1:35 pm

March 2, 2021

Austin Jenkins has a story about the drive to adopt new taxes this year (particularly a capital gains tax), despite the fact that revenues are increasing and Washington does not have a budget shortfall.

Even as the state of Washington’s revenue picture improves, majority Democrats in the Legislature appear committed to a course that will, one way or another, involve raising taxes this year. Not necessarily to balance a recession-era budget, but instead to reform a tax code they view as regressive and to address gaps and inequities exposed by the global pandemic.

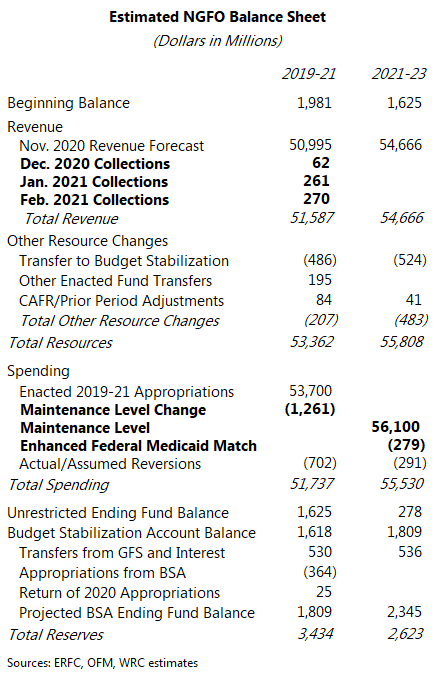

Indeed, the current budget balances over four years, without tapping the rainy day fund or increasing taxes.

It is true that Washington’s tax structure is regressive—all state and local tax structures are. The Institute on Taxation and Economic Policy (ITEP) ranks state tax structures by their regressivity. Doing so requires a number of assumptions about taxpayer income and spending and about how business taxes are passed on to customers and employees. As such, the design of ITEP’s ranking reflects ITEP’s assumptions and preferences.

That’s fine, but the ITEP report is not a measure of overall taxpayer well-being, nor is it a measure of how effective a tax structure is at collecting revenues.

In 2018 we critiqued ITEP’s report. As we showed, ITEP overstates the tax burden on low-income households, especially in Washington. Further, it completely ignores the highly progressive federal income tax system. When you look at the overall federal-state-local tax system, the tax burden is progressive in every state, including Washington.

Additionally, ITEP ignores the impact of spending programs. The late USC professor Edward Kleinbard argued,

As other developed countries have figured out, reducing inequality is not about where the money comes from, but where the money goes, and how much of it is spent.

A fiscal system encompasses both the tax and the spending sides of government. What we should care about is whether those two functions, taken as a whole, enhance the lives of average citizens.

To that point, Sen. Braun writes that rather than focusing on regressivity, legislators could better help low-income people through spending on social service benefits.

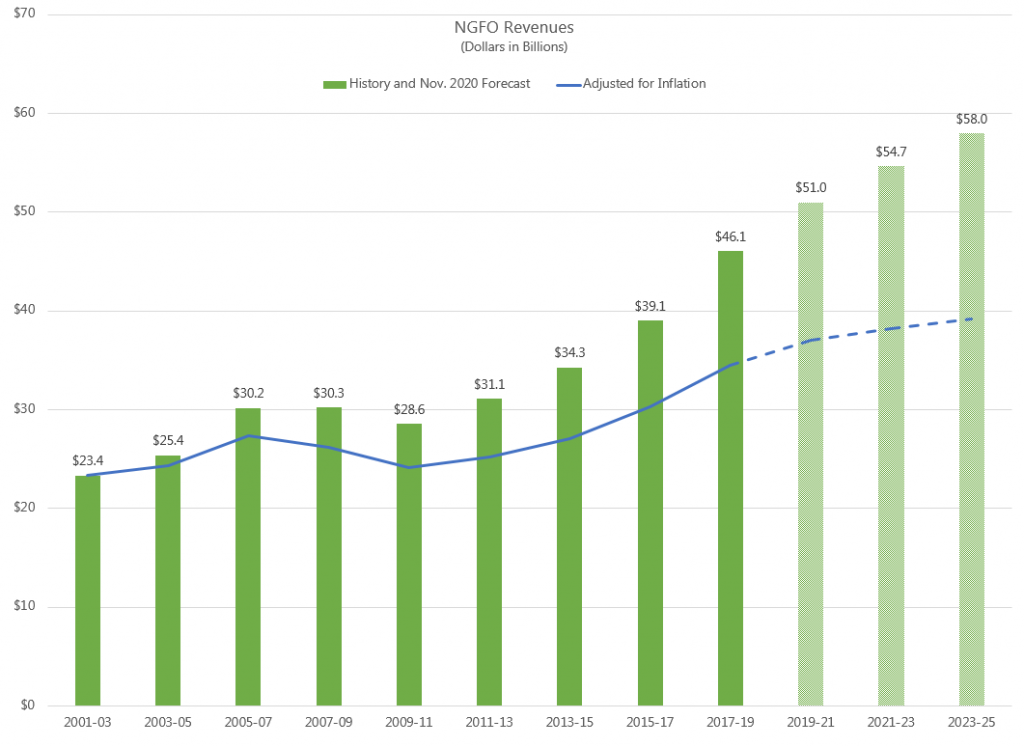

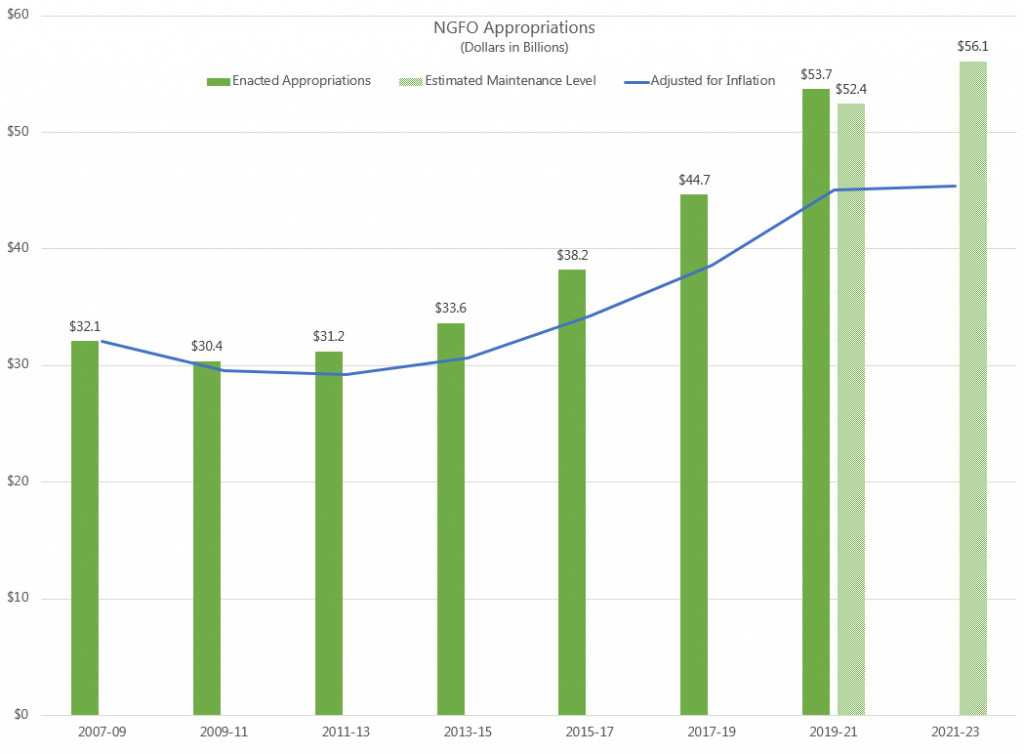

Washington’s tax structure has certainly enabled increasingly high levels of spending. 2019–21 revenues are forecast to increase by 10.7% over 2017–19 (not including the $593 million that has come in over forecast since November). Adjusted for inflation, revenues are up 35.3% over the pre-Great Recession high point. (Further, Washington’s current tax structure has yielded the nation’s second-highest revenue growth since the Great Recession.) Meanwhile, enacted 2019–21 appropriations per capita (adjusted for inflation) are 20.6% higher than the pre-Great Recession peak.

It’s important to remember that even if the state tax system is more regressive than in other states (by ITEP’s measure), it doesn’t mean that Washington’s low-income households are worse off than those in other states (because ITEP doesn’t consider the impact of spending programs).