12:57 pm

October 16, 2020

Yesterday’s monthly report from the state’s Economic and Revenue Forecast Council (ERFC) on general fund revenue collections brought good news.

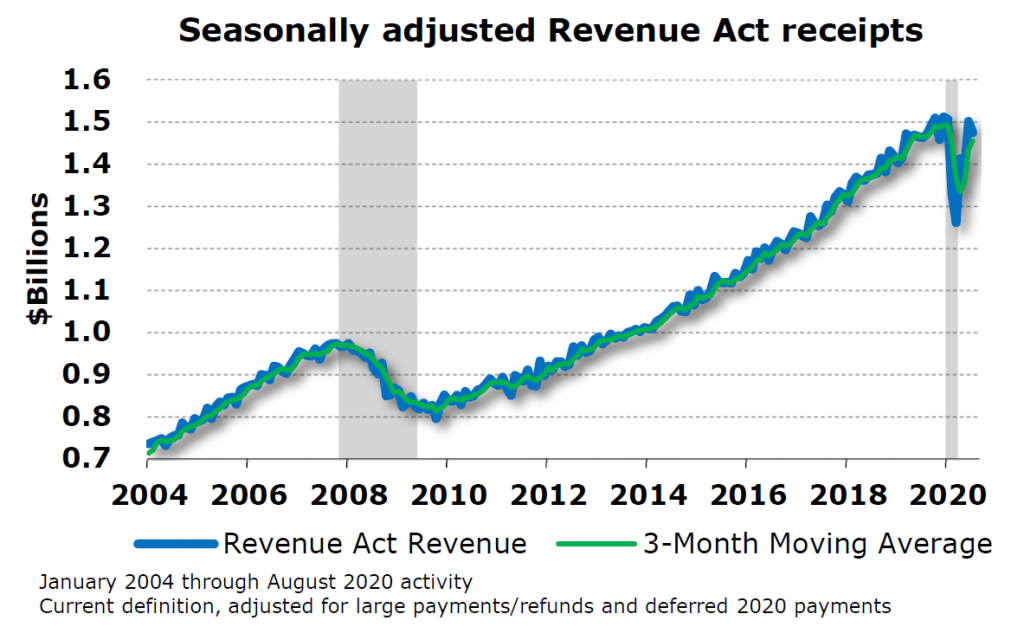

For the sales tax, the use tax, the business and occupation tax, the public utility tax, the tobacco products tax, and penalties and interest (collectively the Revenue Act receipts), this report covers payments received between September 11 and October 10, which generally relate to transactions that occurred in the month of August.

For liquor taxes, cigarette tax, property tax, real estate excise tax, unclaimed property and other sources, the report covers payments received between September 1 and September 30.

The total amount received was $1,677.2 million. This was $132.5 million (8.6%) more than the amount expected under the new forecast that ERFC adopted just three weeks ago. Revenue Act taxes exceeded forecast by $82.2 million (6.0%). Non-Revenue Act taxes exceeded forecast by $50.1 million (29.0%). Within the latter grouping, the real estate excise tax (REET) exceeded forecast by $40.0 million (45.4%).

Here is a chart of seasonally adjusted Revenue Act receipts since 2004:

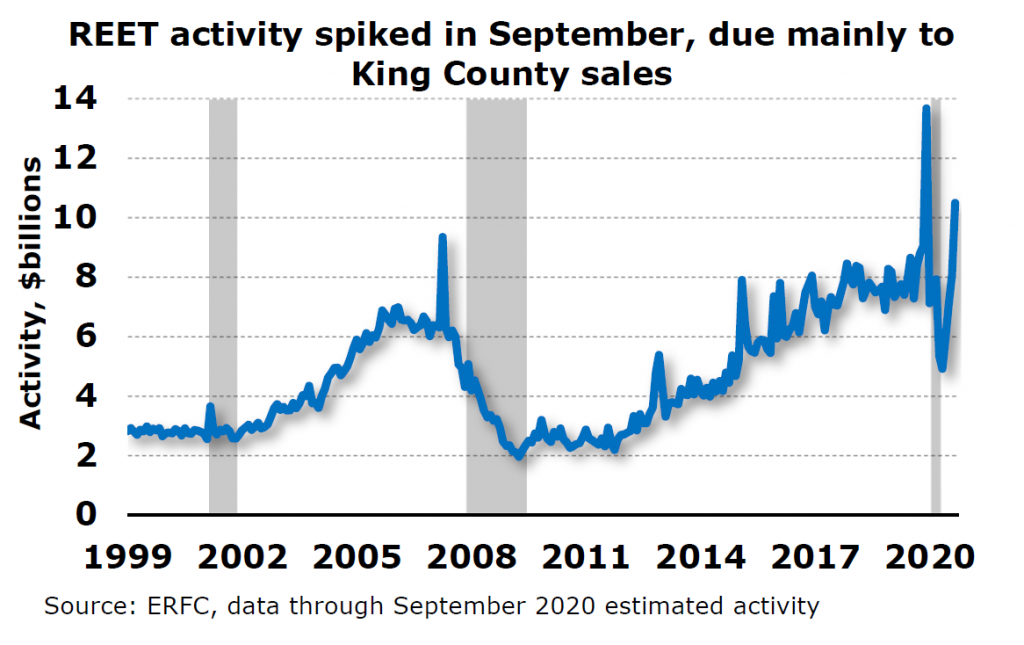

Here is a second chart, showing the value of real estate sales subject to REET monthly since 1999.

Regarding this chart, ERFC explains:

Seasonally adjusted taxable activity spiked to a near-record high, bested only by the December 2019 rush ahead of the change to the current tax rates. Sales of large commercial property (property valued at $10 million or more) totaled $1.0 billion, up from last month’s revised total of $298 million. Most of the increase, however, was in residential sales, primarily in King County. Payments from King County were up 76% year over year. Average prices in the county reached an all-time high and closed sales increased by more than 40% year over year.

The full Economic and Revenue Update is available here.

Categories: Budget , Categories , Economy.