12:08 pm

May 7, 2025

As passed by the Legislature, ESHB 2081 is the state’s largest tax increase. It would make multiple changes to the business and occupation (B&O) tax:

- Permanently increase many B&O tax rates (for example, rates for manufacturers and wholesalers would increase from 0.484% to 0.5% and rates for retailers would increase from 0.471% to 0.5%).

- Add a third rate tier for the service and other activities category, so that businesses with income of $5 million or more would pay a rate of 2.1% instead of 1.75%.

- Add a temporary 0.5% surcharge on taxable income over $250 million. (It would be in place from Jan. 1, 2026 through Dec. 31, 2029.)

- Increase the surcharge on certain financial institutions from 1.2% to 1.5%.

- Increase the advanced computing surcharge from 1.22% to 7.5% and increase the annual cap on collections from members of an affiliated group from $9 million to $75 million.

My estimates of how ESHB 2081 and ESSB 5794 (which also makes B&O tax changes) would impact B&O tax rates by industry are here.

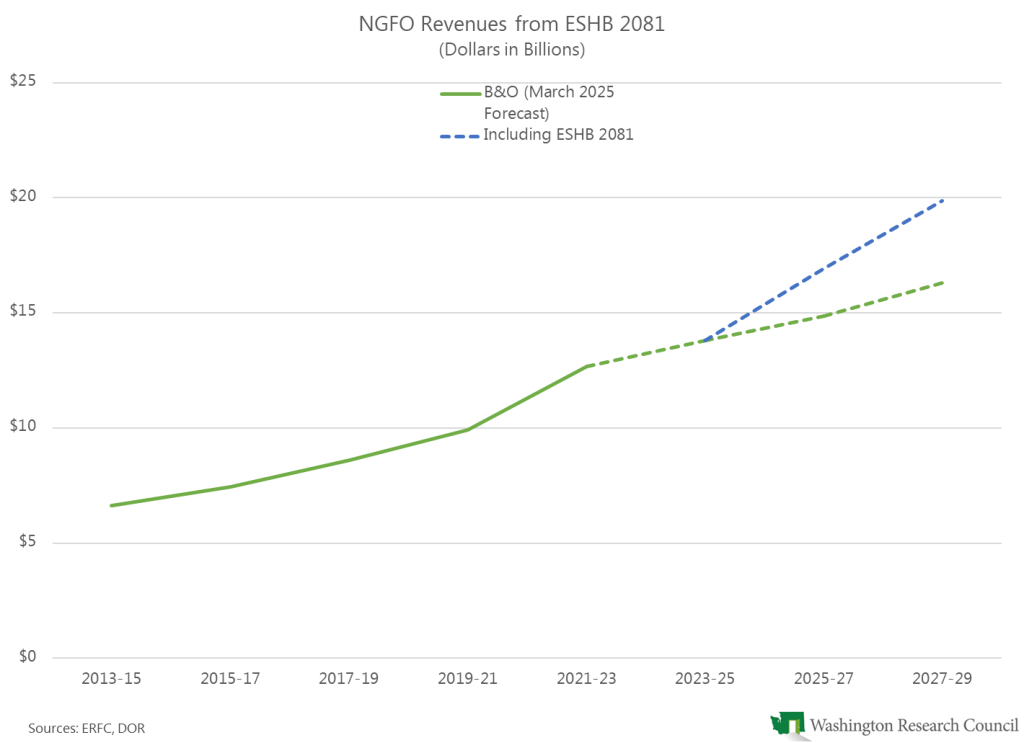

According to the fiscal note for ESHB 2081, it would increase revenues to funds subject to the outlook (NGFO) by $2.066 billion in 2025–27 and by $3.557 billion in 2027–29. Compared to the March 2025 forecast of B&O tax revenues for each biennium, ESHB 2081 would increase B&O tax revenues by 13.9% in 2025–27 and by 21.8% in 2027–29.

The Department of Revenue has provided additional information on the revenue impact of each of the major provisions in the bill. Over the outlook period (2025–27 and 2027–29), the bill would increase NGFO revenues by a total of $5.623 billion. That is comprised of:

- $1.864 billion from the temporary surcharge on income over $250 million,

- $1.744 billion from the new rate tier for service and other activities,

- $1.372 billion from the changes to the advanced computing surcharge,

- $396.2 million from the permanent rate increase, and

- $247.7 million from the increase to the surcharge for financial institutions.