1:44 pm

September 8, 2020

State Senator Joe Nguyen has set up a petition signed by three other legislators that calls on the Legislature to “REJECT an austerity approach in passing the FY2021 supplemental budget and the 2021–23 biennial budget.” Washington State Wire reports on this effort here.

First, let’s define our terms. Sen. Nguyen’s petition states, “An austerity approach is one that prioritizes budget cuts in order to avoid a deficit in times of economic downturn.” Economists use the term to describe both spending cuts and tax increases—both are policies used to reduce deficits. But Sen. Nguyen proposes that “upcoming budget decisions must be augmented with a strategy for implementing new progressive revenue streams.”

Sen. Nguyen argues, “It would be impossible to cut discretionary spending enough to make up for the projected revenue deficits.” It would not be mathematically impossible, especially if you take an expansive view of the discretionary portion of the budget. Note that appropriations for 2019–21 (as adjusted by the 2020 supplemental) increased spending by $9.016 billion over 2017–19. New policy accounted for $3.078 billion of that increase.

The petition continues, “The State Legislature in 2008 thought that short-term cuts could suffice to see Washington out of the financial crisis. But by 2013 we hadn’t recovered sufficiently . . . .”

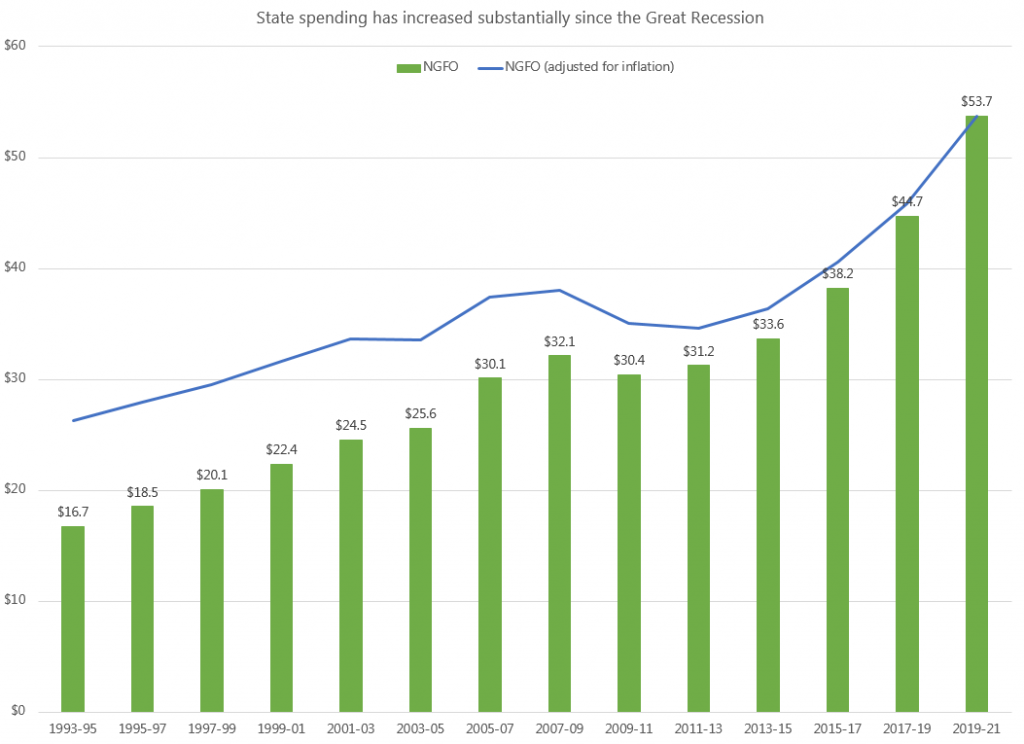

It’s true that state spending in 2013 was still below that of 2008. But spending has increased substantially since 2013. Indeed, from the pre-Great Recession spending high point (the 2008 supplemental) to 2019–21, real spending (adjusted for inflation) has increased by 34.7 percent. Real spending per capita has increased by 15.8 percent.

Finally, the Legislature did not solely cut spending in response to the Great Recession. As we showed in a recent report, the Legislature actually increased spending in the 2008 supplemental budget—even after revenues began to decline. Of all the actions taken to address the Great Recession shortfalls, spending reductions made up 58 percent, federal stimulus funds made up 17 percent, tax increases made up 12 percent, and fund transfers made up 10 percent. The tax increases included a business and occupation tax surcharge on service businesses, a cigarette tax increase, and several others (some of which were later repealed by voters).