2:49 pm

March 8, 2019

The U.S. Department of Labor (DOL) has proposed increasing the federal overtime threshold from $455 a week ($23,660 a year) to $679 a week ($35,308 a year). If adopted, this would mean that employees making less than $679 a week would have to be paid overtime if they work more than 40 hours. The proposal does not include automatic adjustments to the threshold, but it does include a “commitment to periodic review to update the salary threshold. An update would continue to require notice-and-comment rulemaking.”

In 2016, the Obama administration had adopted a final rule increasing the threshold to $913 a week, but it was enjoined by a federal judge. That rule had included an automatic adjustment for inflation.

Meanwhile, Washington’s Department of Labor & Industries is in the midst of new state overtime rulemaking. In a pre-draft proposal released in November, L&I proposed increasing the salary threshold for executive, administrative, and professional employees from $250 a week ($13,000) a year to 2 – 2.5 times the minimum wage beginning Jan. 1, 2020. (There is still a long way to go in the process.)

Washington’s minimum wage will be $13.50 in 2020. If the new threshold is twice the minimum, employees making under $1,080 a week ($56,160 a year) would be eligible for overtime. If the new threshold is 2.5 times the minimum, employees making under $1,350 a week ($70,200 a year) would be eligible.

The Seattle Times reports,

[The federal proposal] amounts to $35,308 a year, or just over 2.3 times the federal minimum hourly wage of $7.25, a multiplier that worker advocates in Washington say should be taken into consideration by Washington state as it updates its overtime wage threshold, a process that has been going on for 11 months.

But it doesn’t follow that because the proposed federal threshold happens to be 2.3 times the minimum wage, Washington’s threshold should be as well. The federal figure was not determined based on an arbitrary multiple of the minimum wage. Instead, DOL “calculated the standard salary amount by applying the same method used to set the standard salary level in 2004—i.e., by looking at the 20th percentile of earnings of full-time salaried workers in the lowest-wage census region (then and now the South), and/or in the retail sector nationwide.”

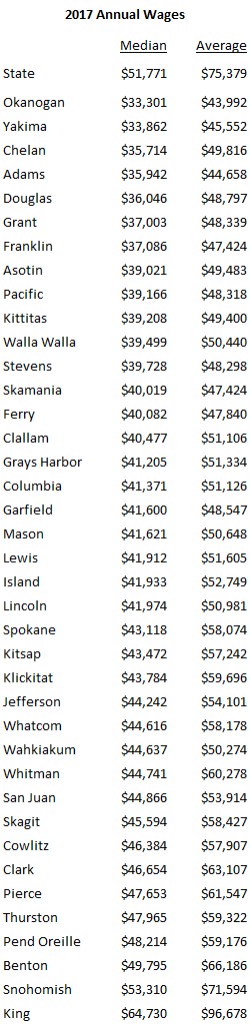

The table below shows median wages for Washington and each county. If L&I decides to change the threshold to twice the state minimum wage, it would be higher than the median wage statewide and in all counties except King.