9:52 am

June 23, 2022

At its quarterly meeting yesterday (June 22), the state Economic and Revenue Forecast Council (ERFC) updated its forecasts of state revenues. These new forecasts add nearly $2.3 billion to the amounts available over the remainder of the current biennium and the next two biennia. These gains, however, are totally erased by increases in the forecast for inflation. When adjusted for inflation, the apparent $2.3 $billion gain becomes a real $1.2 billion loss.

Budget reports from legislative fiscal committees typically roll up four accounts: the general fund–state, the education legacy trust account, the Washington opportunity pathways account and the workforce education investment account. Budgeteers refer to the roll-up as “funds subject to the outlook” (NGFO). Under the four-year balanced budget requirement, positive ending balances are required for both the current and the following bienniums for the NGFO as a whole.

For the NGFO, the new forecast for the 2021–23 biennium is $63,147.4 million; this is $1,456.7 million more than had been estimated in February, when the ERFC last met. This total includes a gain of $1,551.9 million due to stronger than expected economic activity offset in part by a $95.2 million reduction due to legislation enacted during the recent session. The forecast for the 2023–25 biennium increased by $631.5 million to $65,999.2 million; This total includes an economic gain of $1,111.6 million offset by a $480.1 million reduction due to legislation. The forecast for the 2025–27 biennium increased by $177 million to $70,202 million; meeting materials did not provide a breakdown between economic and legislative changes.

From 2019–21 to 2021–23, the forecasted NGFO revenue growth rate is now 18.9%. From 2021–23 to 2023–2025, the forecasted NGFO growth rate is 4.5%. From 2023–25 to 2025–27, the forecasted NGFO growth rate is 0.3%.

As always, the ERFC also adopted optimistic and pessimistic alternative forecasts for the general fund–state. Under the optimistic scenario, revenue exceeds the baseline forecast by $1,928 million in 2021–23 and by $5,034 million during 2023–25. Under the pessimistic scenario, revenue falls short of the baseline forecast by $2,183 million during 2021–23 and by $6,171 million during 2023–25. The ERFC assigns a 15 percent probability to the optimistic scenario and a 35 percent probability to the pessimistic scenario.

In February, the ERFC put symmetric 25% probabilities on its optimistic and pessimistic scenarios. The reason for the ERFC’s increased pessimism is the recent spike in inflation and the Federal Reserve Board’s aggressive policy in response.

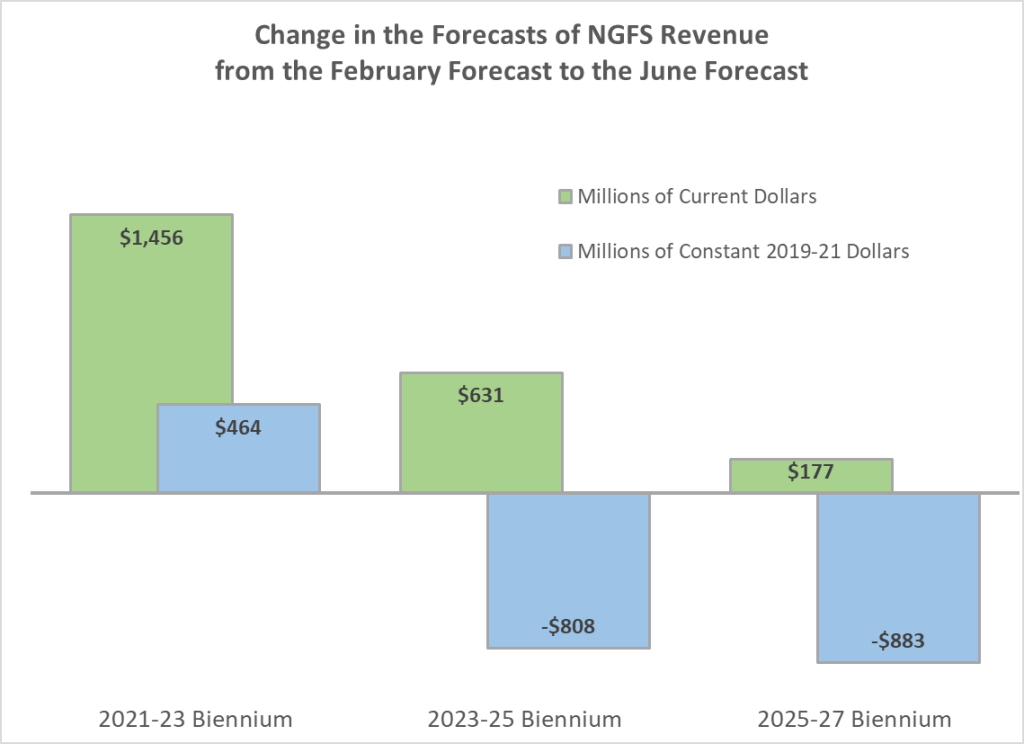

But a higher chance of a recession is not the only reason budgeteers need to worry about inflation. Inflation erodes the purchasing power of state tax dollars. The chart below shows the change in forecasted revenues from the February forecast to the June forecast in both current dollars and inflation-adjusted constant dollars. (I have used the ERFC’s forecast of the personal consumption expenditure price index to make this adjustment.)

Adjusting for inflation reduces the $1,456 million nominal increase from February to June in the forecast of 2021–23 revenues to a $464 million real increase. Adjusting for inflation turns the $631 million nominal February-to-June increase in the forecast of 2023–25 revenues into a $808 million real decrease and turns the $177 million nominal February-to-June increase in the forecast of 2025–27 revenues into an $883 million real decrease.

Adjusted for inflation, the 2021–23 biennium’s forecasted 18.9% nominal NGFS revenue increase over 2019–21 becomes an 8.7% real increase; the 2023–05 biennium’s 4.5% nominal increase over 2021–23 becomes a 0.8% real decrease; and the 2025–27 biennium’s 6.4% nominal increase over 2023–25 becomes a 2.7% real increase. The effect is magnified in 2023–25 and 2025–27 because the reductions compound. What initially appears to be a $2,264 million cumulative gain over the three biennia becomes a $1,227 million cumulative loss when inflation is factored in.

The handout from the ERFC meeting is here; TVW video of the meeting is here.

Categories: Budget , Economy.