1:25 pm

July 7, 2020

The Seattle City Council has passed the “payroll expense tax” that was approved by the Budget Committee last week. (Mayor Durkan has not yet acted on the bill, but it was passed by the Council with enough votes to override a veto.) As passed by the full Council, the tax will sunset Dec. 31, 2040. Additionally, the Council added a three-year exemption for non-profit healthcare entities on employee compensation up to $400,000. (As passed by the Budget Committee, the tax was expected to increase revenues by $214.3 million; it’s unclear what the revenue impact of the non-profit health exemption is.)

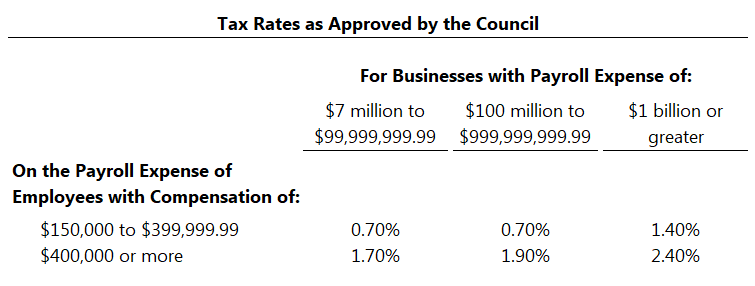

The tax is levied on “every person engaging in business in Seattle,” beginning Jan. 1, 2021. The rate of the tax depends on the total payroll expense of the business and the level of compensation per employee (see the table). No tax is owed on compensation under $150,000 a year, and no tax is owed if a business has a total payroll expense of less than $7 million. (The dollar thresholds will be adjusted for inflation annually.)

The ordinance exempts some businesses from the tax, including:

- Grocery businesses (for which 70 percent of the business’s gross income is attributable to making retail or wholesale sales “of food and food ingredients to consumers that are exempt from the retail sales tax”),

- Independent contractors whose compensation is included in the payroll of another business subject to the tax, and

- Businesses the city is not allowed to tax.

And, as noted above, through Dec. 31, 2023, non-profit healthcare entities may deduct from the tax the payroll expense of employees under $400,000.

Typically, the tax will be due quarterly, but the tax due for 2021 will be collected at the same time as the payment for the fourth quarter of 2021.

Some key definitions:

- Compensation is “remuneration as that term is defined in RCW 50A.05.010, net distributions, or incentive payments, including guaranteed payments, whether based on profit or otherwise, earned for services rendered or work performed, whether paid directly or through an agent, and whether in cash or in property or the right to receive property.”

- An employee is “any individual who performs work, labor, or personal services of any nature for compensation paid by a business.” This includes “members of limited liability companies, members of professional limited liability companies, partners, other owners of pass-through entities, and sole proprietors” and independent contractors.

- Payroll expense is “the compensation paid in Seattle to employees.”

- Compensation is paid in Seattle if (1) “the employee is primarily assigned within Seattle,” (2) “The employee is not primarily assigned to any place of business for the tax period and the employee performs 50 percent or more of their service for the tax period in Seattle,” or (3) “The employee is not primarily assigned to any place of business for the tax period, the employee does not perform 50 percent or more of their service in any city, and the employee resides in Seattle.”

Finally, the ordinance includes this language regarding the possibility of future regional or statewide taxes:

To maintain a level playing field and to provide predictability for the businesses impacted by the payroll expense tax imposed . . . the Council intends to monitor proposals for any taxes imposed by King County or the State of Washington to ensure: a) businesses in its jurisdiction are not subject to additional payroll taxes . . . b) filings are consolidated and streamlined to reduce administrative burden on taxpayers and Finance and Administrative Services, and c) a sustainable, progressive funding source is maintained for the items as described in Council Bill 119811.

That Council Bill 119811 was also passed by the Council yesterday. It sets out a loose spending plan for the payroll tax collections. Collections in 2021 are to be used to repay the emergency fund and revenue stabilization fund (which may be used to fund COVID-19-related spending in 2020, if CB 119812 is adopted). Remaining funds in 2021 are to be used for administration of the tax, to continue services and programs that would otherwise have to be cut due to the recession, to support services for low-income communities and other groups, or to continue funding for programs funded in 2020 under CB 119812.

Collections thereafter are to be used to administer the tax; to build, acquire, or support the costs of low-income housing; to support the Equitable Development Initiative; to support local businesses and tourism; and for the “Green New Deal.”

Specific spending plans will be adopted by resolution or as part of the annual budget process.

Categories: Tax Policy.