12:59 pm

April 16, 2021

Yesterday’s monthly report from the state’s Economic and Revenue Forecast Council (ERFC) on general fund revenue collections once again showed revenues significantly above forecast. This is in spite of the large upward revision to the forecast that the ERFC made just a month ago.

For the sales tax, the use tax, the business and occupation tax, the public utility tax, the tobacco products tax, and penalties and interest (collectively the Revenue Act receipts), this report covers payments received between March 11 and April 10, which generally relate to transactions that occurred in the month of February.

For liquor taxes, cigarette tax, property tax, real estate excise tax, unclaimed property and other sources, the report covers payments received between March 1 and March 31.

The total amount received was $1,612.8 million. This was $79.2 million (5.2%) more than the amount expected under the forecast that ERFC adopted on March 17th. Revenue Act taxes exceeded forecast by $66.0 million (5.1%). Here is a chart showing seasonally adjusted Revenue Act receipts since 2004:

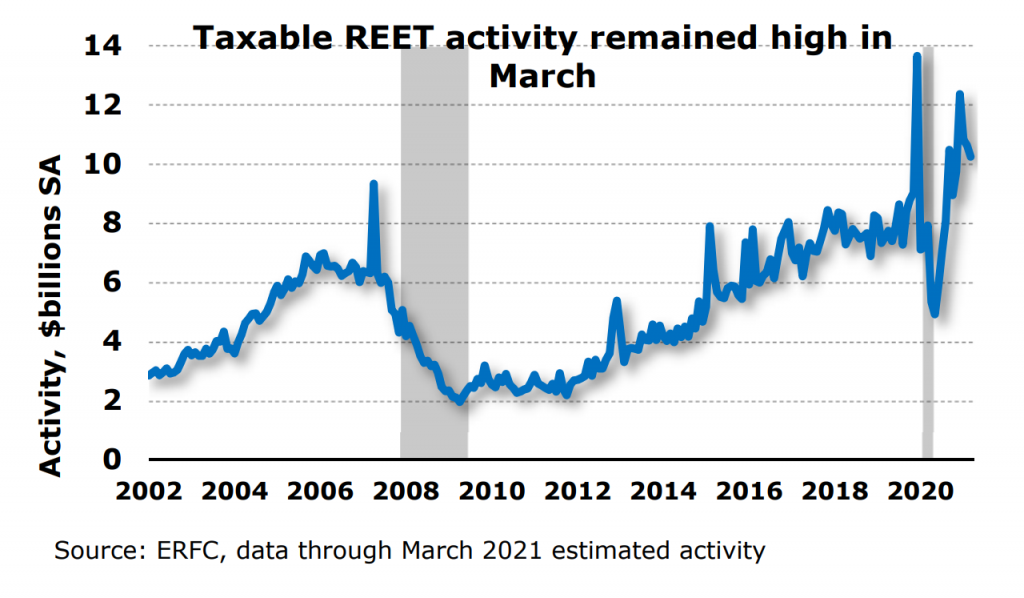

Non-Revenue Act taxes exceeded forecast by $12.2 million (5.4%). Within the latter grouping, the real estate excise tax (REET) exceeded forecast by $7.8 million (7.7%). Regarding REET, ERFC notes:

Sales of large commercial property (property valued at $10 million or more) increased to $508 million from last month’s total of $166 million. Seasonally adjusted taxable activity decreased only slightly from last month’s strong level.

Here is a chart showing the value of transactions subject to REET:

Yesterday’s unexpectedly strong report on March retail sales suggests that next month’s ERFC report will again show collections better than forecast. This month’s report is available here.

Categories: Categories.