1:45 pm

July 15, 2021

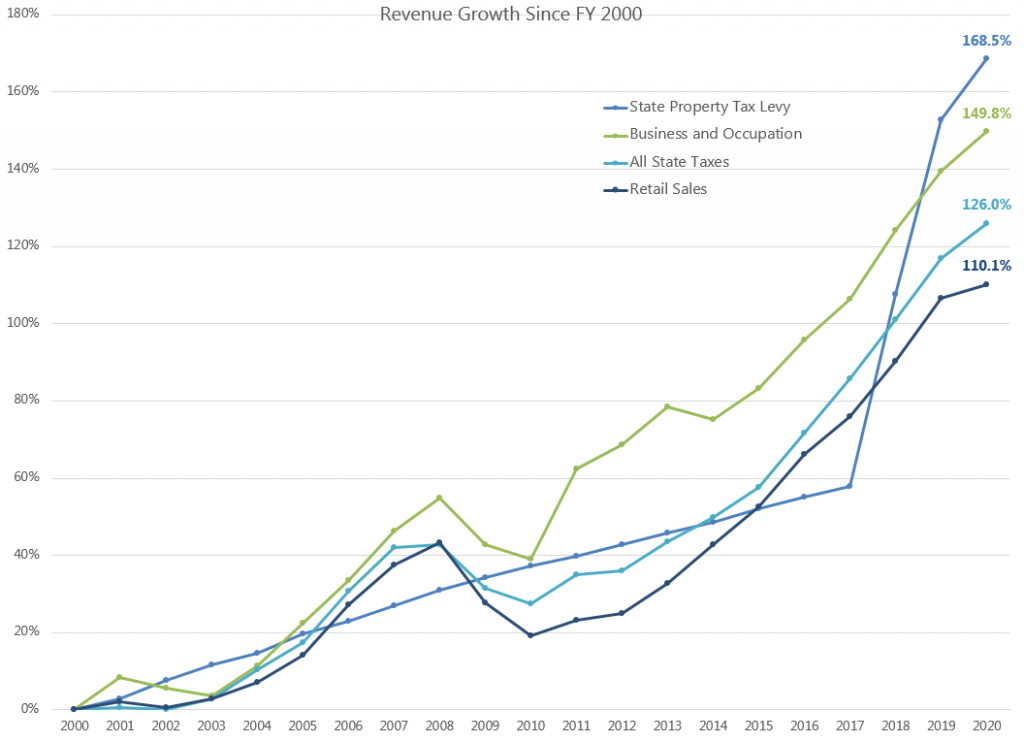

Washington’s three top tax sources are the sales tax, business and occupation (B&O) tax, and property tax. In fiscal year 2020, of total state tax collections, the retail sales tax accounted for 42.3%, the B&O tax 17.3%, and the state property tax 13.3%.

The chart shows the growth in revenues from FY 2000 from each of these sources. Revenues from the state property tax grew slowly but steadily through FY 2017. Then, they jumped by 31.4% in FY 2018, 21.8% in 2019, and 6.2% in 2020. Now, state property tax revenue growth since 2000 is 168.5%—that’s higher than the other two top tax sources, and higher than the growth of all state tax revenues. (Growth in B&O tax revenues is a still high 149.8%.)

The substantial property tax growth is due to the changes to the tax that were made as part of the state’s response to the McCleary decision on school funding. We described the changes in our 2020 report on McCleary. The state property tax increased to $2.70 per $1,000 of assessed value in calendar year (CY) 2018, decreased to $2.40/$1,000 in CY 2019, and increased to $2.70/$1,000 for CY 2020 and 2021. The Legislature also suspended the statutory property tax growth limit of 101% from CY 2019 through CY 2021.

Categories: Tax Policy.