1:57 pm

November 1, 2023

In response to the cash deficits in the paid family and medical leave (PFML) program, the Legislature acted in 2022 to require the Employment Security Department (ESD) to produce an annual actuarial report on the program’s financial condition. The report must include estimates of the “lowest future premium rates necessary to maintain solvency of the family and medical leave insurance account in the next four years while limiting fluctuation in premium rates” (RCW 50A.05.050). The first report has now been submitted to the Legislature. (We wrote about the program’s financial problems in a 2022 policy brief.)

The report notes, “Looking back at three fiscal years (FY 2021 to FY 2023), the program’s financial condition has been deteriorating, mainly driven by the challenge of implementing adequate premium rates matching the increasing expenditures.” The report’s analysis of the program’s financial condition includes an income statement, an actuarial balance sheet, and actual cash flow. These show:

- The program was not “adequately priced to result in positive income” in FY 2021 and FY 2022.

- In FY 2023, with the general fund appropriation of $200 million to the program, the contingency reserve was $427 million, which “is close to the required contingency reserve (about $505 million) under National Association of Insurance Commissions (NAIC) for similar insurance risk.”

- “The program’s cash position indicates no funds available to pay its expenditures when due until the $200 million cash injection happened in June 2023.”

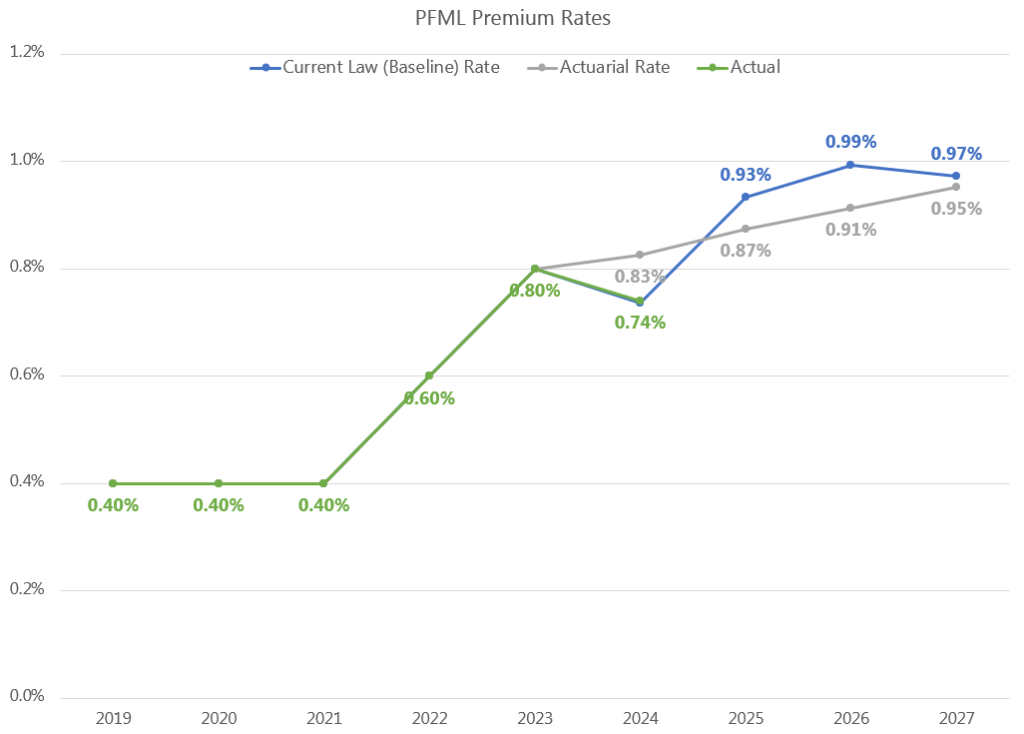

As I wrote last week, the PFML premium rate will decrease to 0.74% next year. That figure is calculated using the formula adopted earlier this year (in SSB 5286). ESD’s actuary estimates that the rate based on the current formula will then increase to 0.93% in 2025. The actuarial report calls this the “baseline rate.” The report also presents “actuarial rates,” which use “the ratemaking method to ensure the projected premium is enough to cover the expected future expenditures and protect the program from insolvent at given scenarios or confidence level.” (The two formulas are shown on page 30 of the report.) The chart below compares the baseline rates to the actuarial rates. (The baseline rate would collect $7.9 billion over the next four years compared to $7.8 billion from the actuarial rates.)

Looking at estimated monthly ending balances, the lowest balance expected from the baseline rates is negative $21 million and the highest is $646 million. For the actuarial rates, the lowest projected ending balance is $170 million and the highest is $512 million. The wider swings in ending balances in the baseline rates also show up in the projected year-end balances.

In the report, ESD

recommends further exploration of adopting actuarial premium rates and shifting to an actuarial rate setting approach to support greater fund stability and better match the program’s expenditures. Over time, the actuarial model would provide greater fund stability while potentially leading to a lower tax burden for employers.

Note that the actuarial rates are projected to increase in each year through 2027; the report does not indicate when rates could flatten or decrease.

Categories: Employment Policy , Tax Policy.