI account—the funds may be used only to the extent they are necessary to keep the account out of deficit. (See Sec. 723 of the budget bill.) The Employment Security Department (ESD) currently estimates that the FMLI account will be -$83 million on June 30.

- The state contracted with Milliman this Fall to provide an actuarial analysis of the PFML program. The analysis was supposed to report on the financial condition of the FMLI account and provide any recommendations “to maintain the long-term stability and solvency” of the account. There was a quick turnaround for this, but the result left a lot to be desired. It only provided projections through 2027, it failed to recognize that there is a one-quarter lag between when premiums are assessed and when they are collected, and it did not provide any recommendations as to how the rate formula should be structured. (Additionally, the overview of PFML premium provisions in other states does not include the formulas they use to determine rates.) Milliman did recommend that the state should target a reserve for the program of three months of annual benefit payments. (There is currently no reserve for the program.)

- Under current law, the premium rate is based on the FMLI account balance ratio (FMLI account balance divided by total covered wages) as of Sept. 30 of the previous year. The statute prescribes a regular rate from 0.1%–0.6% based on the ratio. If the ratio is less than 0.05%, ESD must assess a solvency surcharge of 0.1%–0.6%, which is added on top of the regular rate (so the combined maximum rate is 1.2%).

The legislative task force is tasked with making recommendations to the Legislature on changing PFML premium provisions “to ensure the lowest future premium rates necessary to maintain solvency” of the FMLI account “in the next four years while limiting fluctuation in family and medical leave insurance premium rates.”

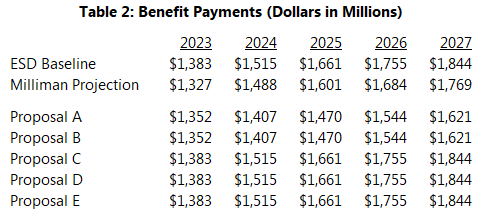

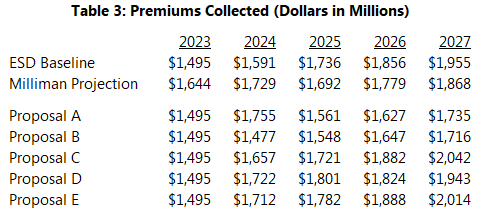

Under all five proposals discussed by the task force, the premium rates through 2027 would be above the current statutory maximum regular rate of 0.6% (see Table 1). This jibes with the Milliman report: According to Milliman’s modelling, a rate of 0.6% “would be inadequate to cover PFML benefit payments and expenses in 2023 and beyond.” Additionally, all five proposals would include reserves for the program. Proposals A and B explicitly target a reserve of three months of benefits (as recommended by Milliman). Proposals C, D, and E result in account balances representing more than three months of benefits. (For example, the account balance in Proposal E would represent 4.3 months of benefits in 2027.)

Below the descriptions of the proposals are tables comparing their estimates of benefit payments, premium collections, and year-end account balances.

Proposal A: The Milliman model projected future program experience and targeted a reserve of three months of benefits. Then it “solved for the contribution rates that sustain this target level in future years.” The task force’s Proposal A would take this approach.

The proposal would project annual benefits by calculating a fund utilization rate over the prior four quarters and applying it to the projected number of eligible workers for the next year. Then, the projected utilization rate would be multiplied by the average length of leave and the average weekly benefit amount.

The benefits projected under this proposal are lower than those in the ESD baseline because ESD currently assumes a five-year phase-in for the program, which means a high amount of benefit growth in the near term. Proposal A does not make that assumption.

Proposal B: This proposal would be the same as Proposal A, except it would seed the three-month reserve with the $350 million that the Legislature set aside in the 2022 supplemental operating budget. As ESD notes, “Providing all of the $350 million results in a lower premium rate in the short-term as the account is able to build the 3-month reserve earlier and without the need to increase the rate in 2024 to do so.”

Proposal C: This proposal would also use the $350 million as seed money for a reserve. The proposal would not change how ESD projects benefits. It would change the rate structure: The rate formula would be 140% of the prior year’s costs (less the fund balance) divided by taxable wages in the prior fiscal year.

Additionally, currently, ESD “must” assess a solvency surcharge when the account balance ratio is below a certain level. Under Proposal C, ESD “may” assess a surcharge, and there would be no account balance ratio trigger specified. (The fiscal estimates for the proposal do not include a solvency surcharge.)

Proposal D: Proposal D would make the same changes to the rate structure and solvency surcharge as Proposal C, and it would also use the $350 million to seed a reserve. On top of that, it would increase the taxable wage base substantially to $250,000 in CY 2024 and increase it in future years by the same rate as weekly benefit amounts (which are tied to the state average wage). Currently, the taxable wage base is the Social Security contribution base, which will be $160,200 in 2023.

ESD estimates that the increase in the taxable wage base would “increase premium collections by $21 million per Quarter initially, growing to $29 million per Quarter by the end of 2027.”

Proposal E: This proposal would make the same rate structure and solvency surcharge changes as Proposals C and D, and it would use the $350 million. Instead of increasing the taxable wage base (as in Proposal D), Proposal E would require employers to pay the employer portion of the PFML premiums if they have at least 15 employees. (Currently, employers have to pay the employer portion if they have at least 50 employees.) ESD estimates that this would “increase premium collections by $19 million per Quarter initially, growing to $23 million per Quarter by the end of 2027.”

The task force will discuss the proposals further tomorrow. It had previously planned to vote on them at that meeting, but there were so many questions last week about how the proposals would work and how they compare that it sounds like votes will be postponed. I can’t blame them. The Milliman report and the fiscal analyses in the proposals only go through 2027. With such a short outlook, it is hard to judge the merits of one formula over another. That said, based on the information provided, Proposal B would yield the lowest, steadiest rates.

Categories: Budget , Categories , Employment Policy , Tax Policy.