1:37 pm

April 21, 2021

Gov. Inslee has signed ESHB 1521. Under the bill, the state will restart payments to certain local taxing districts to mitigate “the negative fiscal impacts to local taxing jurisdictions as a result of the streamlined sales and use tax agreement.”

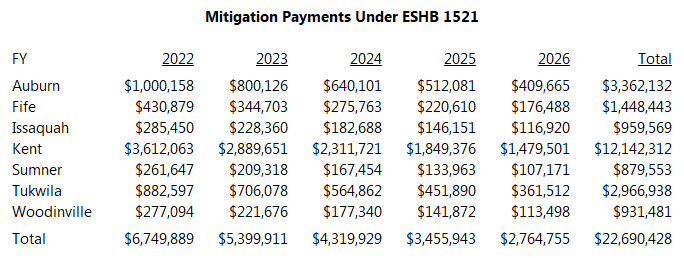

The payments will equal the payment each local taxing district received on June 30, 2020. Beginning July 1, 2022, the quarterly payment will be reduced by 20% of the previous year’s payment. The payments will end after FY 2026. To qualify, a taxing district must have received a streamlined sales tax mitigation payment of at least $60,000 on June 30, 2020. Thus, seven cities qualify: Auburn, Fife, Issaquah, Kent, Sumner, Tukwila, and Woodinville.

According to the fiscal note, the bill will reduce general fund–state (GFS) revenues by $12.2 million in 2021–23, by $7.8 million in 2023–25, and by $2.8 million in 2025–27. Both the House- and Senate-passed 2021–23 operating budgets include a transfer of $12.2 million from the GFS to the manufacturing and warehousing job centers account (from which the mitigation payments will be made). The table shows an estimate of how much each city will receive each year.

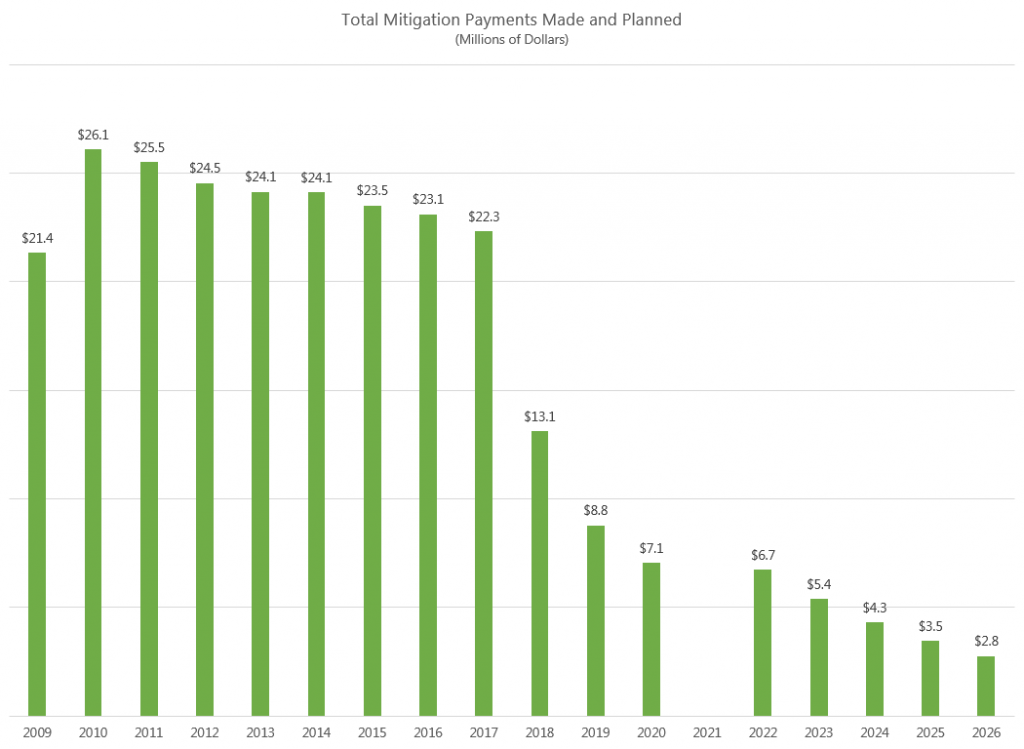

The reason the state is making these payments is that on July 1, 2008, Washington signed the Streamlined Sales and Use Tax Agreement (SSUTA) and changed the local sales tax system so that taxes are collected based on the location of the buyer rather than the location of the seller. This change resulted in revenue losses for some jurisdictions, and the bill making the change (SSB 5089) established mitigation payments. Here’s a timeline of actions affecting the payments:

- The first mitigation payments were made Dec. 31, 2008 to 77 jurisdictions.

- In 2017 (EHB 2163), the Legislature repealed the payments, effective Oct. 1, 2019.

- The 2019–21 biennial budget appropriated funding to continue the payments through FY 2021 for jurisdictions eligible for payments of at least $50,000 in CY 2018.

- The 2020 supplemental did not fund the payments for FY 2021.

- In 2020, the Legislature passed EHB 1948, which would have extended the payments for fewer jurisdictions until Jan. 2026. Gov. Inslee vetoed the bill (to maintain state revenues as the pandemic was beginning).

- The payments ended June 30, 2020 for the last 10 jurisdictions still receiving them.

Through June 30, 2020, the state distributed $243.7 million in mitigation payments. Kent received the most ($55.3 million), followed by King County Metro Transit ($52.0 million), Sound Transit ($26.3 million), Auburn ($21.7 million, and Tukwila ($13.4 million).

Tags: 2021-23