11:42 am

April 11, 2024

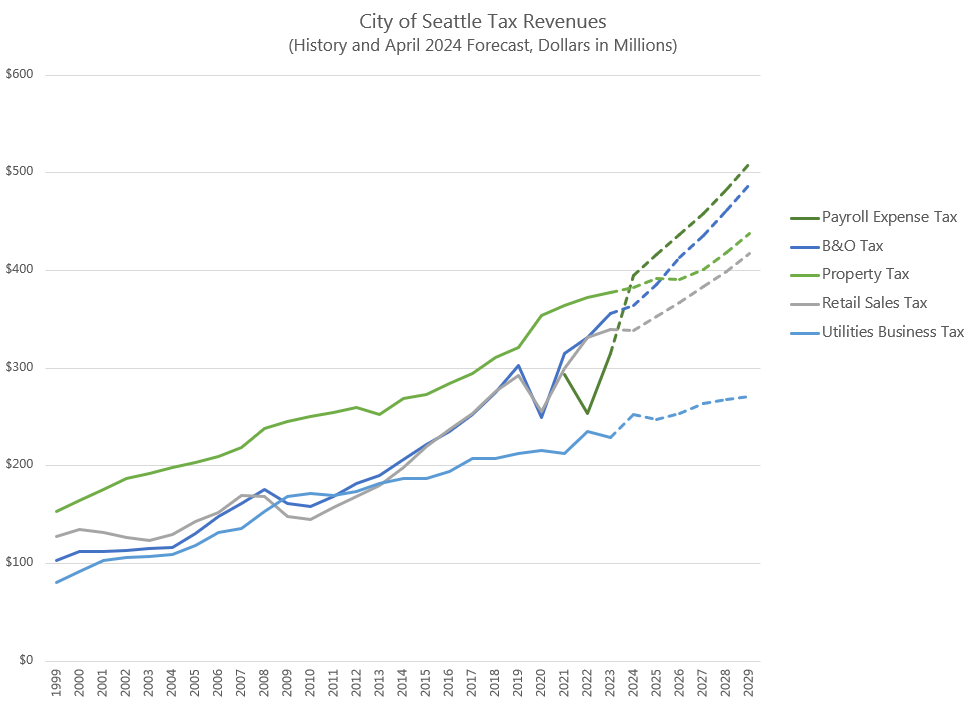

Seattle’s Office of Economic and Revenue Forecasts (OERF) presented the April 2024 revenue forecast on Monday. (The presentation is here and the full forecast is here.) The OERF estimates that payroll expense tax (PET) revenues will increase from $315.2 million in 2023 to $394.7 million in 2024. The PET is a highly volatile tax source—it is driven by technology sector stock prices and has a very small tax base. (In 2023, about 70% of PET revenues came from 10 companies.) On top of that volatility, the tax was first imposed on 2021 activity, so there isn’t a lot of history. (For more on the PET, see our 2023 report.)

That said, if the forecast for 2024 holds, the PET will leapfrog past the property tax, the business and occupation (B&O) tax, and the retail sales tax to become Seattle’s largest tax source this year. Additionally, the forecast estimates that the B&O tax will overtake the property tax and become Seattle’s second largest tax source in 2026.

The OERF compared the April 2024 revenue forecast to the revenues included in the adopted 2023–2024 mid-biennium budget, which was approved in November 2023. The last revenue forecast was conducted in October 2023, but the mid-biennium budget made some changes. Most notably, it increased the PET rates effective Jan. 1, 2024.

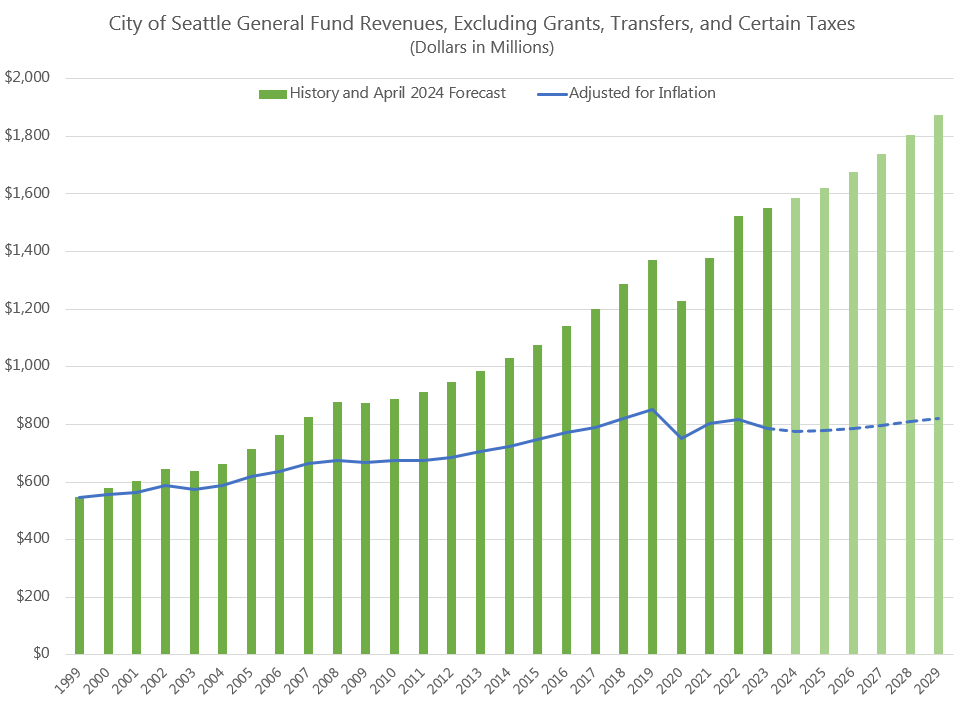

General fund revenues (excluding grants and transfers) for 2024 are now estimated to decrease by $3.6 million compared to the adopted budget. However, the April forecast for general fund revenues exceeds the revenues assumed in the adopted budget in each year after 2024 (by $5.1 million in 2025, $19.1 million in 2026, and $30.7 million in 2027).

Meanwhile, PET revenues for 2024 are now estimated to increase by $69.0 million compared to the adopted budget (which included the higher rates). Going forward, PET revenues are forecasted to be similarly higher compared to the revenues assumed in the adopted budget: by $70.2 million in 2025, $72.6 million in 2026, and $70.5 million in 2027.

The chart below shows the history of Seattle’s general fund revenues over time and the April forecast. It excludes grants and transfers. Also, in order to maintain comparability across years, it excludes several taxes that initially were deposited in the general fund but were later directed to dedicated accounts: the PET, the admission tax, the short-term rental tax, and the sweetened beverage tax.