2:07 pm

October 29, 2021

Here are updates of charts I have posted monthly regarding national income and consumer spending during the COVID-19 recession, including new numbers for September and revisions to numbers for prior months.

Personal Income in September was 0.1% less than in August and 15.1% less than the peak reached in March, which was boosted by the $1.9 trillion federal relief package that was enacted that month. Consumer spending increased by $93.4 billion (seasonally adjusted annual rate) from August to September, while the saving rate decreased from 9.2% to 7.5%.

On the first chart, the stacked columns show estimated personal income for the U.S. as a whole, by month, from January 2019 through August 2021. The numbers are seasonally adjusted annual rates. I have broken personal income into four parts: employee compensation (wages and salaries, and supplements); unemployment insurance benefits; other government social benefits (e.g., Social Security pensions, Medicare- and Medicaid-funded healthcare services, stimulus checks); and other income (e.g., interest, dividends and profits of non-corporate business activities, including property rentals).

Personal income in September was $216.2 billion less than in August: Government social benefits were down by $296.6 billion. (Unemployment insurance, down $254.6 billion, accounts for most of this decline.) Employee compensation was up by $87.9.1 billion. Income from all other sources was down by $7.5 billion. Overall, personal income in September was 7.8 % greater than in February 2020, the last month before the pandemic began to shut down the economy. Employee compensation was 6.3 percent higher in September 2021 than in February 2020, while government social benefits were 22.1 percent higher.

Also on the first chart, the black line shows monthly personal consumption expenditures. Again, these numbers are seasonally adjusted annual rates. Consumption expenditures in September 2021 were $93.4 billion greater than in August and $1,275.1 billion (7.7%) greater than in February 2020.

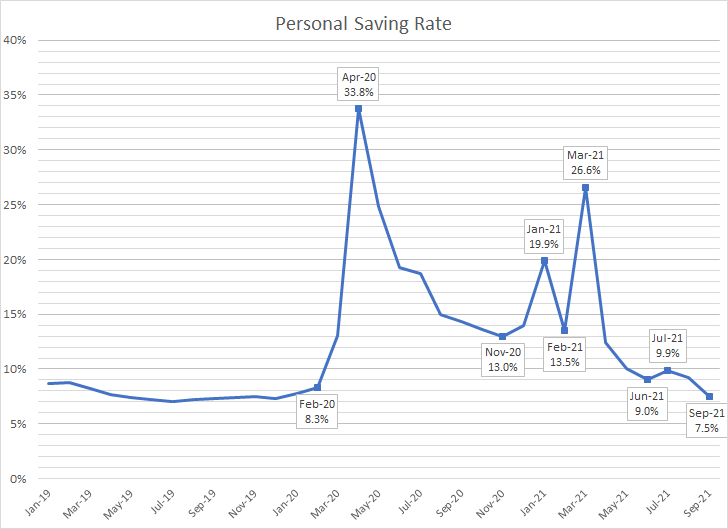

The second chart shows the personal saving rate, monthly from January 2019 through September 2021. (The saving rate is equal to the amount of personal saving divided by the amount of disposable personal income. Disposable personal income equals personal income less personal current taxes, which are mostly income taxes).

The saving rate jumped from 8.3% in February 2020 to an astounding 33.8% in April and then declined in steps to 13.0% in November. The saving rate moved up modestly in December, jumped to 19.9% in January 2021, fell back to 13.5% in February, jumped to 26.6% in March and dropped in steps to 9.0% in June. The September rate was 7.5%. For the five-year period from January 2015 to December 2019, the average monthly saving rate averaged 7.4%, very close to the September value.

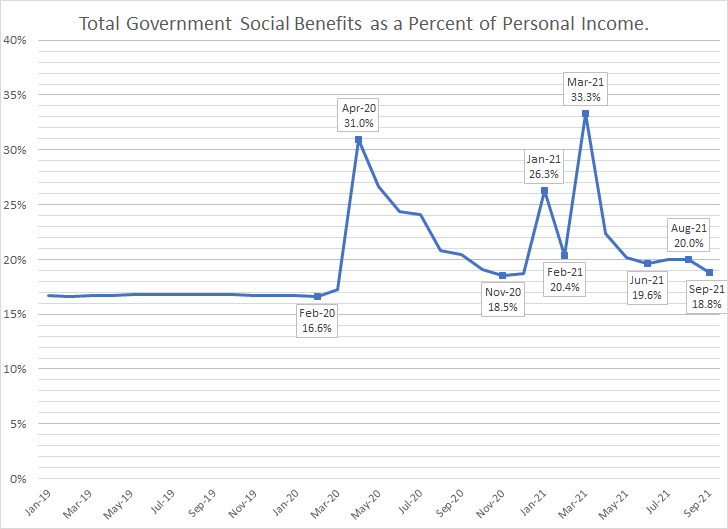

The third chart shows total government social benefits as a percent of personal income. (Total benefits are the sum of the unemployment insurance and other social benefit numbers shown on the first chart.)

In February 2020, prior to the pandemic, government social benefits provided 16.6% of personal income. Federal relief bills took the share to peaks of 31.0% in April 2020, 26.3% in January 2021 and 33.3% in March 2021. In September 2021, government social benefits provided 18.8% of personal income. For the five-year period from January 2015 to December 2016, the average monthly ratio of government social benefits to personal income averaged 16.7%, more than 2 points less than the September value.

The numbers underlying these charts are preliminary estimates that will be revised as more information becomes available to the statisticians at the federal Bureau of Economic Analysis.

The BEA monthly personal income press release is here. A BEA table showing the effects of selected federal pandemic response programs on personal income is here.

Categories: Economy.