5:09 pm

March 6, 2024

Between 10 AM and 1 PM today (March 6), the Department of Ecology held its first 2024 auction of greenhouse gas emission allowances. Results of this auction will be published next Wednesday (March 13). The futures market for allowances indicates that the settlement price for today’s auction will be quite a bit lower than the prices in last year’s auctions. I believe the reason for lower prices is Initiative 2117, which will be on the ballot in November.

In 2021 the legislature passed, and Gov. Inslee signed (with minor vetoes), the Climate Commitment Act (CCA) to establish the cap-and-invest program to reduce over time greenhouse gas emissions in the state of Washington. The program, modeled on California’s cap-and-trade program, became operational on January 1, 2023. (Washington calls its program cap-and-invest to emphasize that money raised by selling allowances will be spent on programs benefiting the environment.)

Under the program, the state regulates the quantity of greenhouse gases emitted through a system of “allowances” (permits to emit fixed quantities of greenhouse gas). The total number of allowances to be issued is limited. This is the “cap” in cap and trade. The state initially issues most allowances via auctions. Once issued, allowances may be bought and sold on secondary markets. This is the “trade” in cap-and-trade.

The fiscal note for the CCA estimated that the average auction prices would be $23.78 for 2023 and $24.66 for 2024. Prices have turned out to be much higher. The weighted average allowance price across the six auctions held by the Department of Ecology in 2023 was $55.12 per metric ton. In early summer, the Seattle Times reported that Washington had the nation’s highest state-wide gasoline prices and that “experts” attributed the high prices to the CCA.

In November, voters will consider a ballot measure (Initiative 2117) that would, if passed, repeal the CCA.

Ecology will hold four standard auctions of Vintage 2024 allowances quarterly during 2024 (on March 6, June 5, September 4, and December 11). The quantity offered for sale at the standard auctions will include 21,056,402 state-owned allowances and a currently unknown number of utility-owned allowances.

In addition, Ecology may offer for sale as many as 8.9 million allowances from the Allowance Price Containment Reserve (APCR). An APCR auction will be triggered whenever the market clearing price at a regular auction exceeds $56.19. All APCR sales will be at the $56.19 trigger price. Ecology hopes that this trigger price will serve as an upper limit on allowance prices.

The company ICE Futures U.S. (ICE) offers futures contracts for CCA allowances. Currently, the most important contract, measured by the number of outstanding contracts held by market participants, is that for Vintage 2024 allowances to be delivered in December 2024. (ICE labels this contract “WCB-Dec24”.)

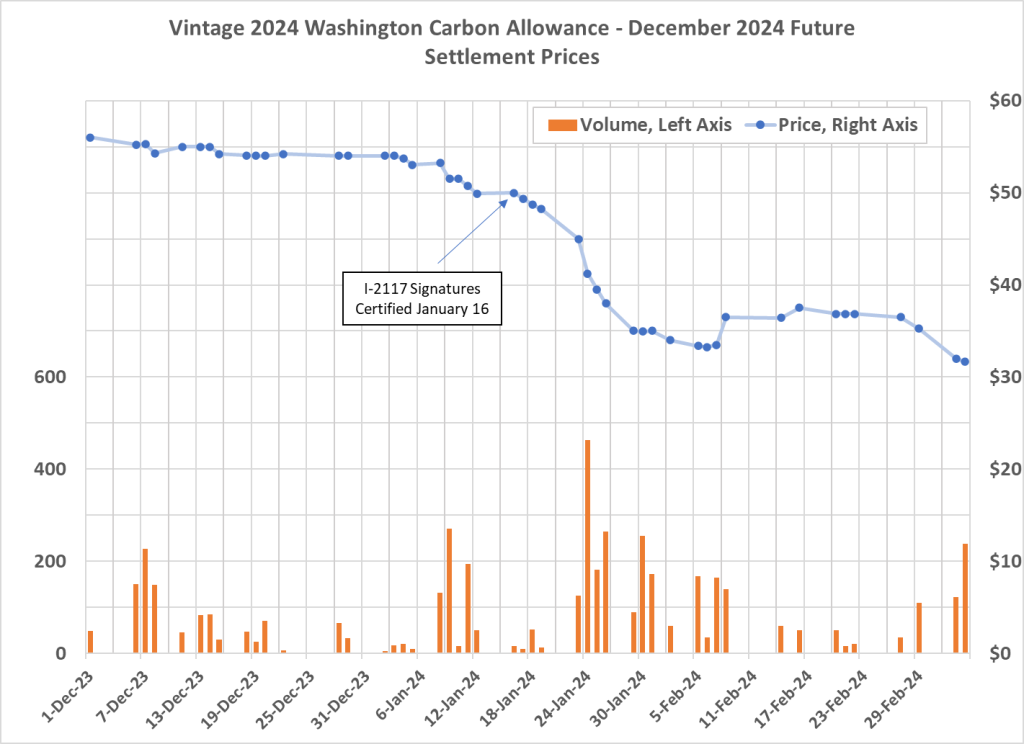

The chart below shows daily settlement prices for this contract between December 1, 2023, and March 5, 2024. Through the month of December, the contract traded in a narrow range just below the 2024 APCR trigger price. In January the futures price began to decline, with the rate of decline increasing after the January 16 certification that I-2117 would appear on the November ballot. The price bottomed out on February 6 at $33.25, then bounced back to spend several weeks in the $36–$37 range. This week the price dropped back to $32.00 on Monday and $31.65 on Tuesday.

I-2117 is the most likely explanation for the price decline shown on the chart: There is no provision in existing state law or in the initiative for owners of allowances to be compensated if the cap-and-invest program ends. The decline in prices reflects increasing pessimism as to the program’s survival.

With heroic assumptions, it is possible to calculate from the future price a probability that voters will reject the initiative: Assume that the market price of a vintage 2024 allowance in December will be either $0 if the initiative passes or $56.16 (the APCR Tier 1 price) if the initiative fails. Further assume that the market sets the price of the future contract as the probability-weighted average of these two possibilities. Let P be the probability that the initiative fails (so that cap-and-invest survives). The future price would then equal P times $56.16. P would equal the future price divided by $56.14. The March 5 future price, $31.65, implies that on Tuesday the market’s probability that voters will reject the initiative was 55.4%.

Categories: Current Affairs , Economy.