11:40 am

September 22, 2020

The U.S. Census Bureau has released state and local government finance data for 2018. In Washington, state and local taxes increased by 10.4 percent over 2017. This includes property taxes, sales and gross receipts taxes, and motor vehicle license taxes. (For other states, it also includes income taxes.)

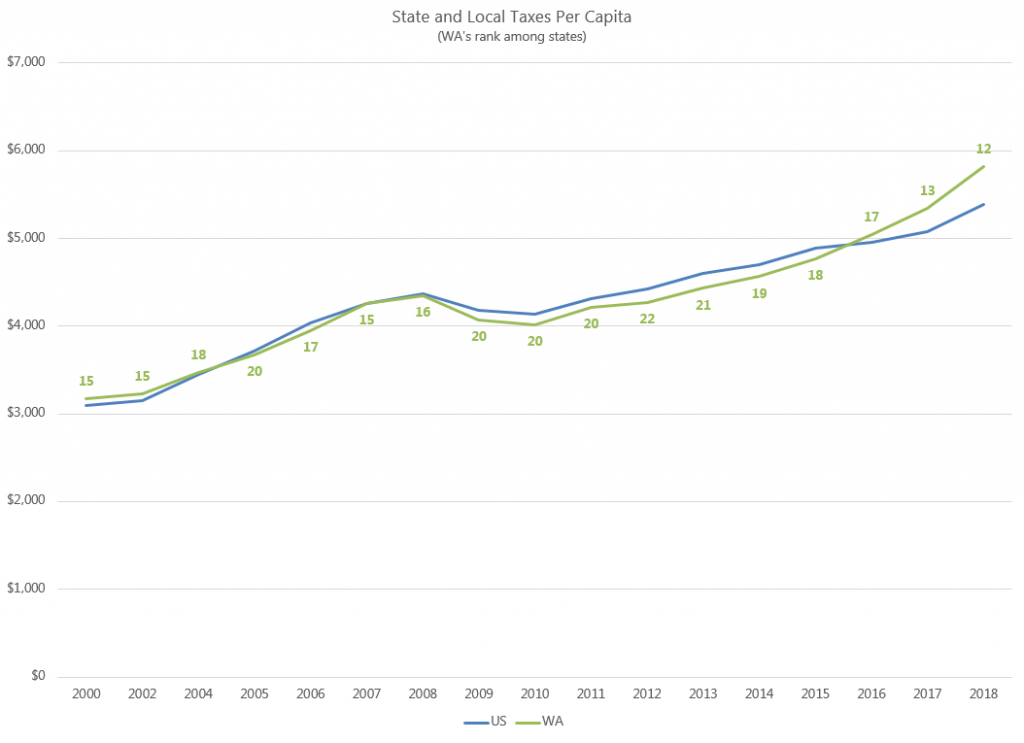

To compare Washington’s taxes to other states, we look at them per capita and as a share of personal income. By both measures, Washington has risen in the national rankings. Washington’s state and local taxes per capita have increased each year since 2010, reaching $5,817 in 2018 (above the national average of $5,392). Among the states, Washington’s state and local taxes per capita ranked 12th highest in 2018.

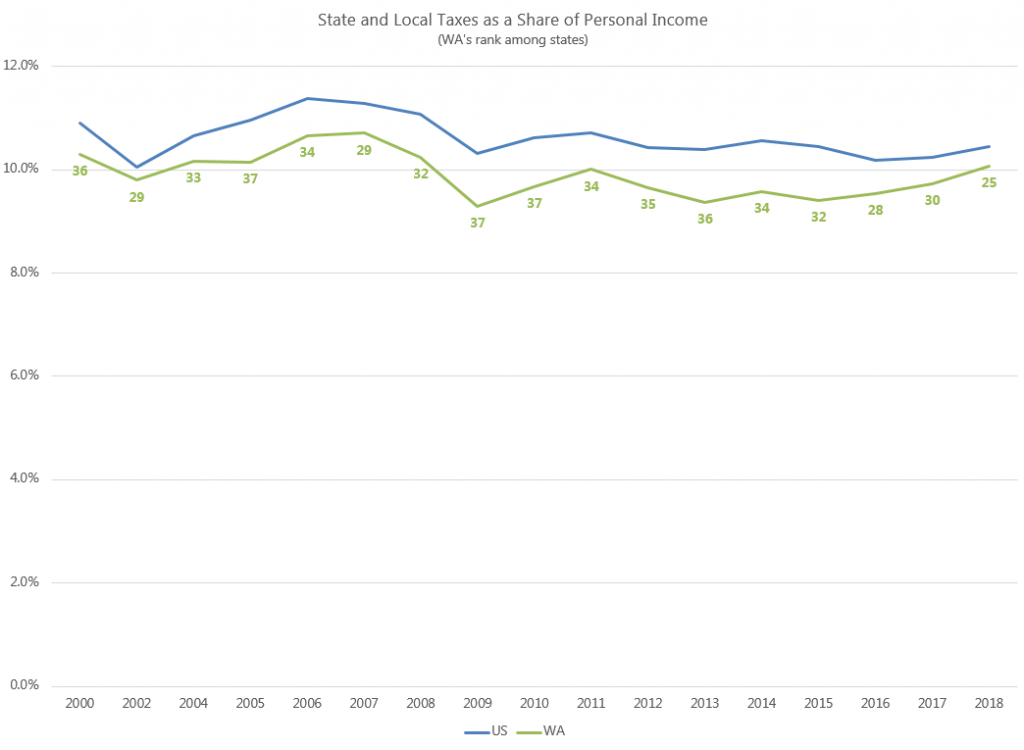

As a share of personal income, Washington’s state and local taxes increased to 10.1 percent in 2018 (slightly below the national average of 10.4 percent). Among the states, by this measure, Washington ranked 25th highest (up from 30th in 2017). (Washington had the 7th highest personal income per capita in 2018.)

The Census figures cover the state fiscal year (July 1, 2017 through June 30, 2018). Thus, they include just a half year of the substantial increase in property taxes that was enacted (for calendar year 2018) to help fund the spending increases related to the McCleary decision on school funding. Further, the substantial tax increases enacted in 2019 are not incorporated in the data yet.

Additionally, the figures do not include unemployment insurance (UI) taxes. UI tax rates are determined by a formula. With this recession’s high unemployment, UI taxes will be substantially higher in 2021, as Kriss wrote last month. Absent legislative action, those higher UI tax rates will add to the already high tax burden in Washington.

Categories: Employment Policy , Tax Policy.