2:11 pm

March 20, 2025

Today Senate Democrats released their revenue proposals for the 2025–27 operating budget. (The budget itself will be released on Monday.) They would impose a wealth tax (dubbed the financial intangibles tax) and a payroll expense tax, increase the property tax growth limit, and repeal several tax exemptions. They would also reduce the state sales tax rate from 6.5% to 6%.

There are no public fiscal notes yet, but the press release includes general revenue estimates.

- The wealth tax would increase revenues by $12 billion over the four-year period.

- The payroll expense tax would increase revenues by $6.9 billion over the four-year period.

- The property tax changes would increase revenues by $779 million over the four-year period.

- The elimination of tax preferences would increase revenues by $1 billion over the four-year period.

- Cutting the sales tax would reduce revenues by $3.250 billion over the four-year period.

Thus, Senate Democrats are proposing $21 billion in new taxes over four years. These would be offset by the sales tax reduction so that the net increase in taxes would be $17 billion over four years. For context, the estimated maintenance level shortfall is $8.7 billion over four years.

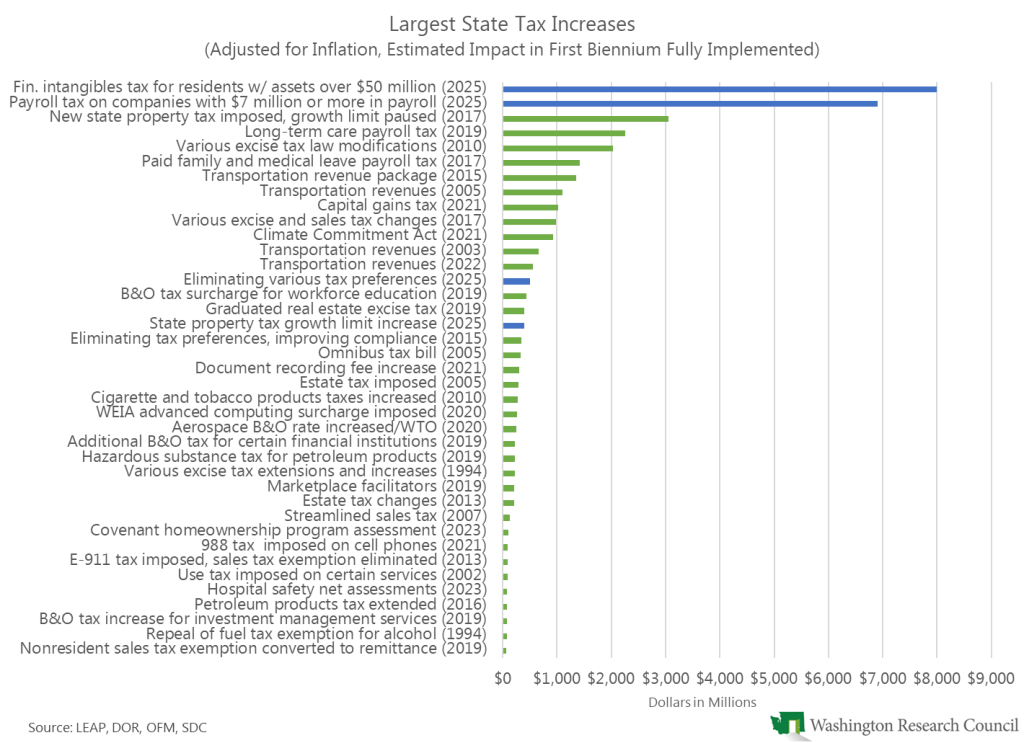

Additionally, the four tax increases would each make the list of the state’s largest tax increases. The wealth and payroll taxes would be the state’s largest tax increases by far. In the chart, the green bars are enacted taxes (the dates indicate when they were enacted). The blue bars are today’s proposals from Senate Democrats.

I’ll write more about each tax proposal in future posts. In the meantime, it’s important to understand what these revenues would be used for.

The bills attempt to tie the need for the tax increases to public schools. This is especially true for the wealth tax, which specifies, “All moneys collected from the intangible assets tax must be deposited into the state general fund for the support of common schools.” This mirrors the language of the state property tax. However, the revenues would all be deposited in the general fund–state, which can be used for any purpose.

Basic education is the state’s paramount duty. The state Supreme Court has held that this means “the State must ‘amply provide for the education of all Washington children as the State’s first and highest priority before any other State programs or operations.’” The Supreme Court further stated, in 2017,

The State does not dispute, indeed it concedes, that there is enough money in the state’s Near General Fund to fully pay for the program of basic education, including salaries. Nor does it dispute that sufficient revenue will be collected to provide full funding. Whether that is achieved by September 1, 2018, is wholly within the legislature’s discretion in making taxing and spending decisions. The court has been clear and consistent that while the constitution empowers the legislature alone to write the budget, in doing so it must meet its “paramount” obligation first.

In 2023–25, state appropriations from funds subject to the outlook (NGFO) for K–12 total $31.202 billion. Former Gov. Inslee proposed appropriating $33.331 billion for K–12 in 2025–27. Under the March revenue forecast, total NGFO revenues are expected to be $66.445 billion in 2023–25 and $70.952 billion in 2025–27. If the Legislature wants to increase funding for K–12, it can do so within current resources.

That may mean the Legislature would need to reduce funding for other programs. If legislators decide to increase taxes, the taxes—by the Supreme Court’s lights—would be to fund those other programs, not K–12. Ultimately, if the taxes proposed today are enacted, it is not necessarily the case that overall K–12 appropriations would increase, nor is it necessary to enact the taxes to increase K–12 appropriations.

Categories: Budget , Education , Tax Policy.Tags: 2025-27