11:54 am

February 15, 2024

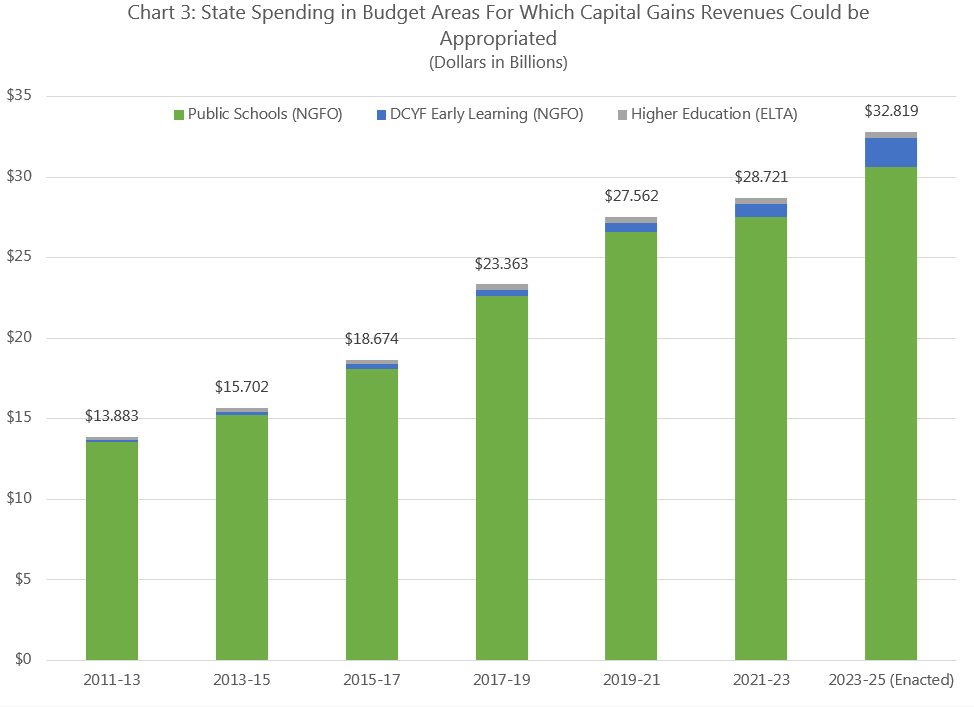

During yesterday’s Economic and Revenue Forecast Council (ERFC) meeting, ERFC Executive Director Dave Reich said that the capital gains revenue forecast was adjusted down because of a double count in fiscal year 2024 and a coding error by the Department of Revenue. As a result, compared to the November 2023 forecast, revenues from the capital gains tax are now estimated to be $223.4 million less in 2023–25 and $144.1 million less in 2025–27. The negative impact is entirely to the capital budget, not the operating budget.

To help manage the inherent volatility of capital gains taxes, statute directs the first $500 million of revenues annually to the education legacy trust account (ELTA, which is a fund subject to the outlook and is appropriated in the operating budget). Any revenues above this threshold (which is adjusted for inflation) are directed to the common schools construction account (CSCA, which is appropriated in the capital budget).

Not only are capital gains taxes volatile, but this is a brand new tax for Washington. It is especially hard to accurately forecast a new tax, where forecasters don’t have any history to help guide them. Consequently, the capital gains tax revenue forecasts should be treated with even more caution than normal.

As Chart 1 shows, the March 2023 forecast (on which the current budget is based) estimated that the capital gains tax would increase revenues by $248.0 million in 2021–23, all of which would go to the ELTA. Actual collections came in much higher: An additional $252.0 million to the ELTA plus $347.5 million to the CSCA.

Given the actual collections in FY 2023, forecasters increased their estimates of revenues going forward. For example, the Nov. 2023 forecast estimated that capital gains revenues to the CSCA would be $668.9 million in 2023–25, up from $197.0 million in the March 2023 forecast. Now, though, the 2023–25 estimate for the CSCA is down to $444.9 million.

Again, given the uncertainty, budget writers should be cautious. Especially for the capital budget, legislators should appropriate only those capital gains revenues that have actually been collected.

The changes to the capital gains forecast mean that the fiscal note for I-2109 will need to be revised. The fiscal note dated Feb. 5 is based on the Nov. 2023 capital gains revenue forecast. That fiscal note estimated that repealing the capital gains tax would reduce total state revenues by $1.606 billion in 2023–25, $1.926 billion in 2025–27, and $2.130 billion in 2027–29.

Based on this fiscal note, Sen. Billig said that passage of I-2109 “would result in the loss of more than $5.6 billion in funding for early learning, childcare and K-12 education programs across Washington by 2029.” However, according to the Feb. 5 fiscal note, the impact to the ELTA (from which appropriations may be made for “support of the common schools, and for expanding access to higher education through funding for new enrollments and financial aid, early learning and child care programs, and other educational improvement efforts”) would be $3.239 billion through 2029 ($981.0 million in 2023–25, $1.104 billion in 2025–27, and $1.154 billion in 2027–29). (Most of the rest of the fiscal impact would be to the CSCA.)

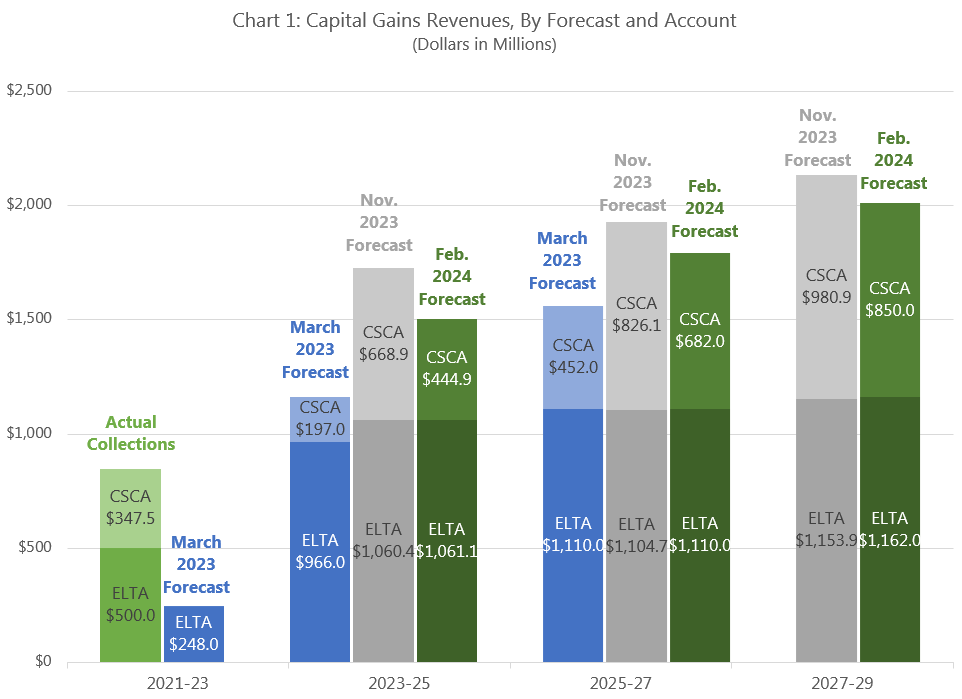

Although $1 billion or so a biennium is a lot of money, it is a small percentage of operating budget revenues (funds subject to the outlook, or NGFO) and it is a small percentage of what the state spends on education. Chart 2 shows the Feb. 2024 forecast of NGFO revenues from the capital gains tax and all other sources. For 2023–25, NGFO revenues are estimated to be $67.005 billion; without capital gains revenues, that figure would be $65.944 billion.

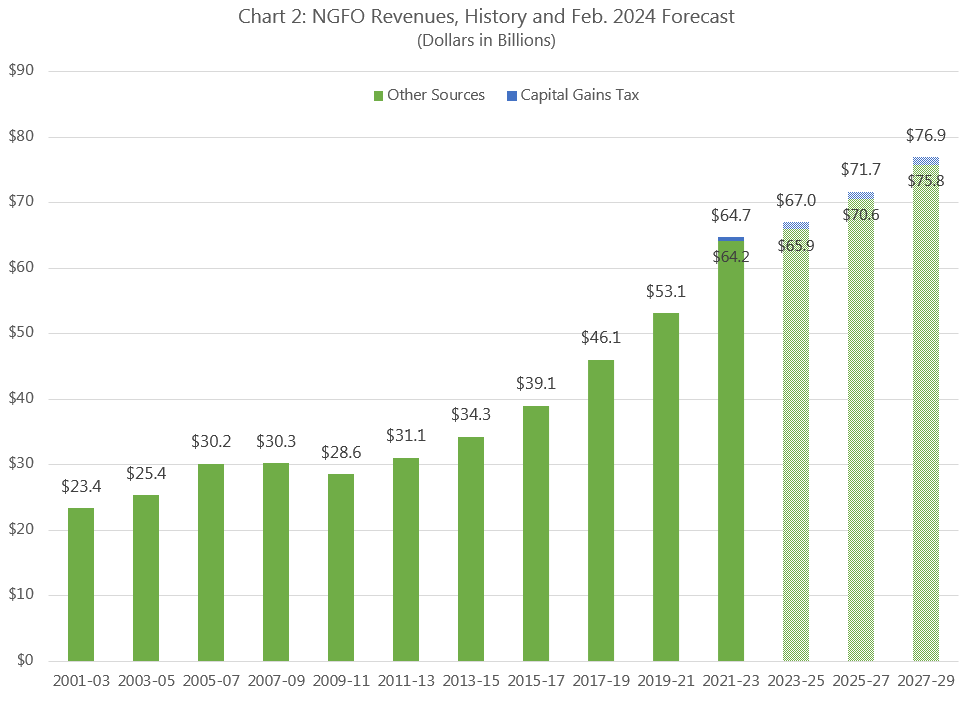

It is impossible to say how the Legislature has appropriated capital gains revenues. Once the revenues are deposited in the ELTA, they are commingled with other ELTA revenue sources (the estate tax and the real estate excise tax, for example). As noted above, the ELTA is statutorily dedicated to the “support of the common schools, and for expanding access to higher education through funding for new enrollments and financial aid, early learning and child care programs, and other educational improvement efforts.” All of these purposes also receive funding from non-ELTA accounts.

Chart 3 provides an idea of the spending areas that could be augmented by capital gains revenues. I’ve included all NGFO spending on K–12, all NGFO spending on the Department of Children, Youth, and Families’ early learning program (which includes child care), and ELTA spending on higher education. The final budget for 2021–23 and the original budget for 2023–25 were based on the March 2023 revenue forecast. Thus, you could say that the capital gains tax accounted for 0.9% of spending on these education programs in 2021–23 and 2.9% in 2023–25.