4:20 pm

May 15, 2020

The state’s Economic and Revenue Forecast Council (ERFC) released its May report on state general fund revenue collections today. This is the first collections report to show the effect of COVID-19 on state revenues.

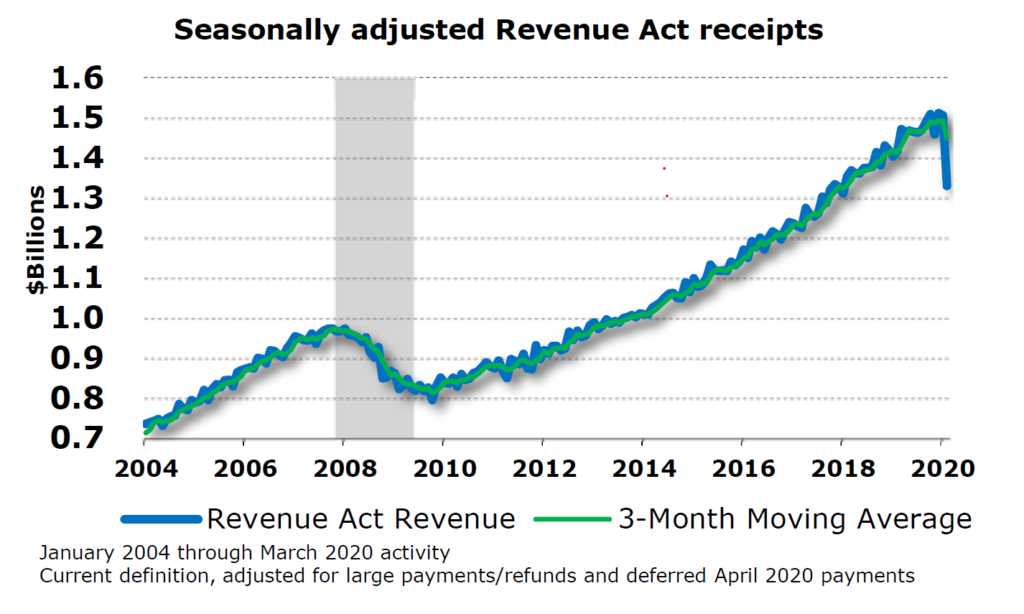

For the sales tax, the use tax, the business and occupation tax, the public utility tax, the tobacco products tax, and penalties and interest (collectively the Revenue Act receipts), this report covers payments received between April 11 and May 10, which generally relate to transactions that occurred in the month of March for monthly filers, or in January, February and March for quarterly filers. DOR has granted a blanket deferral of payment to June 30 for all quarterly filers and approved deferrals of payment to May 25 for a number of monthly filers.

For liquor taxes, cigarette tax, property tax, real estate excise tax, unclaimed property and other sources, the report covers payments received between April 1 and April 30.

The total amount received was $1,495.8 million. This was $434.6 million (22.5%) less than the amount that had been forecast. ERFC estimates that deferrals account for about $200 million of this shortfall. The only sources that came in above forecast were liquor taxes ($141,000 above forecast) and cigarette taxes ($2.3 million above forecast).

Here is a chart of seasonally adjusted Revenue Act Receipts since 2004:

The full Economic and Revenue Update is available here.

Categories: Budget , Categories , Economy.Tags: COVID-19 , COVID-19 & the economy