10:31 am

January 15, 2021

As usual, many new taxes have already been proposed in the Legislature this year. Meanwhile, there is a separate effort to more broadly study Washington’s tax structure, which won’t be complete for several years.

The Tax Structure Work Group’s (TSWG) preliminary report was released at the end of December (here is the technical report). (I wrote about a pre-publication presentation here and about the report’s discussion of taxes and competitiveness here.)

The 2019–21 operating budget re-authorized the TSWG and required the Department of Revenue to estimate how much revenue various alternatives would have generated for the state in 2017–19 and to estimate what the tax rates under the alternatives would have to be in order to replace actual 2017–19 revenues.

The new alternatives considered are:

- Value-added tax

- Margins tax

- Corporate income-net receipts tax

- Personal income tax

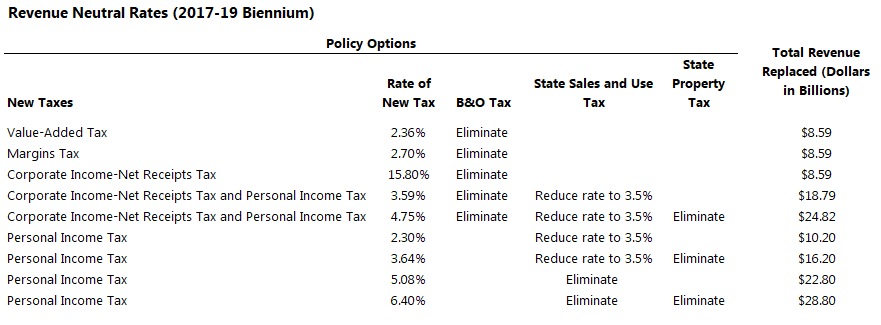

The report’s findings are shown in the table below. For example, if the business and occupation (B&O) tax were eliminated and replaced with a value-added tax (VAT), the revenue neutral VAT rate would be 2.36%. If the state imposed both corporate and personal income taxes at a rate of 4.75%, it could eliminate the B&O tax and the state property tax and reduce the state sales tax to 3.5%.

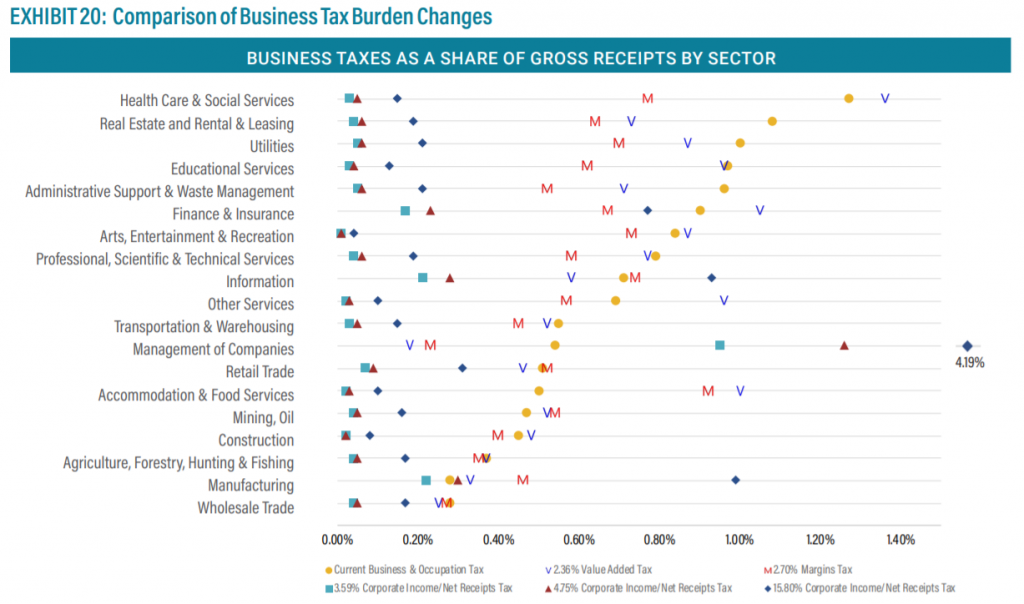

The report also attempts to show how household and business tax burdens would shift under the alternatives. For example, the following chart from the report shows how the business tax burden might change for different sectors.

This report does not make recommendations. Pursuant to the budget proviso, the next step is for the TSWG to present the report to stakeholder groups and the Legislature. Then, after the legislative session, the TSWG must hold at least five meetings around the state to present the findings. After those meetings, a final report is due to the Legislature. The proviso specifies that members commit to serve on the TSWG through 2024.

Categories: Tax Policy.