3:45 pm

December 17, 2020

Gov. Inslee has proposed a 2021 supplemental to the 2019–21 operating budget and a 2021–23 operating budget. The 2021 supplemental would reduce appropriations from funds subject to the outlook (NGFO) by $915 million. The 2021–23 proposal would appropriate $57.8 billion, including $1.7 billion in new policy.

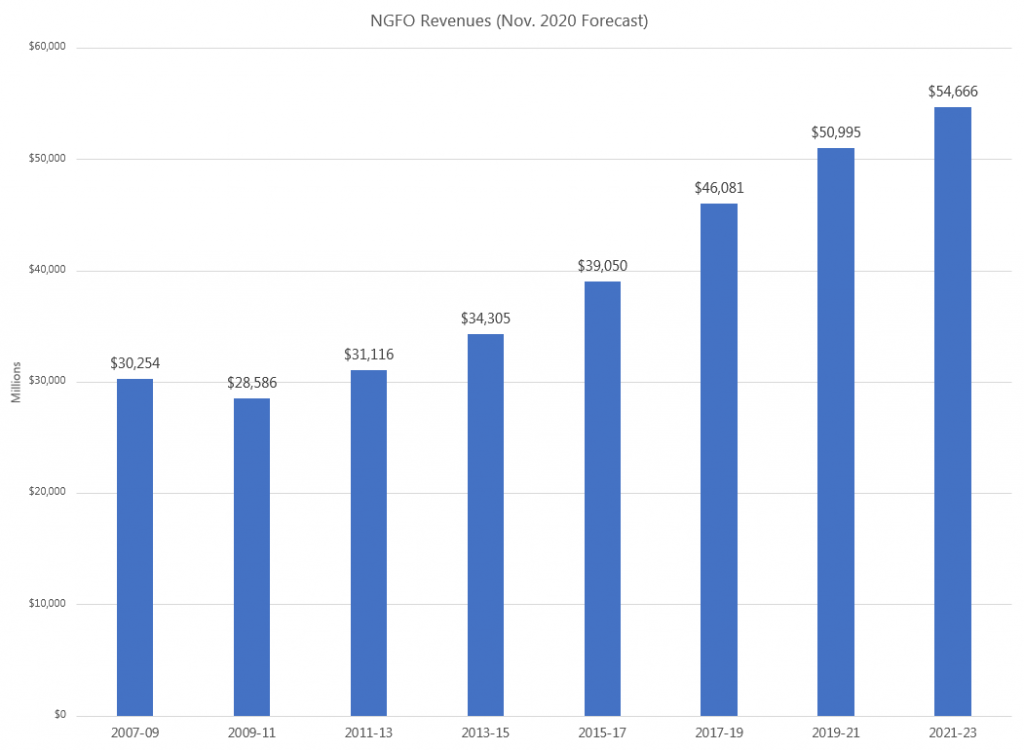

Despite the improved revenue forecast, the governor is proposing a 9% capital gains tax that would take effect in the second year of 2021–23. This is estimated to increase 2021–23 revenues by $1.1 billion. (In November, the Economic and Revenue Forecast Council estimated that 2021–23 revenues will already increase by $3.7 billion over 2019–21.)

Additionally, the governor proposes a new “covered lives assessment.” A fee would be charged to health insurers, managed care organizations, limited health services contractors, and third-party administrators for each person covered. This would increase non-NGFO revenues by $205 million in 2021–23 and $343 million in 2023–25 and would fund public health services.

Finally, the governor proposes draining the rainy day fund in 2019–21. First, $100 million would be used for grants to businesses. Second, another $100 million would be used for rental assistance. Third, the balance in the account ($1.8 billion) would be transferred to the general fund–state. (Employment growth is forecast to be less than 1% in FY 2021, so making these rainy day fund withdrawals would require just a simple majority of the Legislature.)

The unrestricted NGFO ending balance in 2021–23 would be $462 million and total reserves would be $999 million.

We’ll have much more on the governor’s proposals as we read through the details.

Categories: Budget.Tags: 2019-21 , 2021-23