3:28 pm

December 15, 2023

On Wednesday the department of ecology reported the results of its fourth regular auction of Cap-and-Invest Program allowances (link), which was held on December 6. The settlement price for current (2023) vintage allowances was $51.89. This is down significantly from the 2023-vintage price at the August 30 regular auction, which was $63.03.

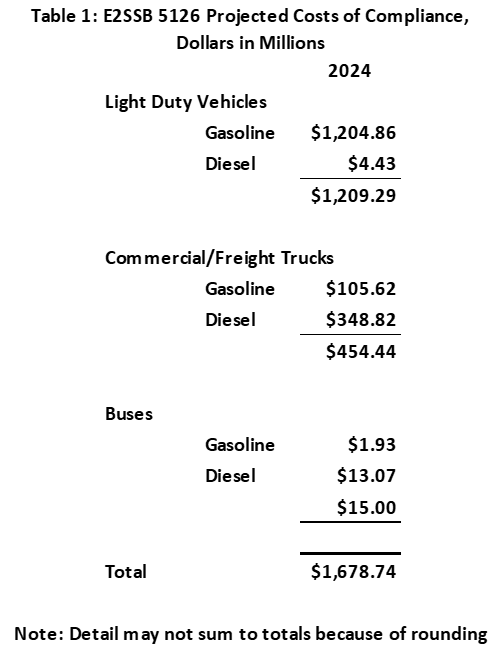

Table 1 contains my updated projections of the cost of compliance under SB 5126’s cap-and-invest system for on-road use of gasoline and diesel fuel in Washington state, by class of vehicle, based upon the settlement price from the department of ecology’s December 6 allowance auction. These compliance costs are projected costs only, and the ultimate cost to vehicle owners will be affected by the results of future allowance auctions as well as the competitive dynamics of the wholesale and retail transportation fuels markets.

How I calculated these numbers:

The Table 1 calculations begin with the state’s November 2023 Transportation Revenue Forecast (link), which provides forecasts of total consumption of gasoline and diesel fuel, in gallons, by fiscal year. I translate the fiscal year forecasts into calendar year forecasts by averaging overlapping fiscal years. I then allocate these fuel quantities across vehicle classes based on national forecasts of fuel use by vehicle class from the U.S. Energy Information Administration’s Annual Energy Outlook 2023 (link), assuming that each class’s share in Washington is equal to its nationwide share. The three classes are light duty vehicles (e.g. cars, pickup trucks and motorcycles), commercial and freight trucks, and buses.

To calculate the costs shown in Table 1, I multiply the forecasted quantities by the fuel-specific projected per gallon compliance costs shown in Table 2.

The first line in Table 2 shows the August auction allowance price per metric ton of CO2. (Prices determined at past and future auctions and in the secondary market for allowances will affect ultimate compliance costs for regulated entities. The most recent auction price is our best estimate of the average of these prices.) On the second and third lines, these metric-ton prices are translated into projected costs per gallon of gasoline and diesel using carbon dioxide emissions coefficients from the Energy Information Administration (link). I assume that gasoline consumed in Washington includes 10 percent ethanol, and that diesel fuel includes 4 percent biodiesel.

Categories: Categories.