3:25 pm

November 18, 2025

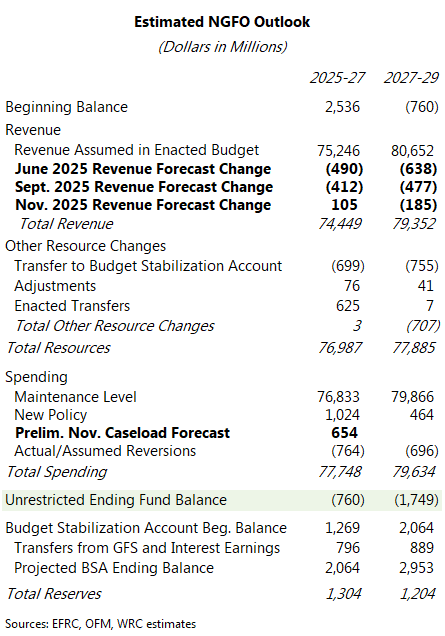

According to the Economic and Revenue Forecast Council, revenues for funds subject to the outlook (NGFO) are estimated to be $66 million lower over the outlook period than was forecasted in September. Final revenues for 2023–25 (which ended June 30) total $67.137 billion, an increase of $13.1 million compared to the September forecast. The forecast for 2025–27 increased by $105.4 million, to $74.449 billion. The forecast for 2027–29 decreased by $185.0 million, to $79.352 billion.

From the prior biennium, revenues are expected to increase by 10.9% in 2025–27 and by 6.6% in 2027–29.

Since the 2025–27 operating budget was enacted, revenues are down by $1.690 billion over the outlook period. Nevertheless, given other final adjustments to 2023–25 resources, the 2023–25 ending balance was higher than previously expected. Combined with the increase to the forecast for 2025–27, this reduced the estimated shortfall for the biennium from $421 million to $107 million.

However, we also have some new information on the spending side. The November caseload forecast was approved last week. According to a preliminary estimate from the Office of Financial Management (OFM), the forecast (and adjustments to utilization and rates) will increase the general fund–state cost of continuing current services by about $654 million in 2025–27. (OFM did not have an estimate of the impact in 2027–29.) It is important to know that this is not an estimate of the total maintenance level change (the cost of continuing current services, adjusted for caseload and inflation)—it is a component of the total maintenance level change.

In the estimated outlook below, I’ve included the November revenue forecast, appropriations that were enacted earlier this year, and the estimated cost of the caseload forecast. With this information, the estimated shortfall is $760 million in 2025–27 and $1.749 billion over four years.

Note that this does not include the cost to backfill the state liability account (possibly $1.5 billion over four years) or the cost of a collective bargaining agreement that was not funded in the budget (about $42 million over four years). It does not reflect the full maintenance level change, and it also does not include any new policy the Legislature may choose to adopt next year.

We’ll have a much better understanding of the full maintenance level change when the governor proposes his operating budget next month. Then there will be another revenue forecast and caseload forecast in February before the Legislature adopts a 2026 supplemental.

Categories: Budget , Tax Policy.