1:07 pm

March 21, 2024

Climate commitment act (CCA) funds (proceeds from the carbon emission allowance auctions) are appropriated in the operating, capital, and transportation budgets. The supplemental budgets passed by the Legislature this year appropriate CCA funds assuming the current revenue forecast, but they delay a large share of those appropriations so that they will be effective only if I-2117 is rejected. (I-2117 would repeal the CCA and the accounts to which auction revenues are deposited.) The delayed appropriations will lapse if I-2117 passes, which means that, as passed by the Legislature, the CCA budget balances within revenues that are estimated to be available before November.

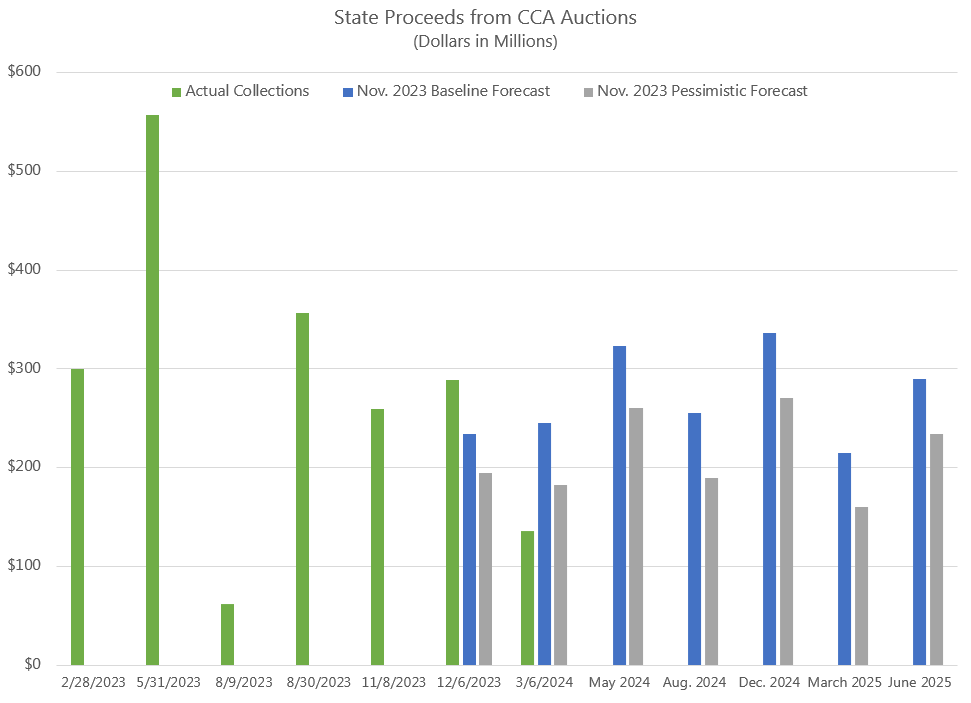

But, as Kriss noted last week, the settlement price at the March 6 auction was $25.76. With 5,260,000 allowances sold, state proceeds total $135.5 million. That figure is $110.0 million less than is assumed for the auction in the Dept. of Ecology’s Nov. 2023 CCA revenue forecast. (It is even $46.9 million less than the pessimistic forecast for the auction.) Counterbalancing that, state revenues from the Dec. 6, 2023 auction were $55.0 million higher than assumed in the forecast.

Adjusting the Nov. 2023 revenue forecast to account for actual revenues to date, the state has $2.523 million to work with for 2023–25. In addition to that, FY 2023 revenues totaled $857.1 million. The total amount of allowance auction revenues that can be appropriated is $3.380 billion (including actual revenues collected and the baseline forecast for the rest of 2023–25).

As Table 1 shows, $54.2 million of that was spent in 2021–23. The original 2023–25 biennial budgets appropriated $2.130 billion. The 2024 supplemental budgets, as passed by the Legislature, increase 2023–25 appropriations by $1.122 billion. This makes the total amount spent or appropriated $3.306 billion, which is within the total amount collected and expected for 2021–23 and 2023–25. (The governor has not yet signed the budgets, so these figures could change.)

However, voters will decide this fall whether to approve I-2117. In recognition of the possibility that the CCA could be repealed, the supplemental operating, capital, and transportation budgets passed by the Legislature restrict most of the of the CCA appropriations. Of the $1.122 billion appropriated in the supplementals from CCA accounts, $704.5 million would not be effective until Jan. 1, 2025 and would lapse if I-2117 is approved. (See Table 2 below.)

The remaining $417.2 million is effective when the budget is effective. That amount (plus already enacted appropriations) is within the baseline revenue forecast for the auctions through Aug. 2024 (the last auction before the election), adjusted for actual collections through the Dec. 2023 auction. (It looks like the lower-than-expected March 2024 collections put the CCA funds out of balance in this scenario, however.)

Additionally, the supplemental operating budget passed by the Legislature creates a new “consolidated climate account,” if I-2117 is approved. After the approval of I-2117 but before the repeal of the current climate accounts, the supplemental budget appropriates:

- $1.6 billion or the account balance (whichever is less) from the climate commitment account to the consolidated climate account,

- $800.0 million or the account balance (whichever is less) from the climate investment account to the consolidated climate account,

- $600.0 million or the account balance (whichever is less) from the natural climate solutions account to the consolidated climate account, and

- $25.0 million or the account balance (whichever is less) from the air quality and health disparities improvement account to the consolidated climate account.

The consolidated climate account could be used for the same purposes as the four current climate accounts. The operating budget specifies that appropriations from the current climate accounts in the 2023–25 biennial and 2024 supplemental operating and capital budgets “shall be paid from the consolidated climate account as if they were appropriated from that account beginning on the effective date” of I-2117. However, the operating supplemental specifies that “funds from the consolidated climate account may not be used” for $231.7 million of its CCA appropriations if I-2117 is approved. These spending items are effective at the same time the budget is, so CCA accounts could be used for them until the initiative is approved. (If I-2117 passes and the May and August auction revenues don’t make up for the lower-than-expected March auction revenues, the items in this bucket would probably be cut first in order to balance the accounts.)

Similarly, the supplemental transportation budget creates a new “transportation carbon emissions reduction account,” if I-2117 is approved. The new account could be used for the same purposes as the current carbon emissions reduction account (CERA). Any balance of the CERA on the effective date of I-2117 would be transferred to the new account. Appropriations from CERA in the 2023–25 biennial and 2024 supplemental transportation budgets “shall be paid from the transportation carbon emissions reduction account as if they were appropriated from that account, beginning on the effective date” of I-2117. However, the transportation budget specifies that $203.7 million in CERA appropriations begin Jan. 1, 2025. These appropriations would lapse if I-2117 is approved.

As Table 2 shows, the three supplementals restrict most of their CCA appropriations in case I-2117 is approved. Just $180.4 million is effective with no qualification when the budgets go into effect.

Tags: 2024 supp