11:58 am

May 13, 2021

States and local governments may use their shares of the coronavirus state and local fiscal recovery funds for many purposes (generally related to the pandemic). The U.S. Department of the Treasury’s interim final rule for the program provides additional guidance for recipients. Earlier, I went over some of the allowable uses.

Under the American Rescue Plan Act, jurisdictions may use the funds “for the provision of government services to the extent of the reduction in revenue due to the COVID-19 public health emergency relative to revenues collected in the most recent full fiscal year prior to the emergency.”

Based on the plain language, you might expect that Washington would not be able to use the coronavirus state fiscal recovery fund (CSFRF) for this purpose, since state tax collections increased from FY 2019 to FY 2020. However, the guidance specifies, “recipients will compute the extent of the reduction in revenue by comparing actual revenue to a counterfactual trend representing what could have been expected to occur in the absence of the pandemic.”

The guidance bases the counterfactual on “general revenue,” as used in the Census Bureau’s Annual Survey of State and Local Government Finances, less federal intergovernmental revenues. To estimate the counterfactual, recipients may assume that revenues would have grown by 4.1% a year (beginning with actual FY 2019 general revenues), or that they would have grown by their own average annual revenue growth over the prior three years. Washington’s general revenue average growth rate from FY 2016–2019 was 7.8%.

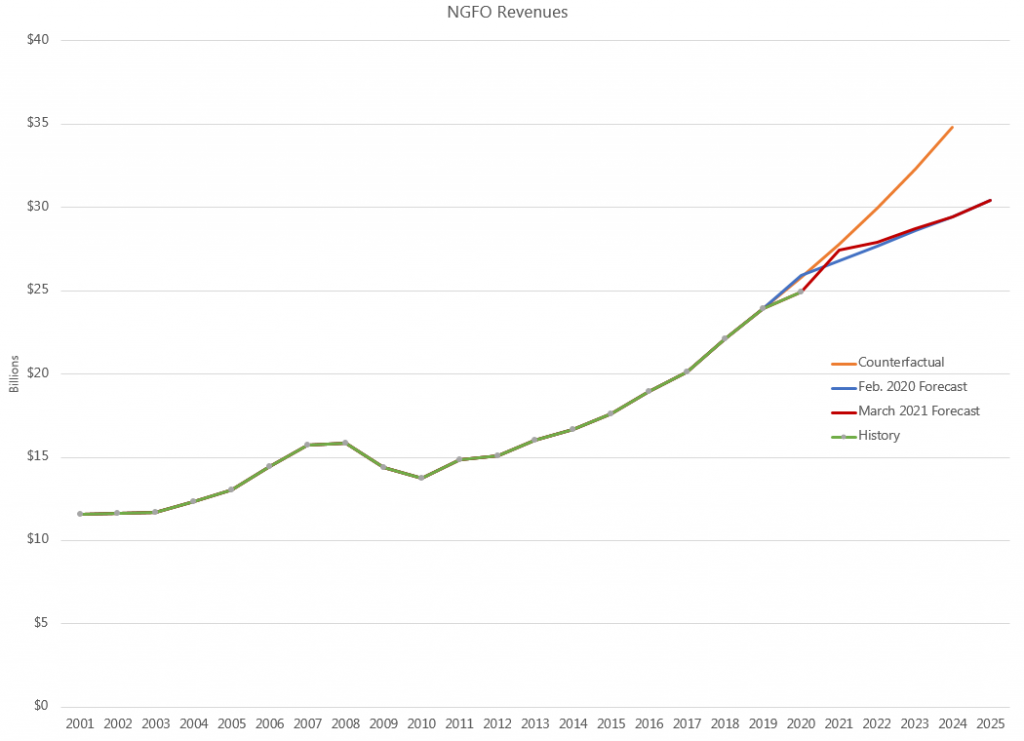

State general revenue data is available from Census through FY 2019. Funds subject to the outlook (NGFO) are just a subset of Washington’s general revenue (roughly 60%), but we have more recent NGFO actuals and a forecast, so I’m using NGFO figures here for illustration purposes. As we’ve shown, in the March 2021 forecast, NGFO revenues are on par with those forecast in the pre-pandemic Feb. 2020 forecast.

Based on my very-back-of-the-envelope calculation, the growth of Washington’s counterfactual general revenues will significantly exceed estimated growth of the NGFO through 2023, as the Economic and Revenue Forecast Council (ERFC) expects NGFO revenue growth to average 4.7% from 2020 to 2023. For example, the chart shows NGFO revenues as forecast in Feb. 2020 and March 2021 and a counterfactual NGFO that grows by 7.8% a year. Again, this is only an illustration; it is not the same data as the general revenues to be used under the Treasury guidance, and the forecasts aren’t set in stone. However, it seems pretty clear that the Treasury methodology is very favorable to Washington. It would potentially allow revenues to be backfilled that had never been expected by the state.

(FY 2020 might be an exception to that. FY 2020 NGFO revenues were below what had been expected in the Feb. 2020 forecast. But under the guidance, recipients will calculate their revenue reductions from their counterfactual as of Dec. 31, 2020; Dec. 31, 2021; Dec. 31, 2022; and Dec. 31, 2023. Dec. 31, 2020 is halfway into FY 2021, in which the ERFC now expects NGFO revenues to be higher than they had expected in the Feb. 2020 forecast.)

If it turns out that Washington qualifies for this use of the CSFRF, it could use funds (to the extent of the revenue loss) for “maintenance or pay-go funded building of infrastructure, including roads; modernization of cybersecurity, including hardware, software, and protection of critical infrastructure; health services; environmental remediation; school or educational services; and the provision of police, fire, and other public safety services.”

The 2021–23 transportation budget appropriates $600.0 million from the CSFRF to backfill lost transportation revenues. Transportation revenues did decline from FY 2019 to FY 2020. However, the guidance notes that revenue reductions must be calculated “on an aggregate basis”—not by source. It will be interesting to see whether the state determines it experienced a revenue loss given this methodology, and whether the transportation revenue backfill is determined to be an allowable use of the CSFRF.

Categories: Budget.Tags: ARP Act