4:09 pm

February 15, 2023

Yesterday the state’s Economic and Revenue Forecast Council (ERFC) issued its monthly report on general fund revenue collections.

This report covers payments received between January 11 and February 10 for the sales tax, the use tax, the business and occupation tax, the public utility tax, the tobacco products tax, and penalties and interest (collectively the Revenue Act receipts), and it covers payments received between January 1 and February 31 for liquor taxes, cigarette tax, property tax, real estate excise tax, unclaimed property and other sources.

This report includes payments related to December economic activity from monthly filers and payments related to October, November and December activity from quarterly filers.

The total amount received this month was $2,287.7 million, $5.2 million (0.2%) more than the amount expected under the forecast that ERFC adopted on November 18th. Last month revenues exceeded forecast by $87.8 million (3.9%).

For the month, Revenue Act taxes (primarily the sales, use, utility, and business and occupation taxes) exceeded forecast by $6.6 million (0.3%). Here is a chart showing seasonally adjusted Revenue Act receipts since 2004:

For the month, Non-Revenue Act taxes fell $1.1 million (0.6%) short of forecast. Within this category, property tax collections fell $8.3 million (30.1%) short of forecast, while real estate excise tax fell $7.9 million (12.2%) short of forecast.

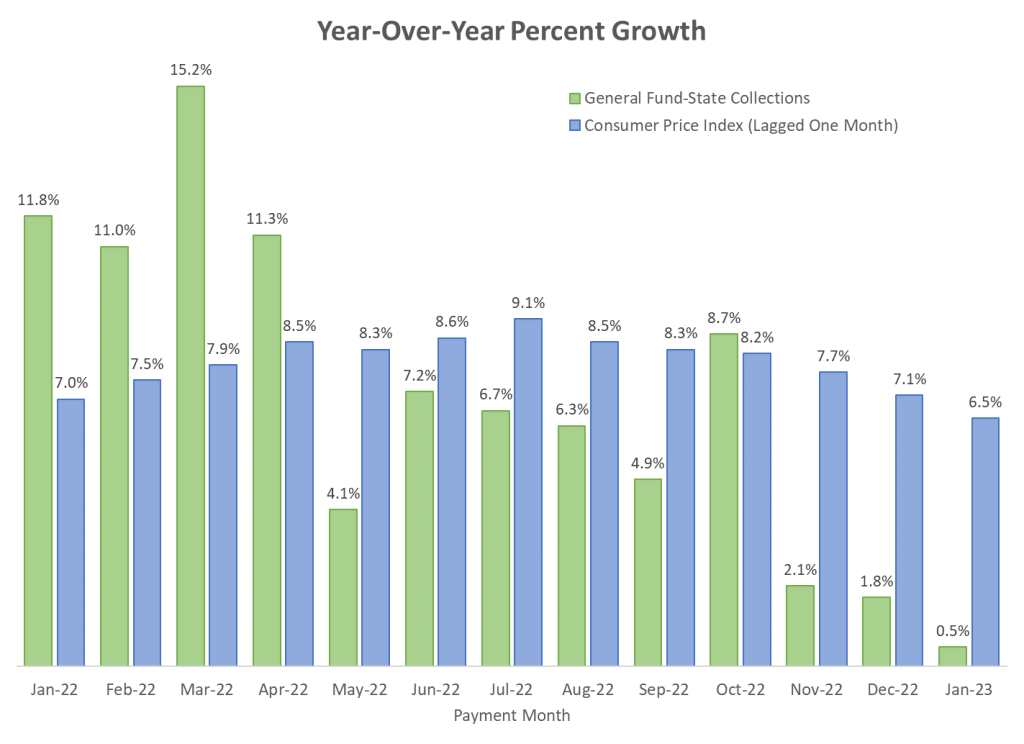

The chart below compares year-over-year growth rates of general fund-state revenues to year-over-year inflation in the consumer price index.:

For 8 of the last 9 months, year-over-year CPI inflation exceeded the year-over-year increase in GFS revenues. While inflation has trended downward since mid-summer, the gap between inflation and revenue growth has widened.

The February collections report is available here.

Categories: Budget , Economy.