12:57 pm

November 16, 2022

Yesterday the state’s Economic and Revenue Forecast Council (ERFC) issued its monthly report on general fund revenue collections.

This report covers payments received between October 11 and November 10 for the sales tax, the use tax, the business and occupation tax, the public utility tax, the tobacco products tax, and penalties and interest (collectively the Revenue Act receipts), and it covers payments received between October 1 and October 30 for liquor taxes, cigarette tax, property tax, real estate excise tax, unclaimed property and other sources.

The total amount received this month was $2,502.6 million, $125.9 $156.6 million (6.7%) more than the amount expected under the forecast that ERFC adopted on September 21st.

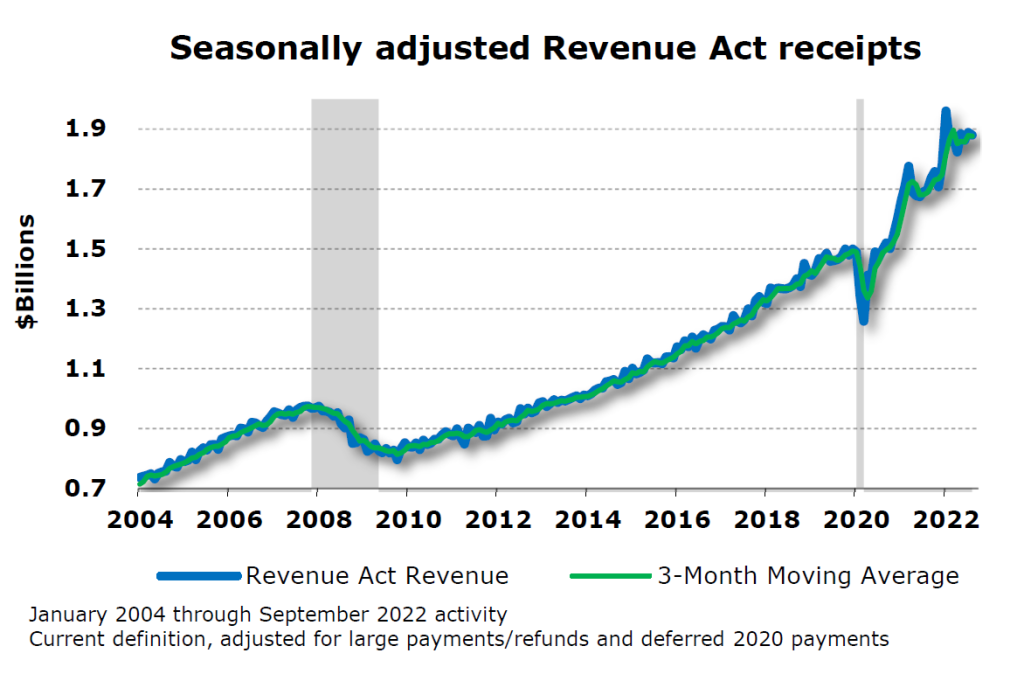

For the month, Revenue Act taxes (primarily the sales, use, utility, and business and occupation taxes) exceeded forecast by $182.1 million (9.6%). These taxes generally reflect economic activity in the month of September, for which tax payments were due by October 25. Here is a chart showing seasonally adjusted Revenue Act receipts since 2004:

For the month, Non-Revenue Act taxes fell $25.5 million (5.7%) short of forecast. Within this category, unclaimed property was $12.3 million (7.3%) short of forecast, while property tax collections were $12.2 million (13.3%) short of forecast. (The percentage is so high because most property tax collections are booked in the June and December collections reports.)

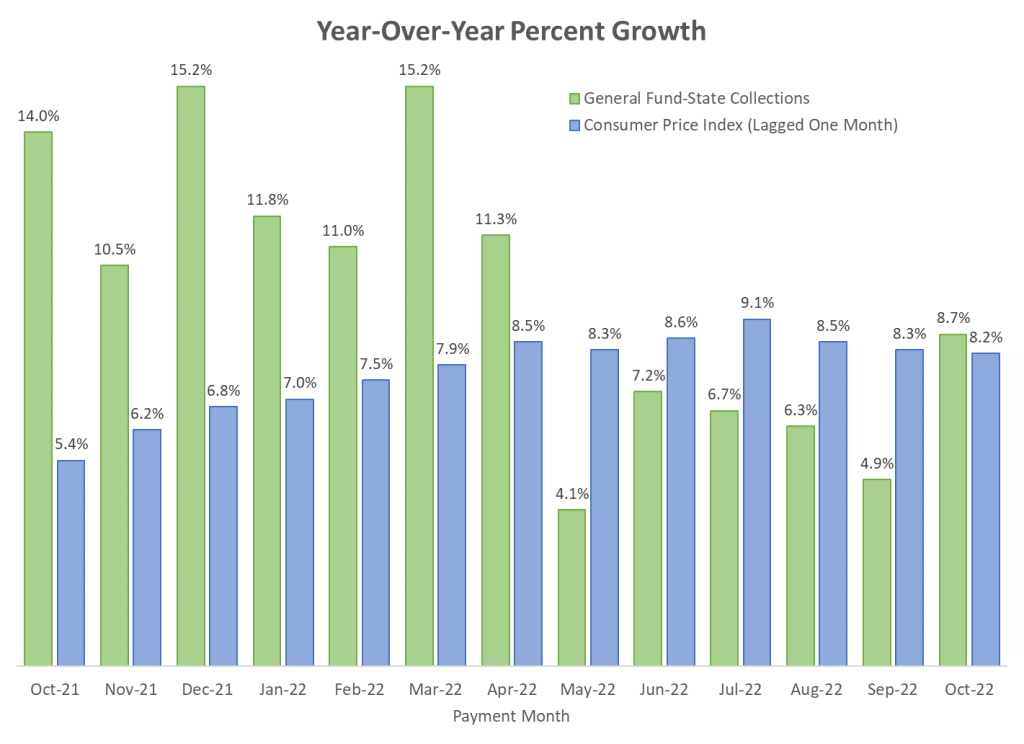

Over the last year, year-over-year growth rates of general fund-state revenues trended down, while inflation measured by year-over-year increases in the consumer price index have trended up, as the following chart shows:

Last month (unlike the preceding 5 months) the year-over-year percentage increase in GFS revenues exceeded year-over-year CPI inflation.

On Friday (November 18) ERFC will meet to revise its forecast of state revenues. In the two months since the last revision, collections have exceeded forecast by $282.8 million (6.5%) in total. Normally a positive variance such as this would lead me to expect an increase to the forecast. But these are not normal times. Higher interest rates and layoffs in the Tech sector should slow the economy next year. The question is whether the landing will be soft or hard.

The October collections report is available here.

Categories: Categories.