9:32 am

August 16, 2022

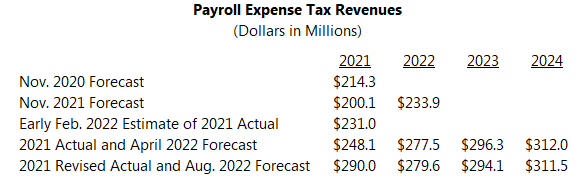

When the City of Seattle closed its financial books for 2021, it had collected $248.1 million for the year from the new payroll expense tax. Since then, an additional $41.9 million has come in, according to the city’s Office of Economic and Revenue Forecasts (OERF). The OERF and the City Budget Office presented the August revenue forecast last week.

The payroll expense tax was effective Jan. 1, 2021. Payments of taxes for 2021 were due at the end of this January; beginning in 2022 they are payable quarterly. The ordinance specifies that revenues from the tax for 2021 be deposited in the general fund, but they are dedicated to a separate account beginning in 2022.

This is a complicated new tax with no history. Consequently, both the city and businesses are figuring it out as they go. During the forecast meeting, the OERF director said that, since the books were closed on 2021,

Multiple taxpayers have come forward and said . . . “We’re still just coming to understand how that payroll expense tax works, and we should have paid you in 2021.” . . . So, [the $41.9 million] is not in our forecast because we haven’t budgeted this tax before. We didn’t know who was even going to be subject to tax.

All told, the city collected $290.0 million in payroll expense taxes that were due for 2021. The $41.9 million that came in after the books were closed will still go to the general fund, but it will show up as 2022 revenues.

Despite the substantial increase in 2021 payroll expense tax collections, the forecast for the tax for 2022, 2023, and 2024 is roughly the same as was forecast in April. (The table below shows the evolution of payroll expense tax forecasts.) In the August forecast, 2022 payroll expense tax revenues are expected to total $279.6 million. Quarterly payments made so far this year are not on pace to reach 2021 levels. According to the forecast, “It appears that declining stock values, which are an important component of compensation in the sectors that drive these revenues, are leading to lower tax obligations.” The forecast also makes the point that because of the link to stock values, the payroll expense tax is “likely to be much more volatile than sales tax or B&O tax.”

Additionally, “Looking forward to 2023 and beyond, we are forecasting somewhat slower growth in the coming years anticipating that less of the overall regional job growth in the technology and related sector will be concentrated specifically in the city.”

Meanwhile, the August general fund revenue forecast is pretty close to the April forecast. Compared to the April forecast, general fund revenues are up $24.1 million for 2022, down $6.6 million for 2023, and down $11.2 million for 2024.

Substantial one-time general fund items in 2021 and 2022 complicate year-over-year comparisons. General fund revenues in 2021 totaled $1.743 billion, but that includes $248.1 million in payroll expense taxes that will go to a dedicated account in the future. General fund revenues for 2022 are now estimated to be $1.736 billion, but that includes the $41.9 million in payroll expense taxes that were owed for 2021, $65.0 million from the Mercer mega-block sale, and $149.6 million in other one-time transfers to the general fund. 2023 general fund revenues are estimated to be $1.519 billion. That’s a decrease of 12.5% from 2022, but it’s an increase of 2.7% if you remove the 2022 one-time funds.